Spectacular Comparative Balance Sheets Quizlet

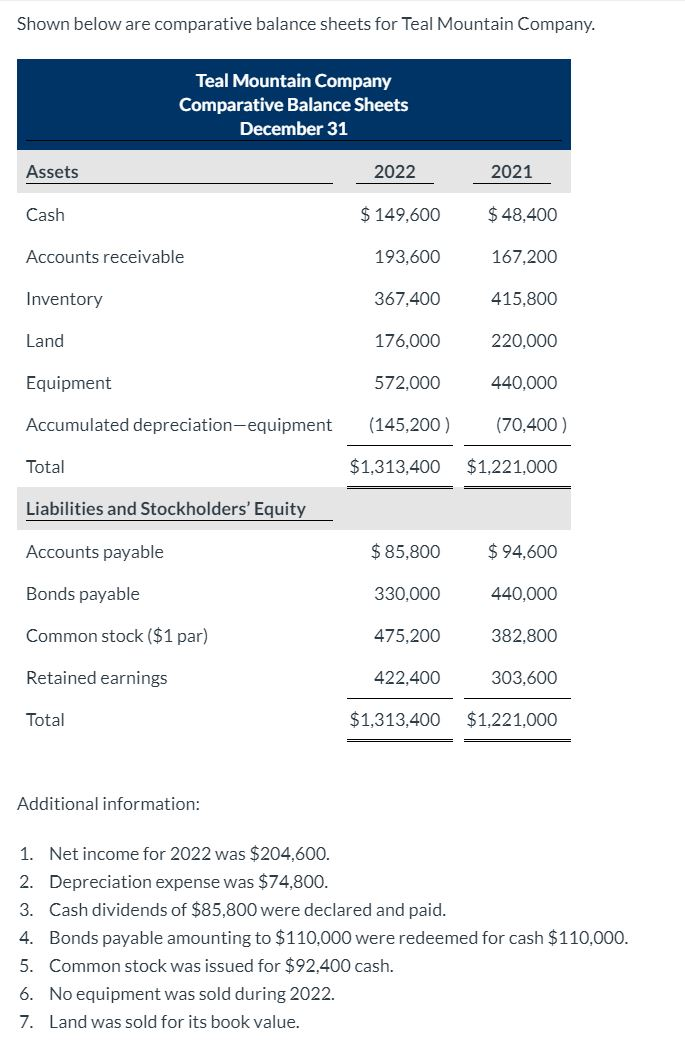

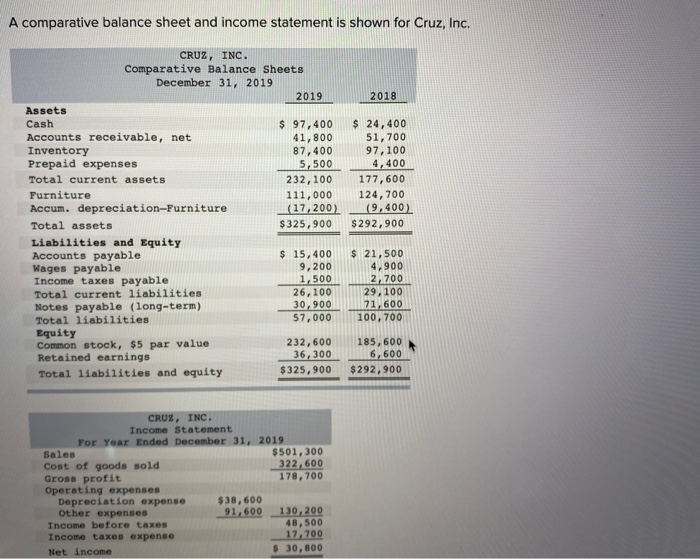

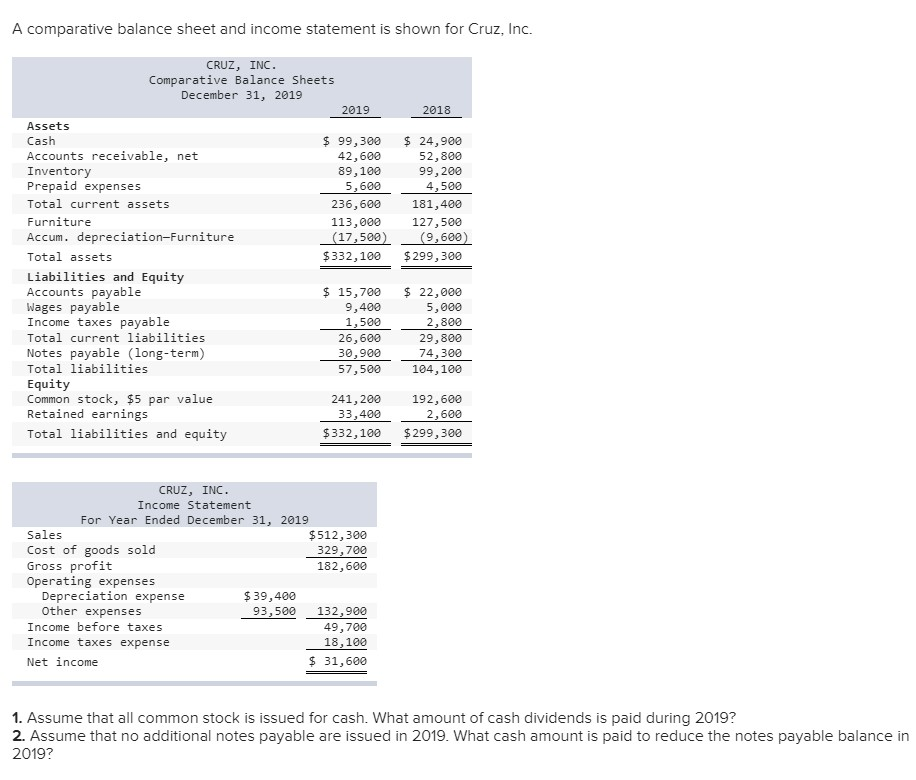

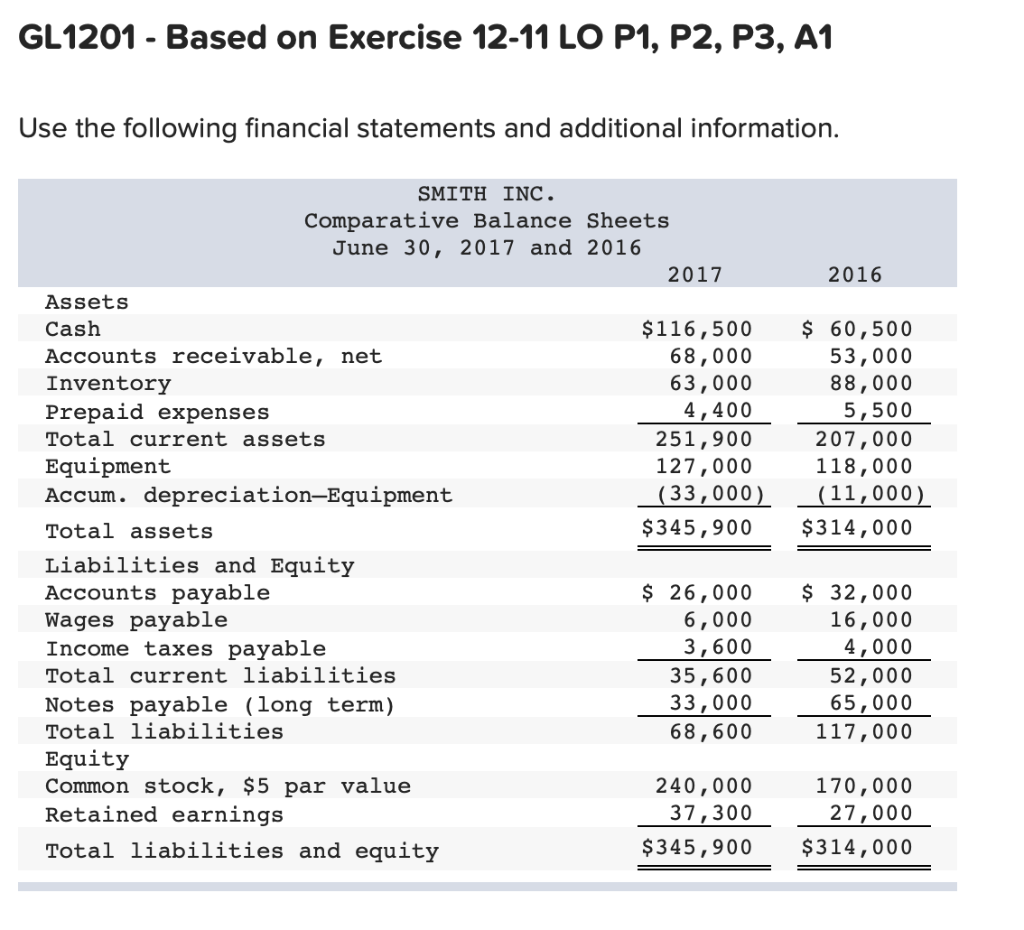

Fortune Corporations comparative balance sheet for current assets and liabilities was as follows.

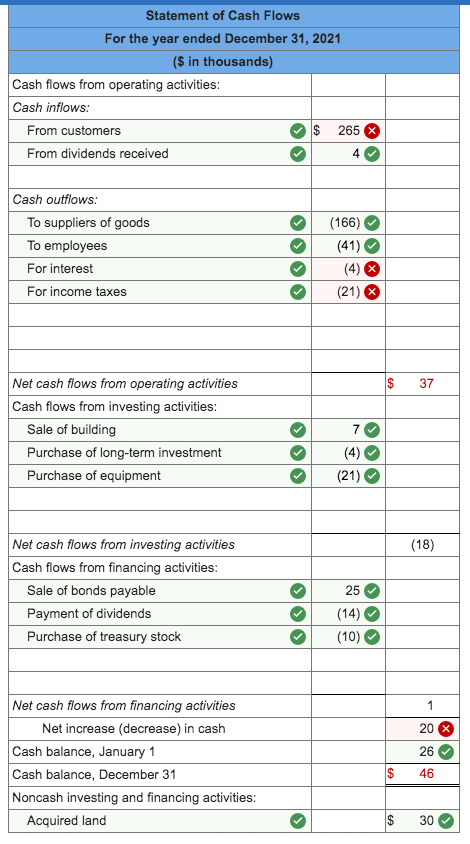

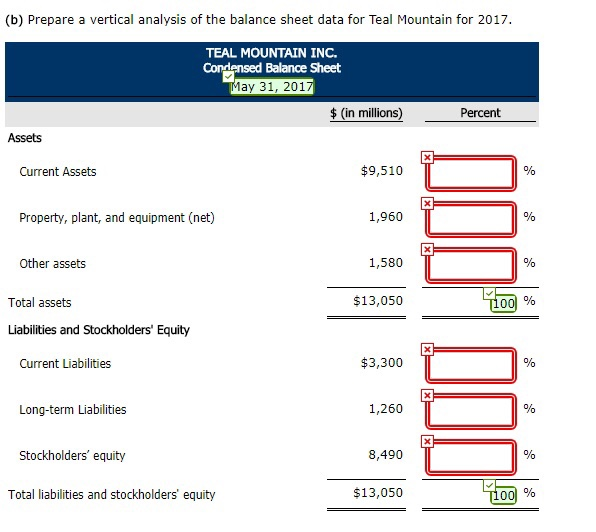

Comparative balance sheets quizlet. 2 Determine the cash provided by or. Comparative Balance Sheets For 2021 And 2020 A Statement Of Income For 2021 And Additional Information From The Accounting Records Of Red Inc Are Provided Below. Publicly-traded companies filing financial statements with the SEC are required to include a comparative Balance Sheet in their financial statements.

Equipment that cost 525000 and had a book value of 234000 was sold for 270000. Shows each major type of business activity that caused a companys cash to. It is essentially a snapshot of the financial condition of a business at a given moment say December 31st 2XXX.

31 Year 1 Accounts receivable 7737 5406 Inventory 11481 15340 Accounts payable 3911 5521 Dividends payable 4600 2382. A company can easily compute the difference between the beginning and the ending cash balance from examining its comparative balance sheets. Reports the components of cash flows from operating activities as gross receipts and gross payments.

In a balance sheet a firms assets must balance the sum of creditors claims liabilities and owners claims owners equity on these assets. 31 Year 2 Dec. The first column of amounts contains the amounts as of a recent moment or point in time say December 31 2020.

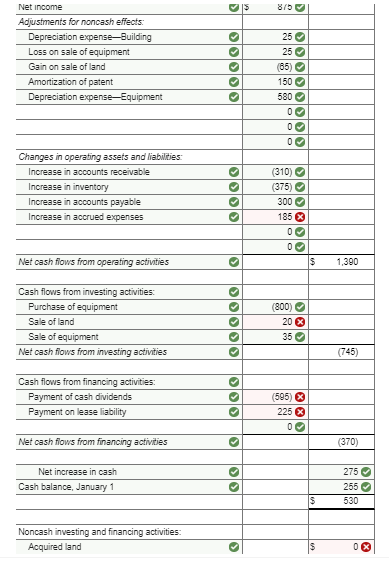

Companies follow four steps to prepare the statement of cash flows from these sources. In the context of comparative financial statements comparative balance sheets. It involves analyzing not only the current years income statement but also comparative balance sheets as well as.

The financial position of a firm at one point in time. Can be used to check if the owners equity had increased Nusreen a financial manager in a company compares the operating budgets from the past three years to identify trends in the cost of materials purchased and to learn whether the companys net expenses have. Accumulated DepreciationEquipment was 1374000 at 123114 and 1470000 at 123115.