Fantastic Accounts Receivable Turnover Ratio Interpretation Sample Business Balance Sheet

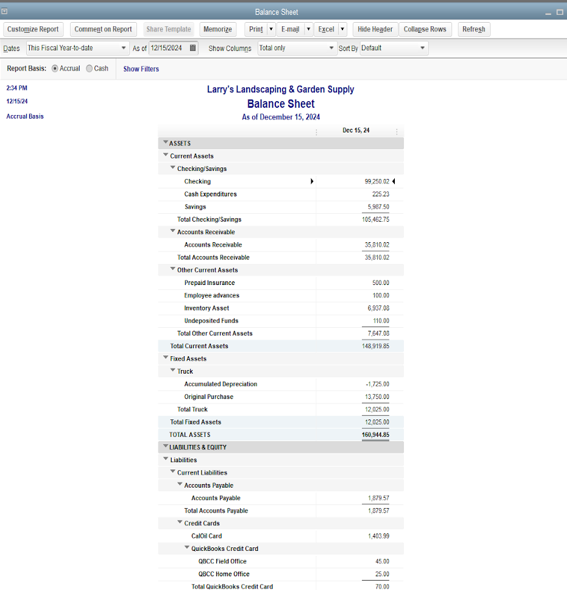

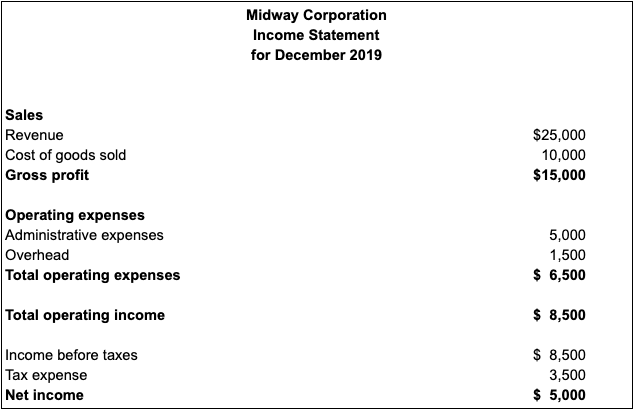

Credit sales are found on the income statement not the balance sheet.

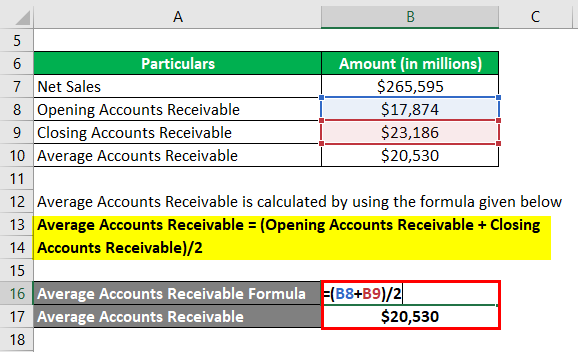

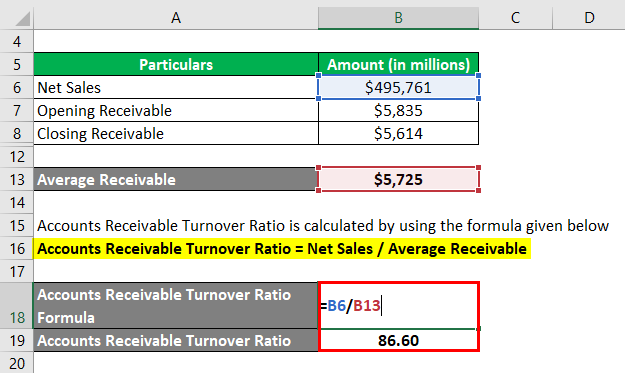

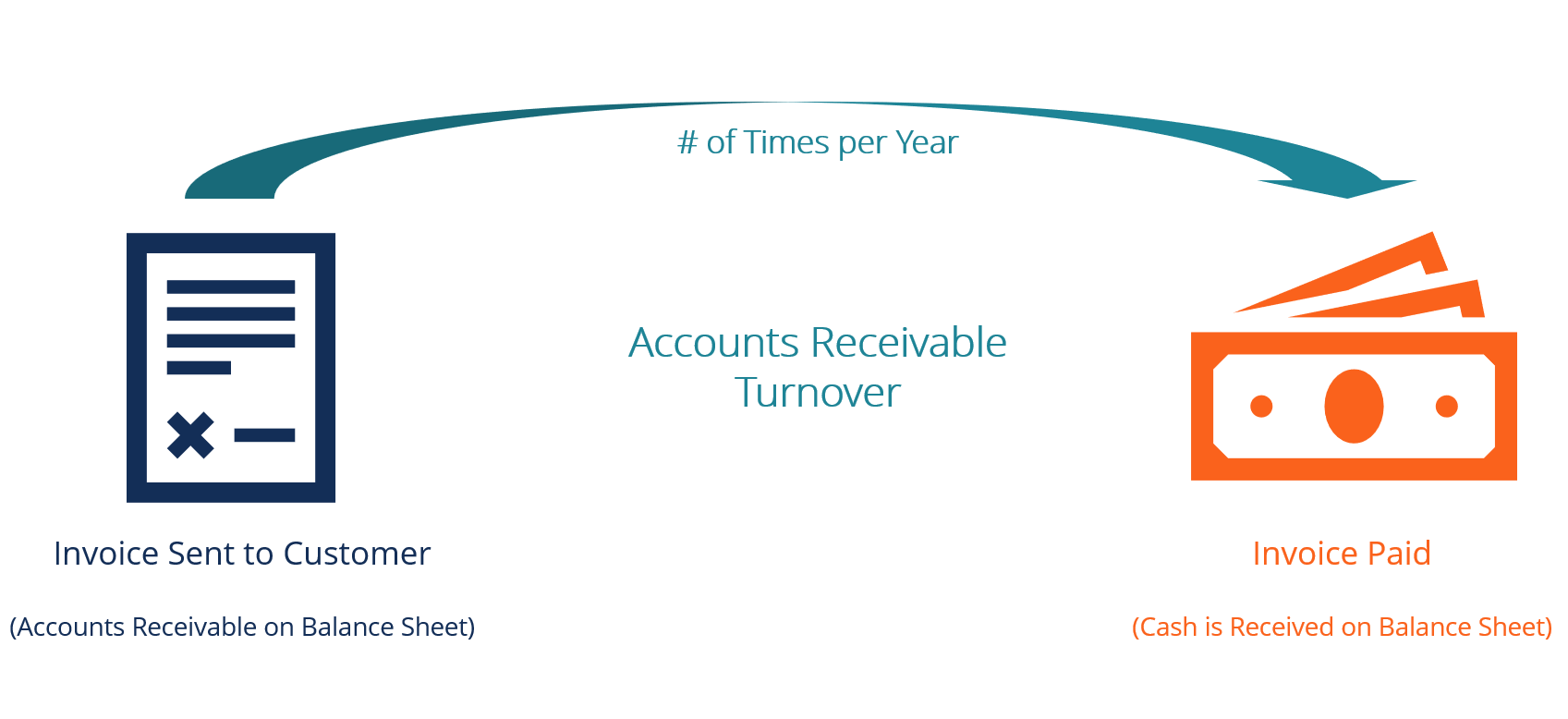

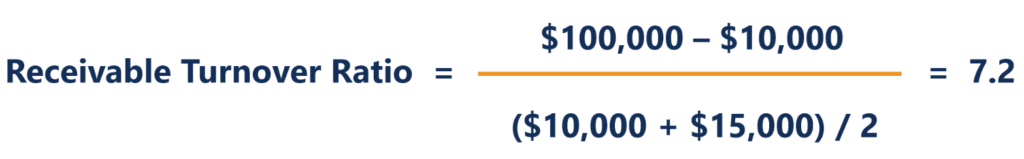

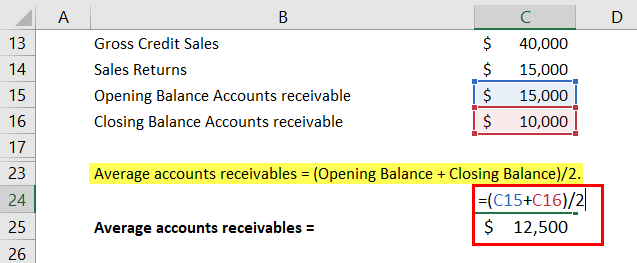

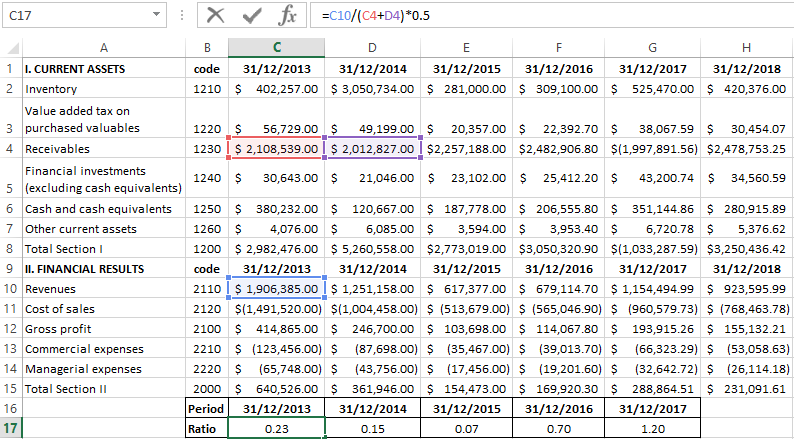

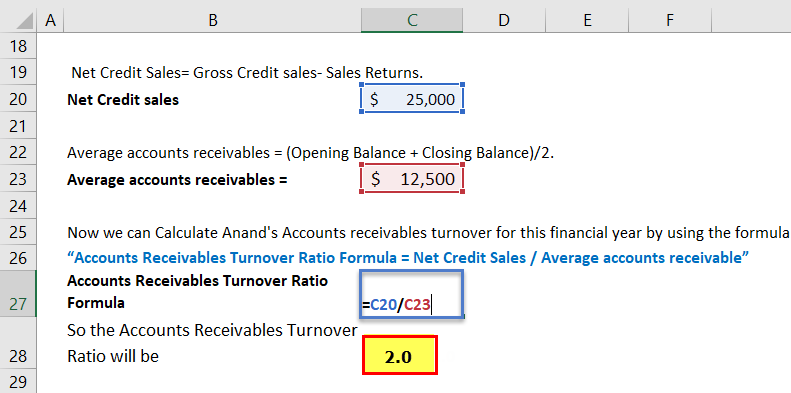

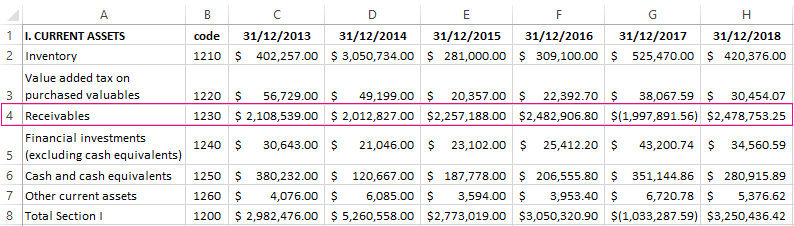

Accounts receivable turnover ratio interpretation sample business balance sheet. Receivable Accounts Receivable collected on an annual basis. Accounts Receivable Turnover is the efficiency ratio that directly measures the performance of receivable collecting activities over the year. Average accounts receivable can be calculated by averaging beginning and ending accounts receivable balances 20000 40000 2 30000.

Quick ratio 25000 20000. Quick ratio 2100015000 141. Amount of accounts receivable Receivables turnover ratio 570000 60000 Receivables turnover ratio 95 times.

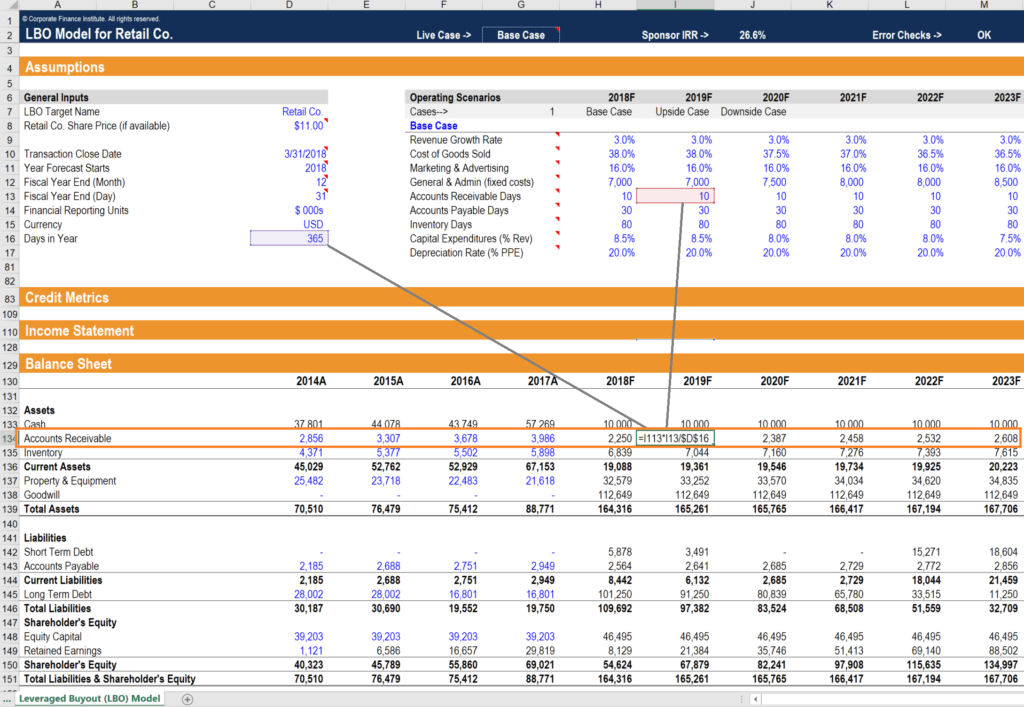

As you can see in the example below the accounts receivable balance is driven by the assumption that revenue takes approximately 10 days to be received. Subtracting 10000 in credit sales returns from 150000 in total credit sales results in. Therefore to collect credit sales takes time in days approximately 37 days.

Accounts receivables turnover ratio 140000 16000 875. This concludes our discussion of the three financial ratios using the current asset and current liability amounts from the balance sheet. Receivables turnover ratio net credit sales for the year avg.

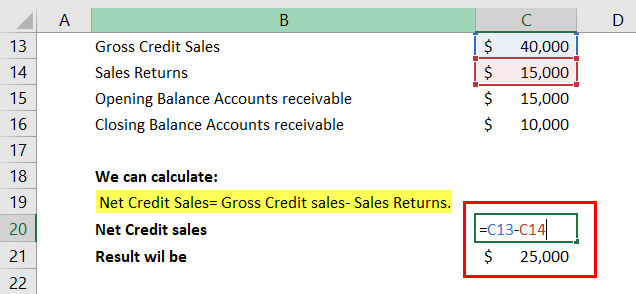

Understanding the accounts receivable turnover ratio formula can help you d. Here we discuss the top 4 types of Balance Sheet Ratios like Efficiency ratios Liquidity Ratio Solvency Ratio Profitability Ratios along with formulas and classifications. In order to measure the turnover ratio we calculate net credit sales and average accounts receivable.

As with every other average in accounting one simply divides the sum of the beginning and ending balance by two. To determine if this companys receivables turnover ratio of 95 is acceptable or. The Asset Turnover ratio can often be used as an indicator of the.