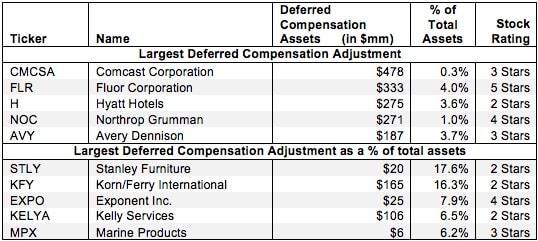

Formidable Deferred Compensation Balance Sheet

Sometimes companies declare their deferred compensation assets directly on the balance sheet.

Deferred compensation balance sheet. Sometimes companies declare their deferred compensation assets directly on the balance sheet. The journal entry is simple. Sometimes companies declare their deferred compensation assets directly on the balance sheet.

A more detailed discussion of unearned compensation and FIN 44 can be found here. Nonqualified deferred compensation plans Assets COLI taxable asset and plan liabilities shown separately on employers balance sheet Increases decreases in asset and plan liability values are reflected on employers income statement and balance sheet Gainslosses of investments Additional amounts credited and. 718-40-25 Recognition Deloitte Guidance.

Balance Sheet Classification of Deferred Compensation Grandfathered Shares Acquired Before January 1 1993 718-40-25 QA 21. Earnings on trust assets should be recorded in income although if the plan is a defined contribution plan that income usually will be counterbalanced by a corresponding expense resulting from an increase in the deferred compensation liability. The deferred compensation element of an equity - based deferred compensation arrangement is the amount of compensation cost deferred and amortized expensed to future periods as the services are provided.

On the company balance sheet the accounting for deferred compensation appears on the left or assets side as salaries expense and on the right or liabilities side as salaries payable. 7513 Balance sheet classification of rabbi trust assets Publication date. In 2020 the deferred compensation plan matures and the employee is paid.

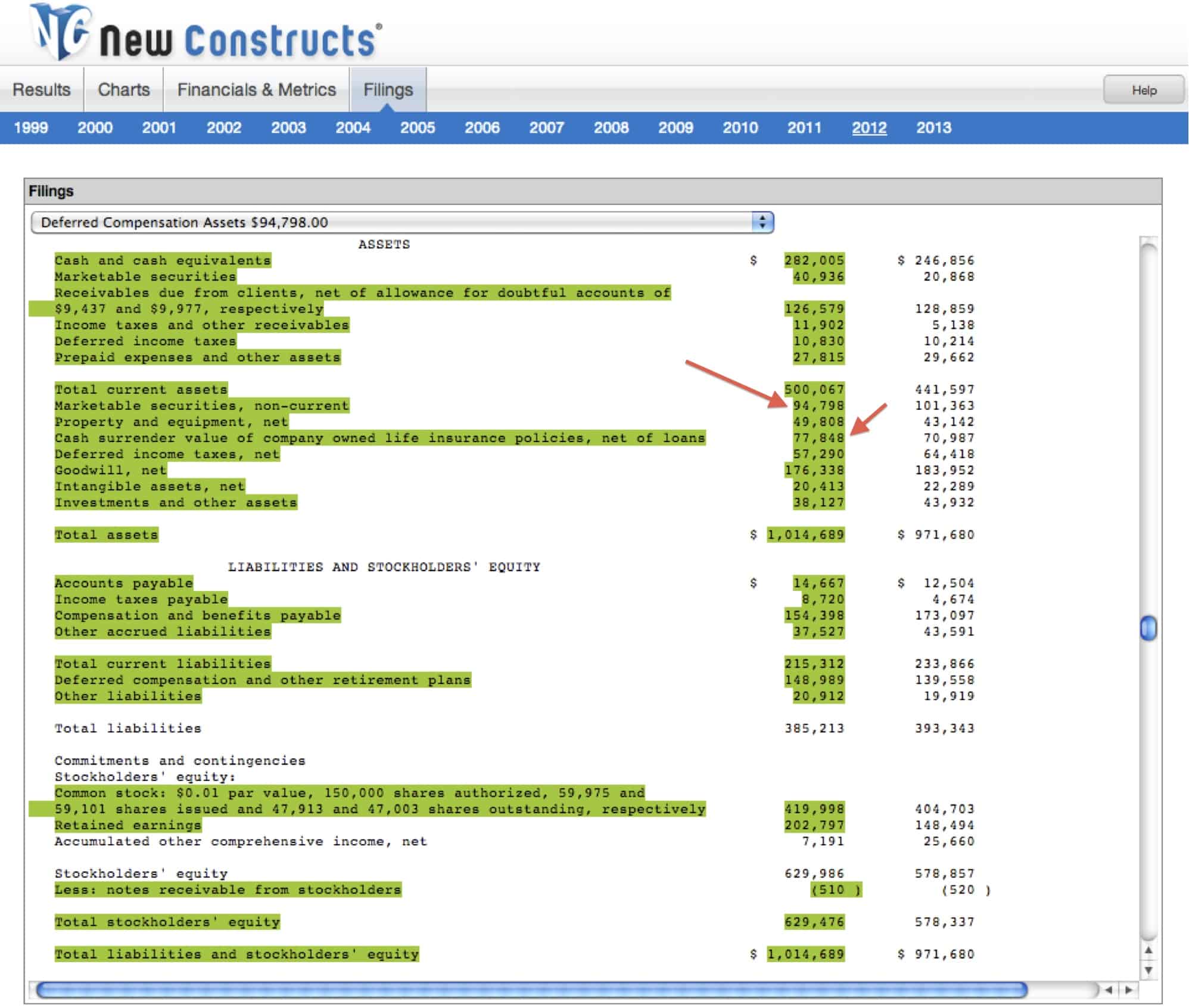

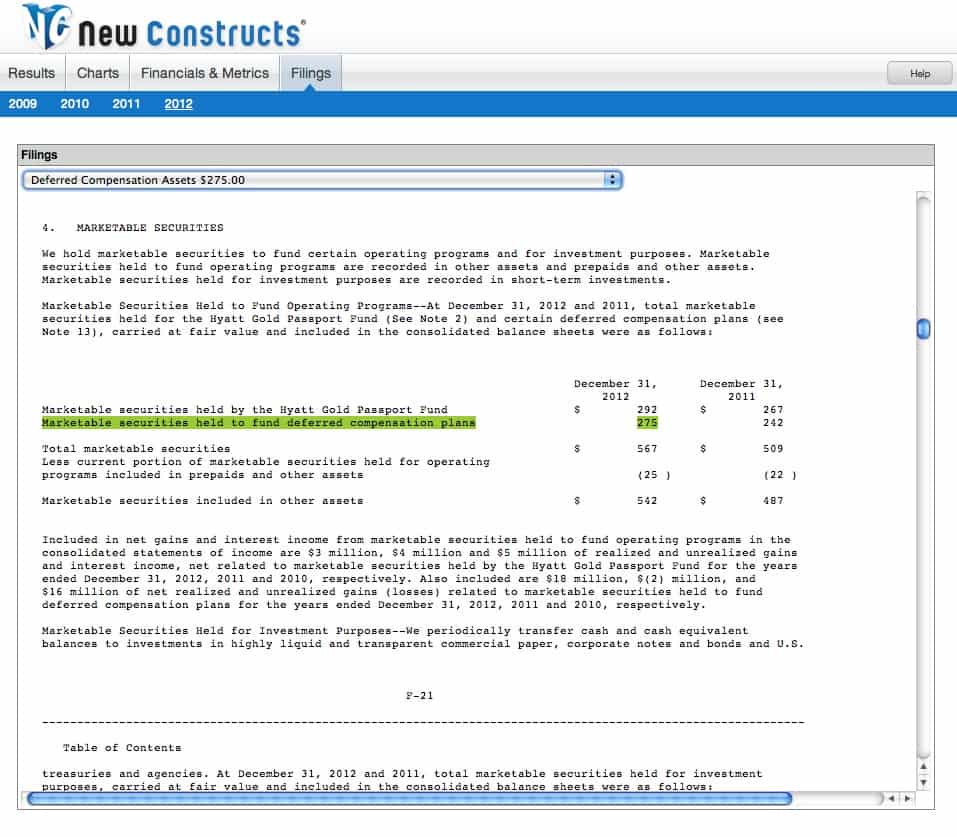

KornFerry International KFY lists the assets to fund its deferred compensation plan under. CORPORATE-OWNED TAXABLE INVESTMENTSSFAS 159. Deferred revenue which is also referred to as unearned revenue is listed as a liability on the balance sheet because under accrual accounting the revenue recognition process has not been.

Basic Elements of The Balance Sheet in Financial Reporting and Analysis. Incremental Depreciation Amortization Deferred Revenue. The nonqualifi ed deferred compensation plan is a contractual obligation from the company to pay the plan participants in the future and participant accounts are treated as a long-term liability.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)