Fun General Ledger Trial Balance Report

The accounts reflected on a trial balance.

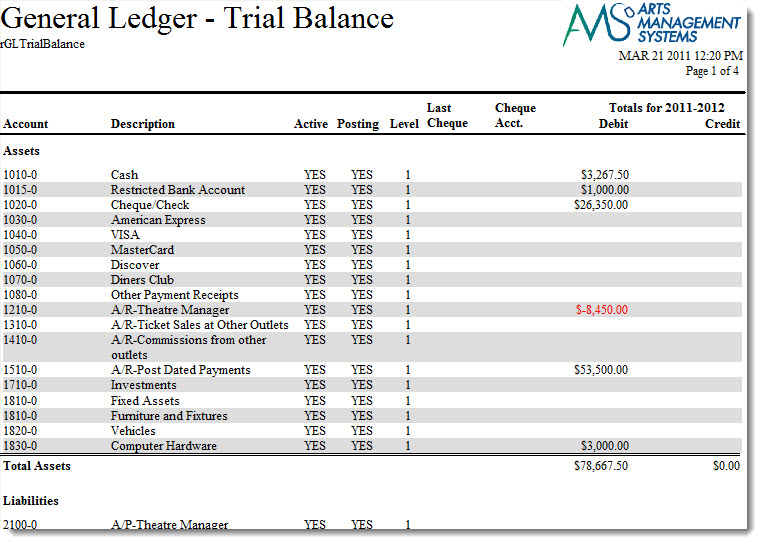

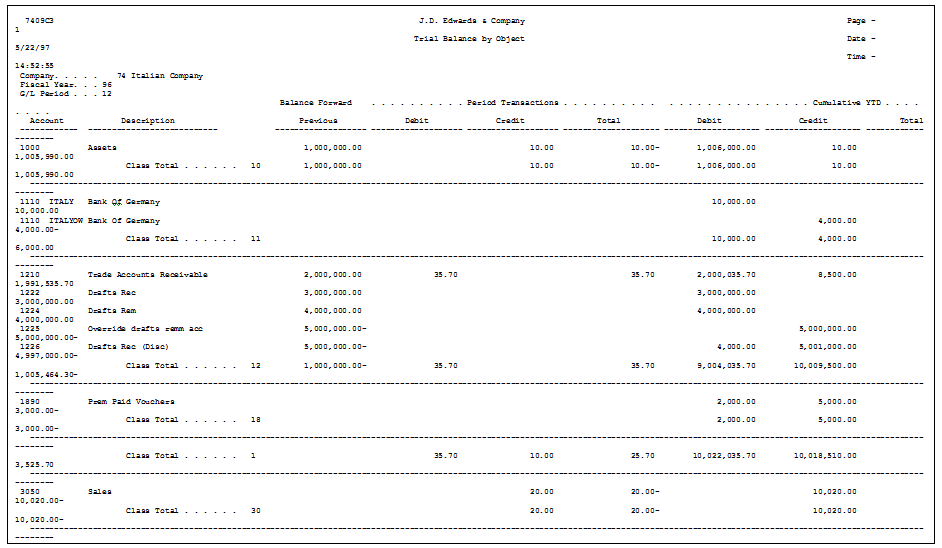

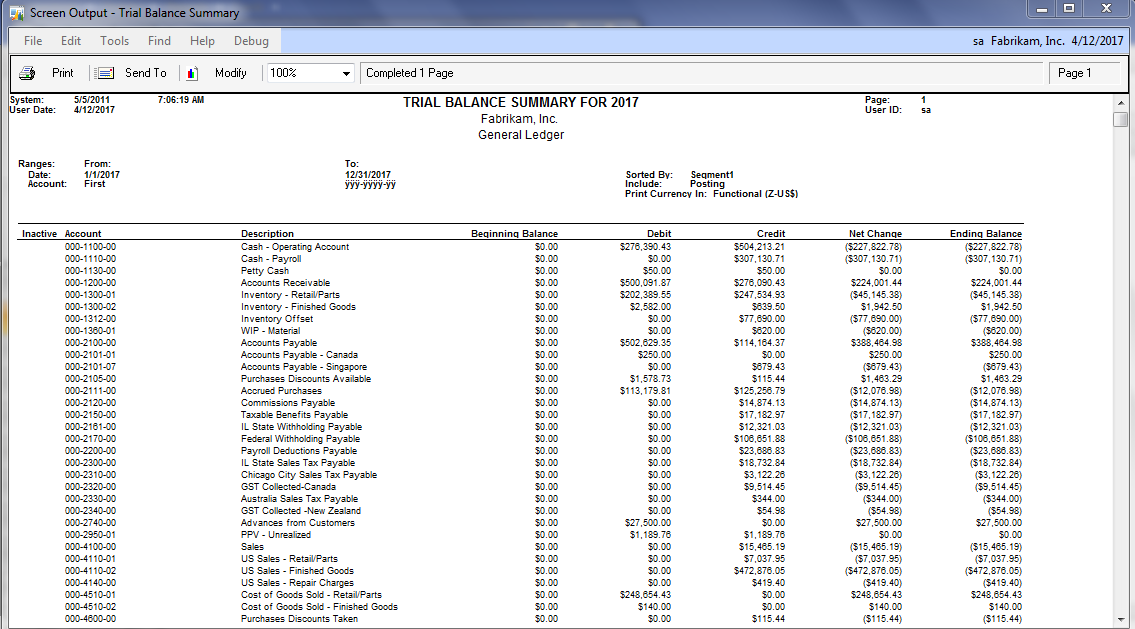

General ledger trial balance report. Minutes Books of Directors and Stockholders. Select the accounts for which you want to print the general ledger and click the Print General Ledger report at the top of the screen. The General Ledger Trial Balance shows each account and its balance as of the date or period you select.

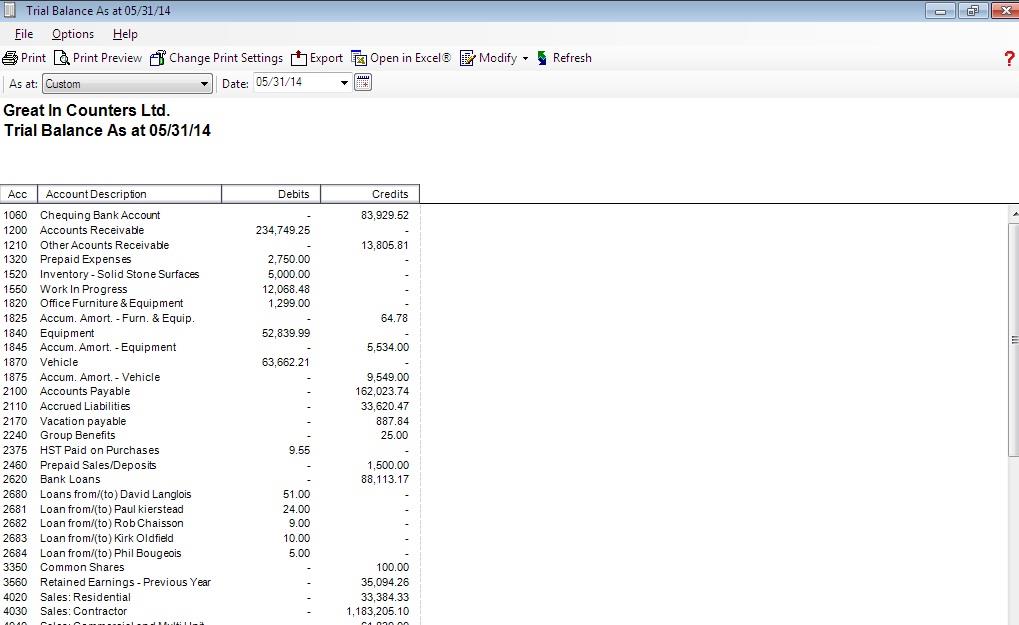

The general ledger trial balance report is essentially a report that illustrates every single one of your accounts from the chart of accounts. For this report Sage 50 displays the following filter options. The transaction detail report allows you to get detailed information about the transactions taking place inside your system.

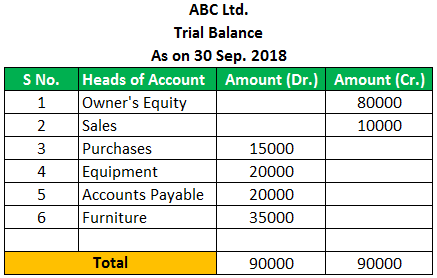

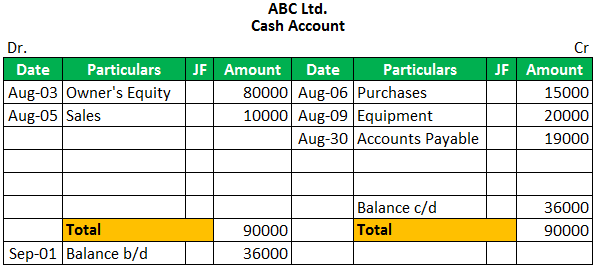

The general ledger and trial balance allow you to see what your current account balances are and what debits and credits have been posted to those accounts. The Trial and General Ledger Balance Check report is an exported XLSX file that can help you confirm the completeness of a General Ledger GL by comparing your supplied closing balances with our calculated values. Your trial balance is an accounting report that contains your general ledger account balances in debit and credit columns.

A General Ledger of an organization is the record containing all its assets revenue liability expense gain and loss accounts with the amount in respective accounts. Trial balance reports are useful to verify the accuracy of individual ledger account balances and your overall ledger. Property Appraisals by Outside Appraisers.

While the general ledger displays transactions for an account a trial balance will show one amount either debit or credit for each account. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. G12 Trial Balance Reports.

Insurance Records Current Accident Reports Claims Policies. Available General Ledger Reports Trial Balance Report. Click the Options button to determine the data criteria for the reports you want to see or print.