Stunning Asc 842 Balance Sheet Presentation

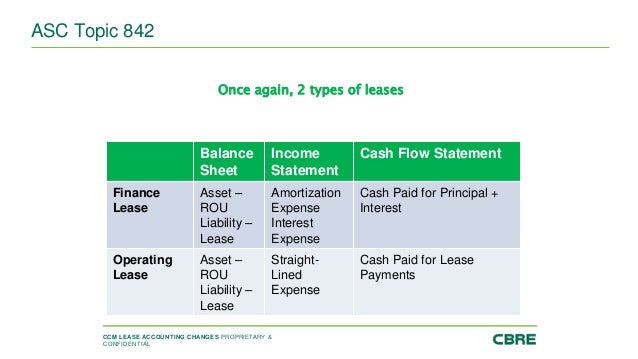

For ASC Topic 842 the income statement presentation is more straightforward than the balance sheet presentation.

Asc 842 balance sheet presentation. ASC 842 the new lease accounting standard is effective for public companies for annual periods beginning after December 15 2018 and for nonpublic companies for annual periods beginning after December 15 2019. If not presented separately an entity would disclose in the notes what. For finance leases the expense components should be recorded in a manner similar to a transaction involving the purchase of an asset whereby there is interest expense.

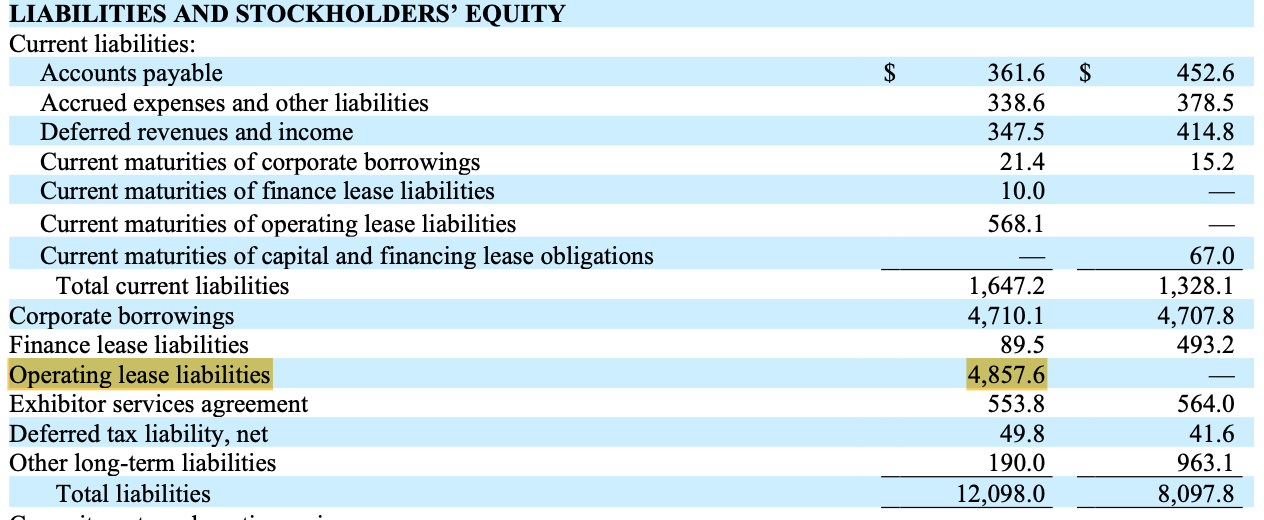

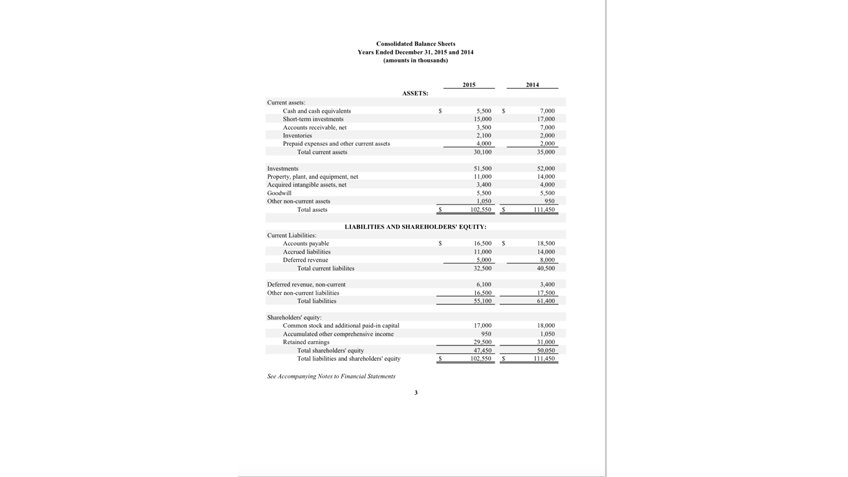

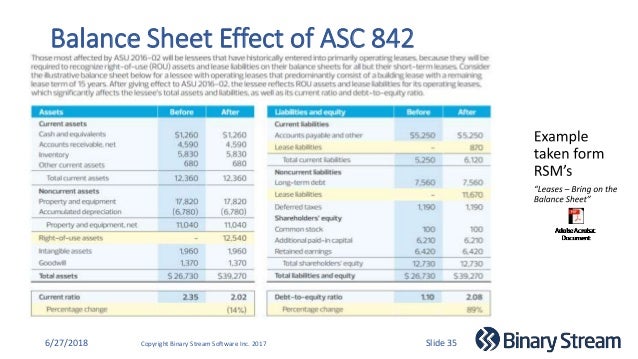

The Board decided that consistent with all three proposals lessees should be required to recognize the assets and liabilities arising from le ases on the balance sheet. Since the overall liability is measured on a present value basis the. Operating leases have become a significant source of off balance sheet financing making it difficult.

Prior to ASC 842 only capital leases leases that are essentially purchase agreements were recorded on the balance sheet. The standards bring many leases onto the balance sheet and could significantly impact a. As noted in LG 4222 initial direct costs should be included in the initial measurement of the right-of-use asset.

Proposed Accounting Standards Update Leases Topic 842. Loans and impairment pre ASC 326 Stock-based compensation. In order to ensure that all requirements have been met entities.

Under its core principle a lessee will recognize right-of-use ROU assets and related lease liabilities on the balance. Under ASC Topic 842 leases all contracts meeting the definition of a lease will be presented on the balance sheet even if the lease meets the criteria of an operating lease. We also shine spotlights throughout our guide on a variety of.

Improve consistency of presentation by requiring all leasesto be presented on the. Although ASC 842-20-45-1 permits disclosure in the notes in lieu of separate presentation on the balance sheet ASC 842-20-45-3 prohibits combining finance lease and operating lease liabilities on the balance sheet. In February 2016 the Financial Accounting Standards Board FASB or the Board issued its highly-anticipated leasing standard in ASU 2016-02 ASC 842 or the new standard for both lessees and lessors.

-A-Guide-for-Tech-Com/Tech_Lease-Accounting-Guide_brochure_10-18_webcharts1.png.aspx)