Fun Ifrs 16 Illustrative Disclosures

Illustrative consolidated financial statements of Good Group International Limited and subsidiaries for the year ended 31 December 2020.

Ifrs 16 illustrative disclosures. IFRS IN PRACTICE 20192020 fi IFRS 16 LEASES 5 1. These reflect changes to IFRS effective for year ending 31 December 2019. The example disclosures in this supplement relate to a listed corporation in the.

BC217 Maturity analysis paragraph 58 paras. Year in which it adopts IFRS 16 with a date of initial application of 1 January 2019. Extracts from financial reports presented in this publication are reproduced for illustrative purposes.

Sector-specific disclosures are available for banks insurers and investment funds. 2020 edition PDF 295 MB 2019 edition PDF 29 MB 2018 edition PDF 27 MB Supplements to annual Illustrative disclosures. This publication illustrates possible formats entities could use to disclose information required by IFRS 16 Leases using real-life examples from entities that have early adopted IFRS 16.

There is a common thread in IFRSs to require disclosure of the most relevant information rather than simply setting out a prescriptive list of disclosures. IFRS 16 inclusive of the examples in the supplemental implementation. 2 These reflect changes to IFRS.

COVID-19 supplement PDF 25 MB IFRS 12 supplement PDF 12 KB IFRS 16 supplement PDF 18 MB Annual Disclosure checklists. In compiling the illustrative disclosures we have made a number of assumptions in relation to the adoption of IFRS 16. IFRS 16 offers a range of transition options.

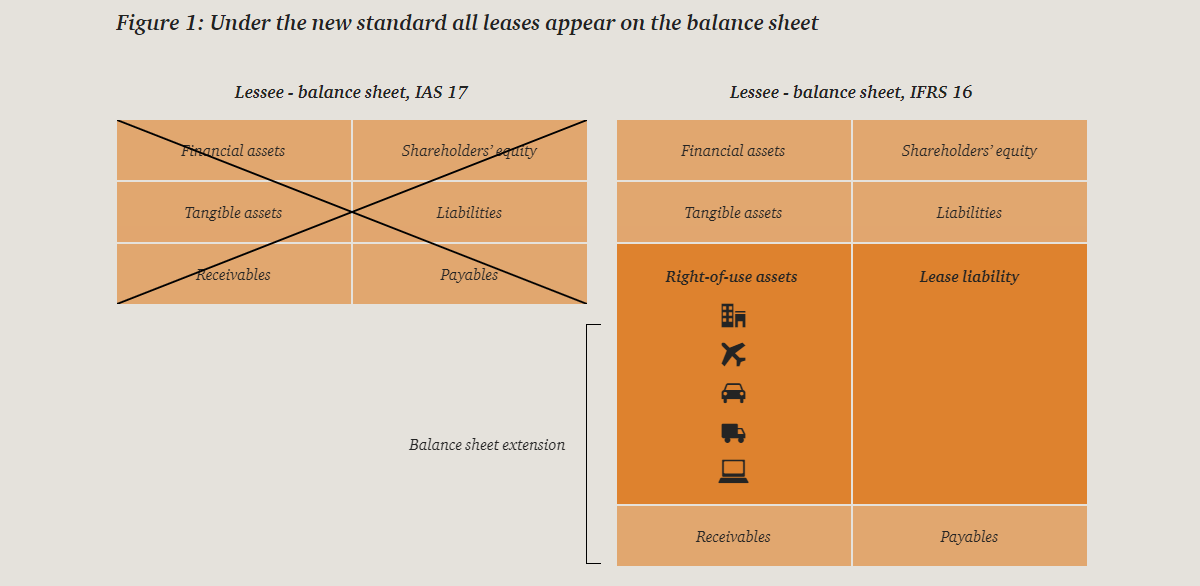

The carrying amount of all ROU assets summarized by asset class as of the end of the reporting period ROU asset depreciation expense summarized by asset class for the reporting period. INTRODUCTION IFRS 16 Leases brings significant changes in accounting requirements for lease accounting primarily for lessees. The corporation is a lessee in most of its leases but also acts as a lessor occasionally and owns a property that it classifies as investment property.