Cool Golden Corporation Statement Of Cash Flows

Week 6 Assignment GOLDEN CORPORATION Statement of Cash Flows Year Ended Dec 31 2016 Cash Flows from Operating Activities.

Golden corporation statement of cash flows. View AGM Notice 2020 PDF 200KB. Cash flows from operatingactivities. Cash flows from investingactivities.

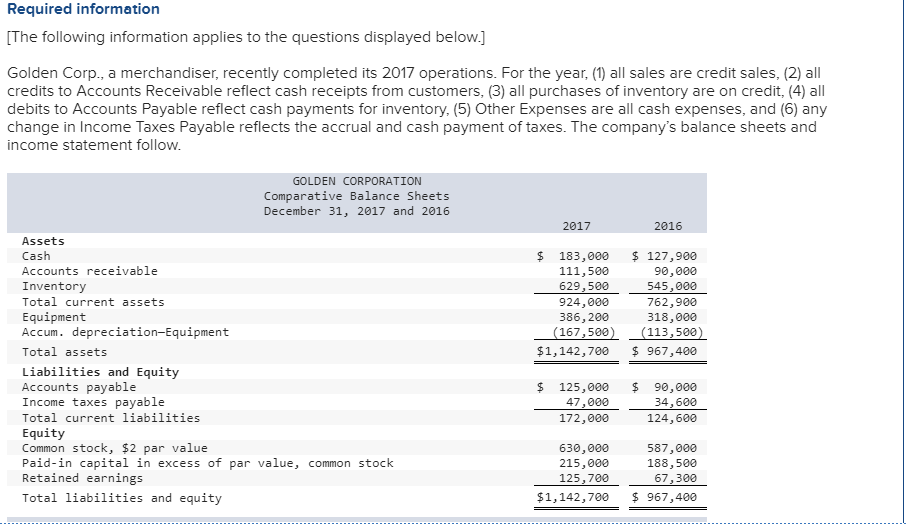

For the year 1 all sales are credit sales 2 all credits to Accounts Receivable reflect cash receipts from customers 3 all purchases of inventory are on credit 4 all debits to Accounts Payable reflect cash. Cash balance at beginning ofyear. Cash flows from operating activities.

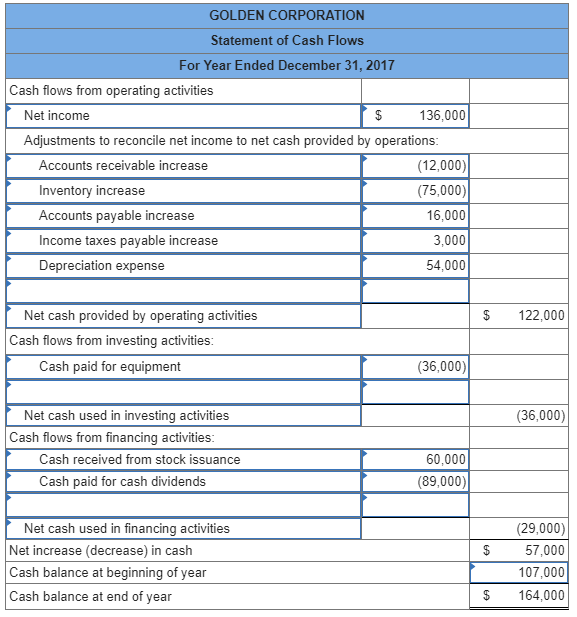

We have audited the financial statements of Dynasty Gold Corp. GOLDEN CORPORATION Statement of Cash Flows For Current Year Ended December 31 Cash flows from operating activities Net income 138000 Adjustments to reconcile net income to net cash provided by operations. The Company which comprise the consolidated statements of financial position as at December 31 2020 and 2019 and the consolidated statements of changes in shareholders equity comprehensive loss and cash flows for the years then ended and notes to the consolidated financial statements including a summary of significant accounting policies collectively referred as the financial statements.

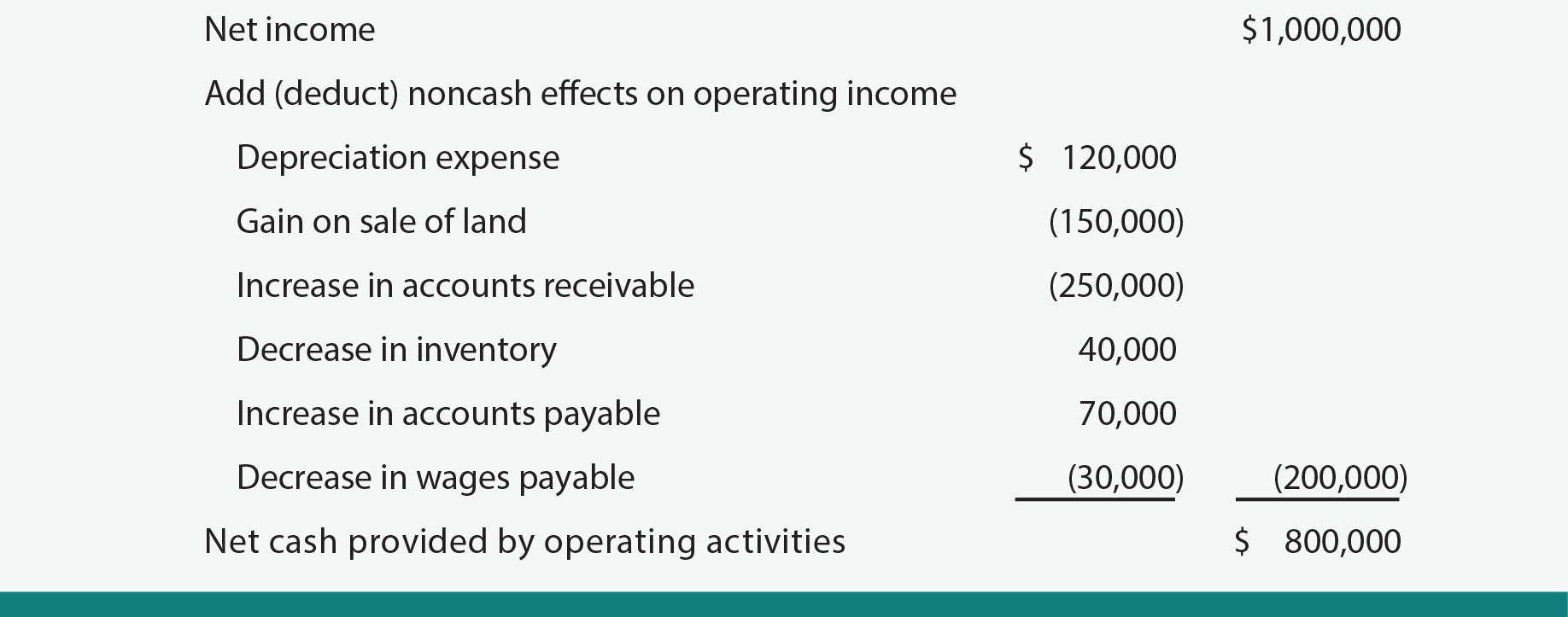

GOLDEN CORPORATION Statement of Cash Flows For Year Ended December 31 2013 Cash flows from operating activities Net income. Prepare a complete statement of cash flows using a spreadsheet as in Exhibit 12A1 attached report operating activities under the indirect method. Cash flow statements are vital because they take the Financial Performance presented in the PL and provide a cash adjusted view.

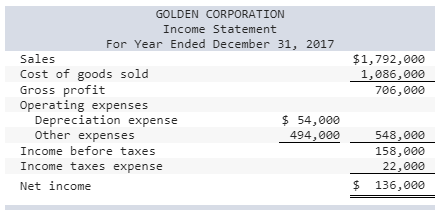

Cash generated by operating activities. Net increase decrease incash. Goldens balance sheets and income statement follow.

Accounts receivable increase 12000 Inventory increase 75000 Accounts payable increase 10000 Income taxes payable increase 3000 Depreciation expense 54000 122000 Net cash provided by operating activities Cash flows. Sales 1797000 Cost of goods sold 1090000 Gross profit 707000 Operating expenses Depreciation expense 51000 Other expenses 496000 547000 Income before taxes 160000 Income taxes expense 21000 Net income 139000. For the year 1 all sales are credit sales 2 all credits to Accounts Receivable reflect cash receipts from customers 3 all purchases of inventory are on credit 4 all debits to Accounts Payable reflect cash payments for inventory 5 Other Expenses are all cash expenses and 6 any change in Income Taxes Payable reflects the accrual and cash payment of taxes.