Fabulous Negative Retained Earnings Balance Sheet

So what are retained earnings.

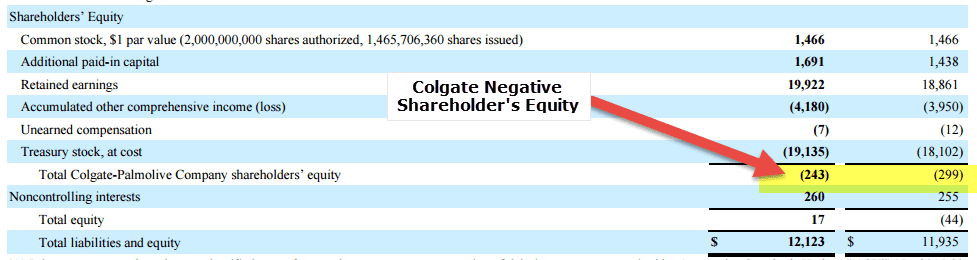

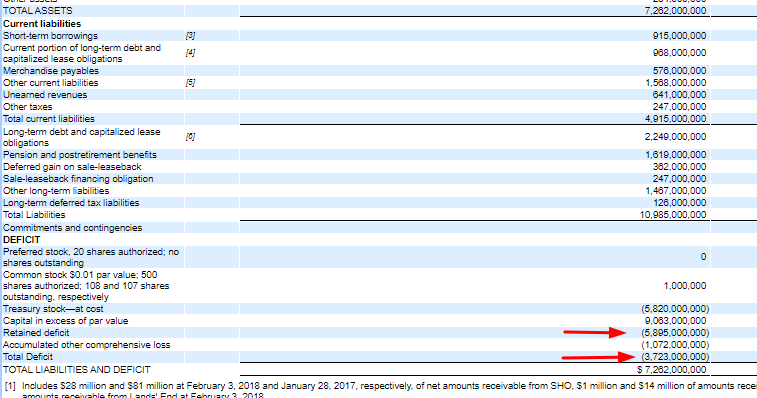

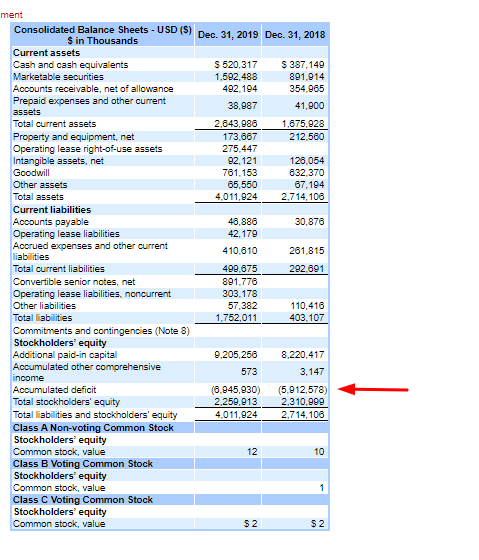

Negative retained earnings balance sheet. Its in the balance sheet above. Stockholders equity might include common stock paid-in capital retained earnings and treasury stock. If the net loss for the current period is higher than the retained earnings at the beginning of the period those retained earnings on the balance sheet may become negative.

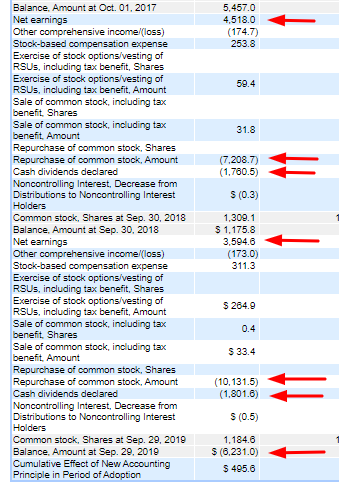

Negative Retained Earnings Retained earnings represent the cumulative net income of a company. If a business has a cumulative retained loss also known as negative retained earnings it has a debit balance in the retained earnings account. When a company has a negative retained earnings balance.

In this situation the Assets of the company are worth less than its debt and obligations. As the company becomes profitable the roll-forward of corporate profits will increase the retained earnings balance and bring it closer to zero. Hence if it is reported as a separate line it is reported as a negative amount since the owners equity section of the balance sheet normally has credit balances.

If a company operates at a net loss the net losses will result in a negative retained earnings account on the balance sheet. Retained earnings can be negative if the company experienced a loss. The negative retained earnings are mainly because of consistent losses from its.

Accumulated losses over several periods or years could result in a negative shareholders equity. Its important to master retained earnings when you want to grow. When earnings are retained rather than paid out as dividends they need to be accounted for on the balance sheet.

This deficit arises when the cumulative amount of losses experienced and dividends paid by a business exceeds the cumulative amount of its profits. Author Anfisa Dmitrieva Posted on Posted on. What do negative retained earnings mean on the balance sheet.