Fabulous Notes Payable Cash Flow Statement Indirect Method

Statement of Cash Flows.

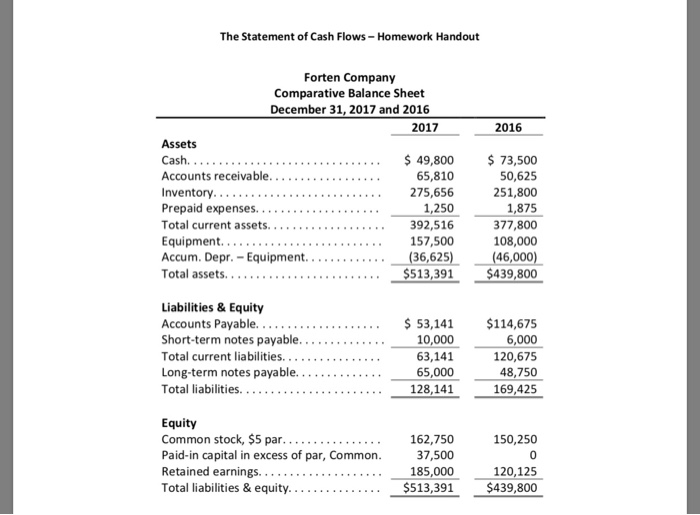

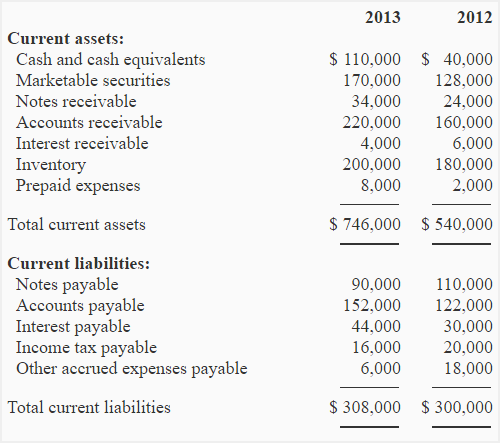

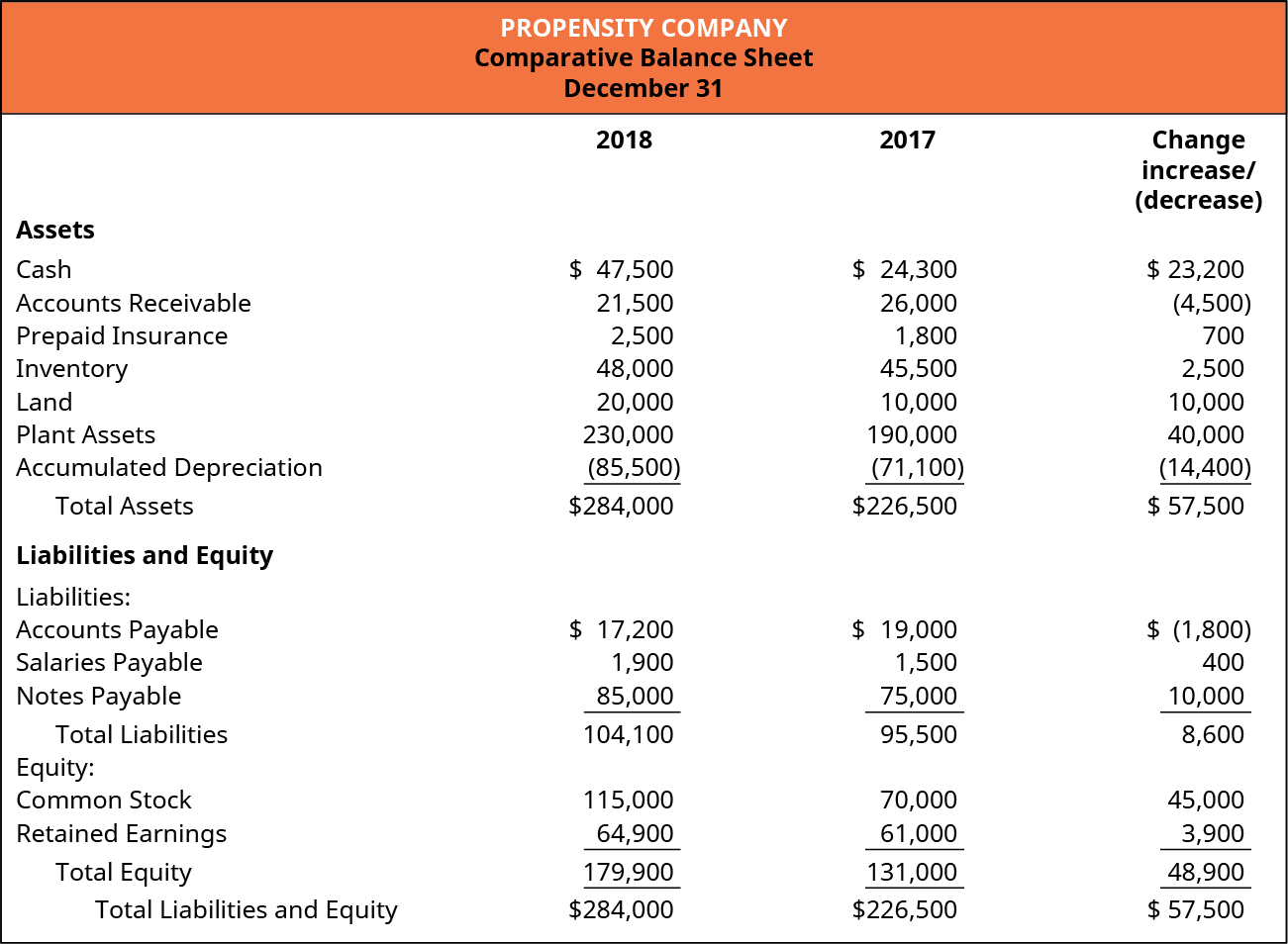

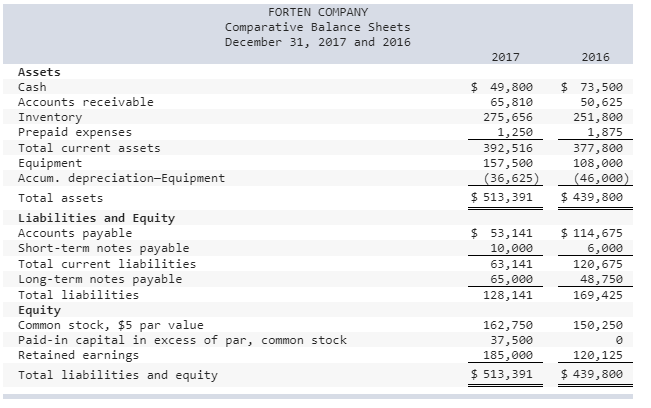

Notes payable cash flow statement indirect method. Notes payable affect the financing activities and operating activities sections of cash flow statements. Remember that under the accrual basis of accounting revenues and expenses are recorded following the revenue recognition and matching principles which do not require cash receipts to record revenues or cash payments to record expenses. After studying and solving these problems you can solve other questions related to cash flow statement.

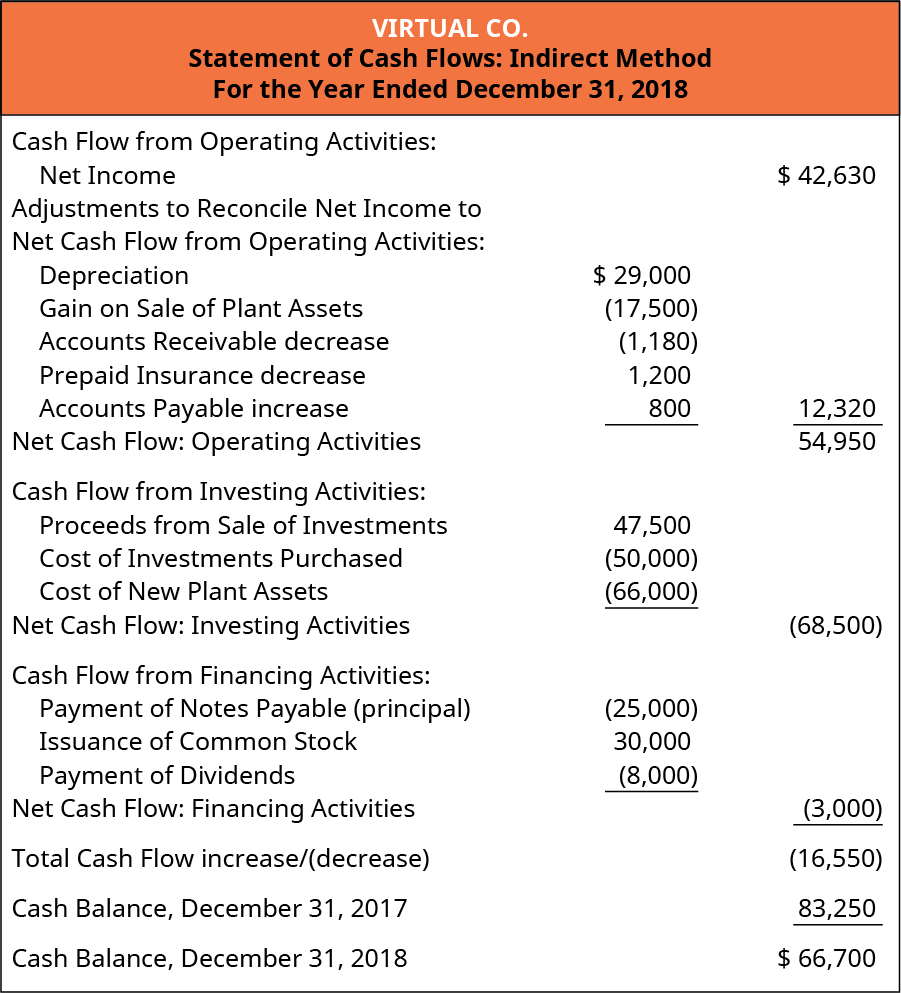

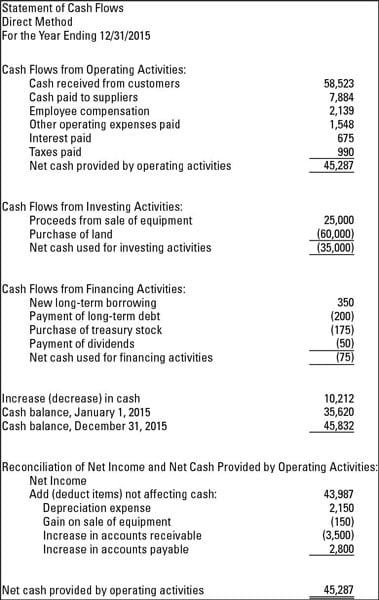

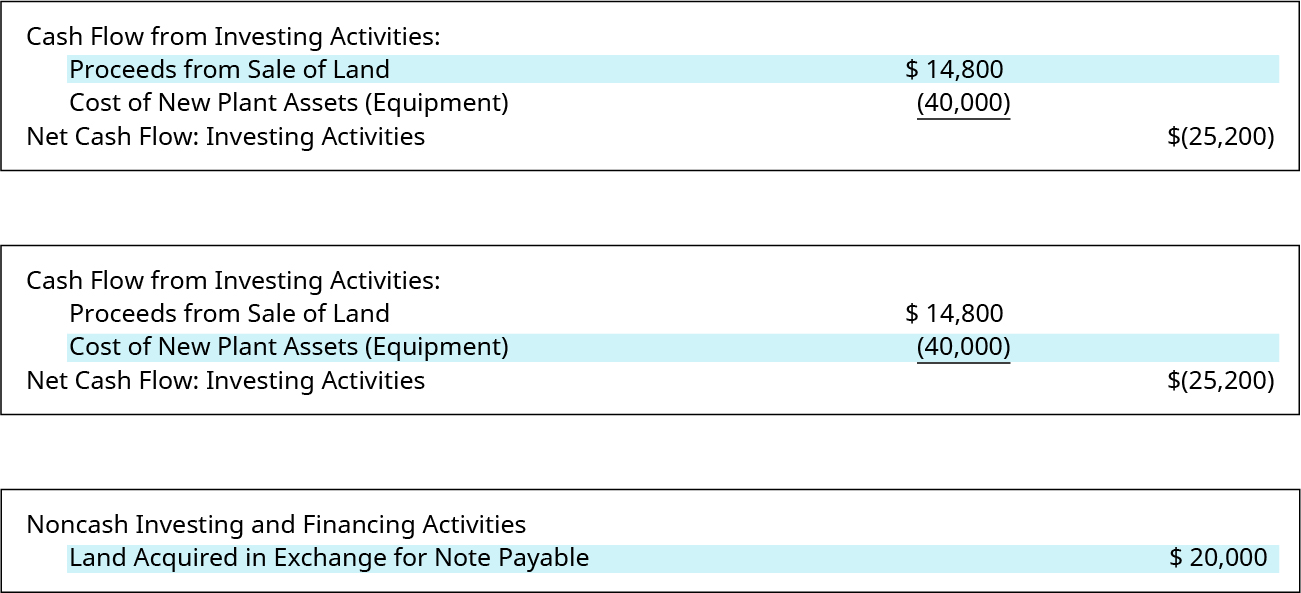

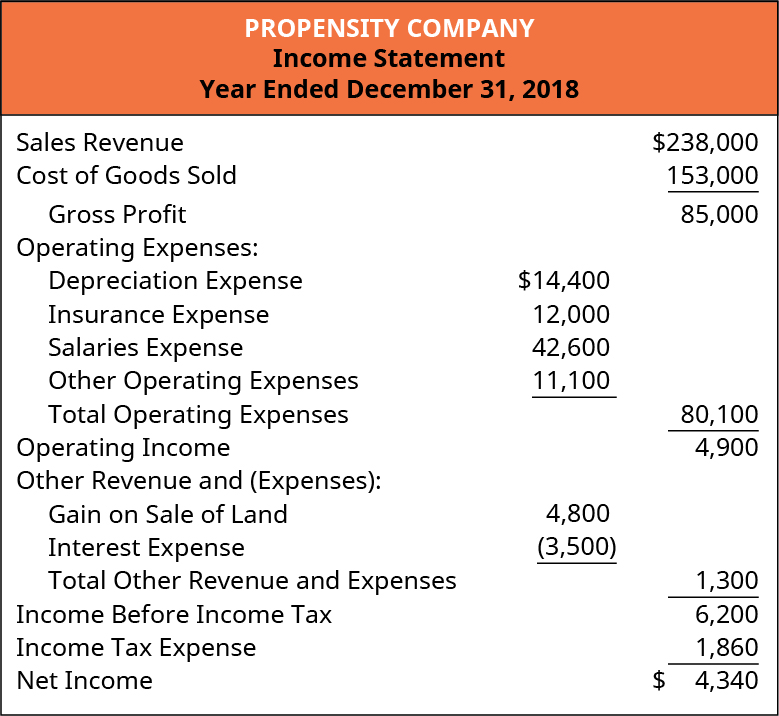

The statement of cash flows is one of the components of a companys set of financial statements and is used to reveal the. Identify Cash Flows using the indirect method The indirect method adjusts net income rather than adjusting individual items in the income statement for 1 changes in current assets other than cash and current liabilities and 2 items that were included in net income but did not affect cash. Cash flow statement direct method For the year ended December 31 2015.

When using a cash flow statement you can calculate total cash flow by subtracting total cash outflow from total cash inflow in each section. This is the cash receipts from customers. Determine Net Cash Flows from Operating Activities.

The interest paid on a note payable is reported in the section of the cash flow statement entitled cash flows from operating activities. Prepare the Statement of Cash Flows Using the Indirect Method. See also related solutions.

18 cash flow statement indirect method Cash flow statement indirect direct method formula. The Cash Flow Statement Indirect Method is one of the two ways in which Accountants calculate the Cash Flow from Operations another way being the Direct Method. Here best questions are solved from easy to difficult methods.

While generally accepted accounting principles GAAP approve both the indirect method is typically preferred by small businesses. The indirect method assumes everything recorded as a revenue was a cash receipt and everything recorded as an expense was a cash payment. Since most corporations report the cash flows from operating activities by using the indirect method the interest expense will be included in.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)