Supreme Equation For Free Cash Flow

Free cash flow to business FCFF shows the amount of cash flow from operations that is available for distribution after accounting for depreciation working capital taxes and capital expenditures.

Equation for free cash flow. What Is Free Cash Flow Per Share Free cash flow per share FCF is a measure of a companys financial flexibility that is determined by dividing free cash flow by the total number of shares. There are two approaches to valuation using free cash flow. In free cash flow valuation intrinsic value of a company equals the present value of its free cash flow the net cash flow left over for distribution to stockholders and debt-holders in each period.

Since net income has been provided to us lets solve for FCFE using the formula. -30504700 As per the outcome of the free cash flow calculation it can be seen that the capital expenditure is more than the available free cash flow. The simplest way to calculate free cash flow is to subtract a businesss capital expenditures from its operating cash flow.

Free cash flow to equity is also used in financial modeling for determining the value of a companys equity. If youre analyzing a company that doesnt list capital expenditures and operating cash flow there are similar equations that. As an example let Company A have 22 million dollars of cash from its business operations.

The formula below is a simple and the most commonly used formula for levered free cash flow. Free Cash Flow Operating Cash Flow CFO Capital Expenditures Most information needed to compute a companys FCF is on the cash flow statement. The ratio is calculated by taking the.

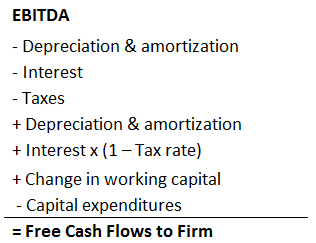

Free Cash Flow to the Firm. Unlevered free cash flow is the amount of cash a company has prior to making its debt payments. 14026300 37657800 Rs.

F C F E 2 0 0 1 5 5 0 5 0 2 0 1 3 5. Free cash flow to the company. How to Calculate Free Cash Flow Add your net income and depreciation then subtract your capital expenditure and change in working capital.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-b54b46188f5746769a37298478048177.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)