Casual Bad Debts Debit Or Credit In Trial Balance

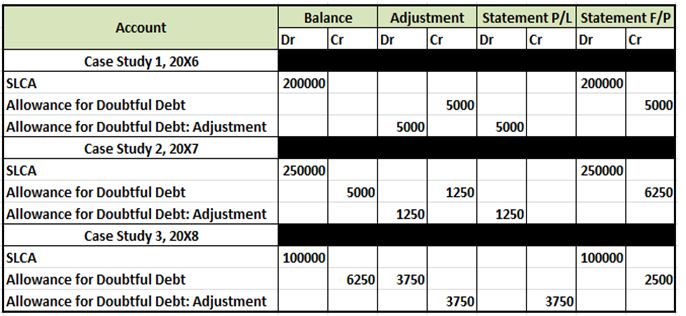

The calculation of the necessary adjustment is 100000 x.

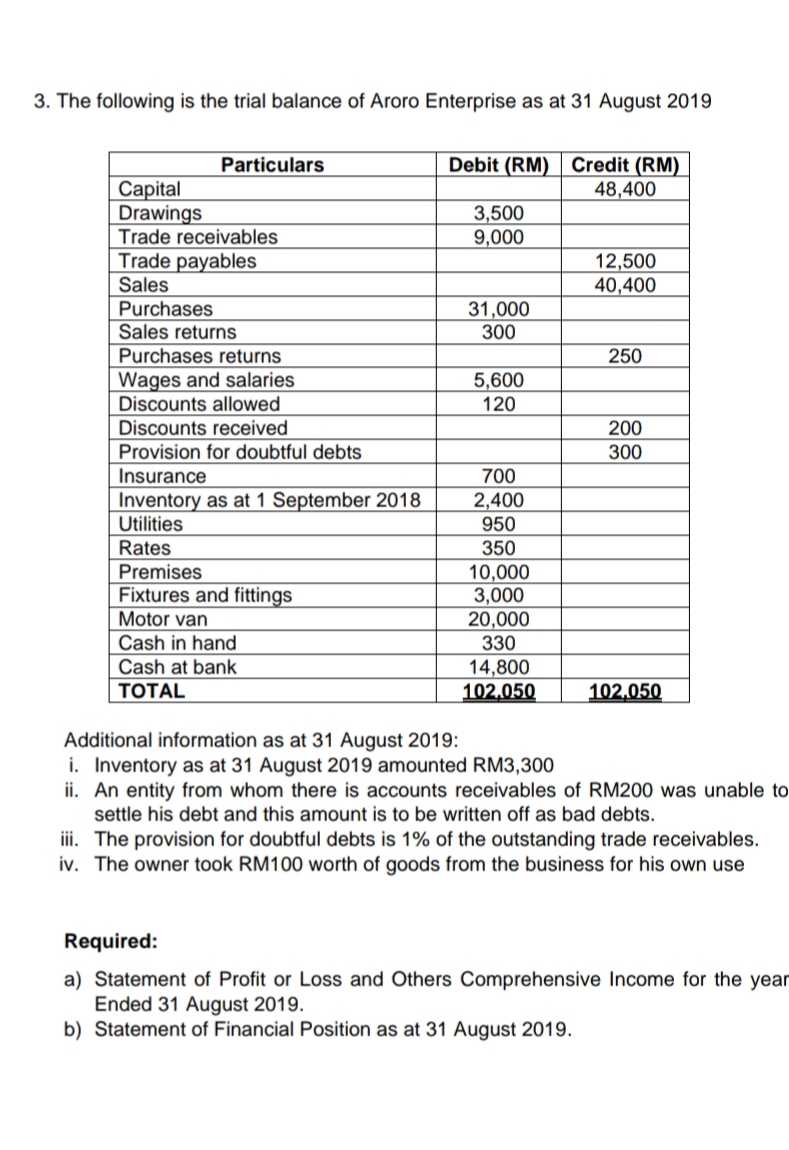

Bad debts debit or credit in trial balance. Then a credit of 6300 would be necessary to bad debt expense to get the balance to the required 6000 credit balance. Lets say youve been in business for a year and that of the total 300000 in credit sales you made in your first year 20000 ended up uncollectable. However the credit above is placed on the bad debt provision account in the balance sheet to reflect the uncertainty over payment.

Bad Debts AC Dr. If the sum of all credits does not equal the sum of all debits then there is an error in one of the accounts. As another example suppose that Rankin had a 300 debit balance in the allowance account before adjustment.

It means under this method bad debt expense does not necessarily serve as a direct loss that goes against revenues. The capital revenue and liability increases when it is credited and visa versa. The credit balance on the account is then transferred to the credit of the statement of profit or loss added to gross profit or included as a negative in the list of expenses.

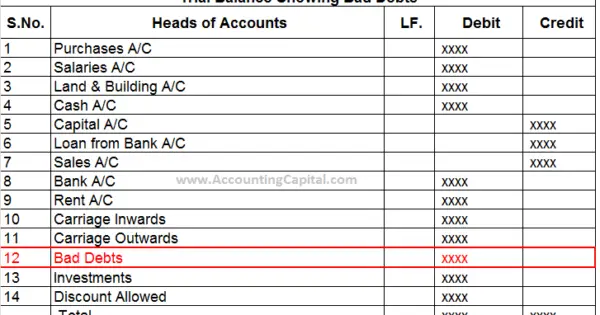

We will demonstrate how to record bad debt when bad debts written off debit or credit in trial balance related customer invoice considered. You want to set up an allowance for bad debts to take these bad debts into account ahead of time. Generally capital revenue and liabilities have credit balance so they are placed on the credit side of trial balance.

Items that appear on the credit side of trial balance. The journal entry is debit to bad debt expense and credit to provision for bad debts. Ad Get Your Trial Balance Template Download Print in Minutes.

Ad Get Your Trial Balance Template Download Print in Minutes. So according to the mentioned concept provision for bad debt is an expense. This provision of doubtful debt is a contra asset and hence credit in nature as compared to the accounts receivable that are classified as assets and are debit.