Fabulous Ongc Ratio Analysis

ROCE 791 1824 1441 1642 962 1331.

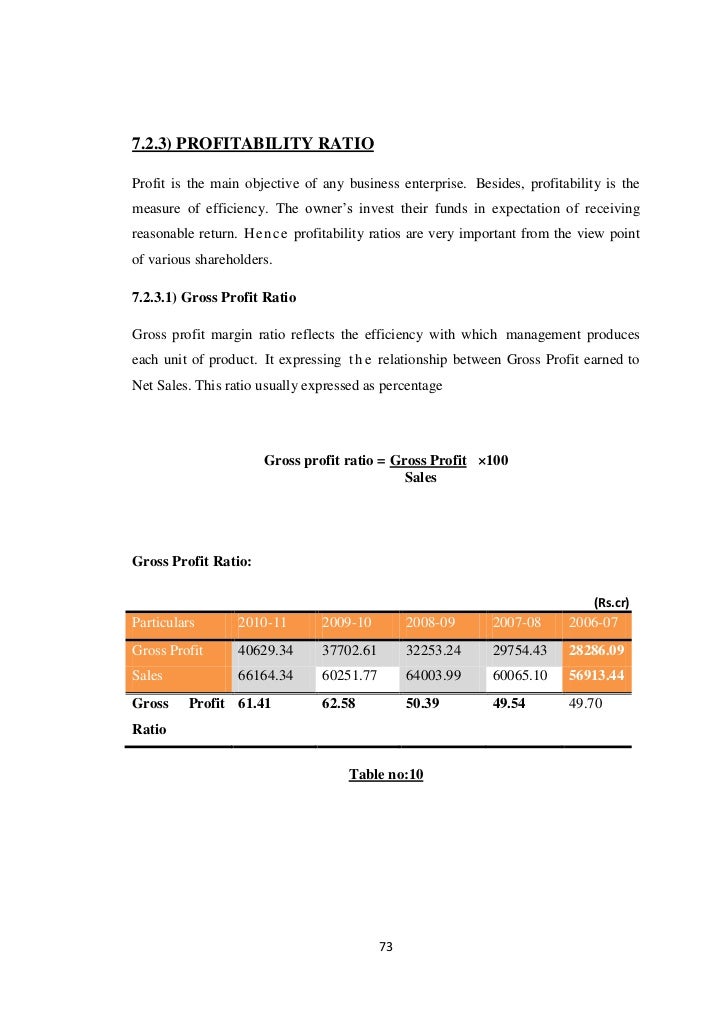

Ongc ratio analysis. ONGCs debt to equity ratio 453 is considered high. 39 CHAPTER-V FINANCIAL PERFORMANCE OF ONGC- AN ANALYSIS RATIOS 51 CURRENT RATIO It is used for measuring short-term liquidity or solvency. ONGC Ratios Financial summary of ONGC ONGC Profit Loss Cash Flow Ratios Quarterly Half-Yearly Yearly financials info of ONGC.

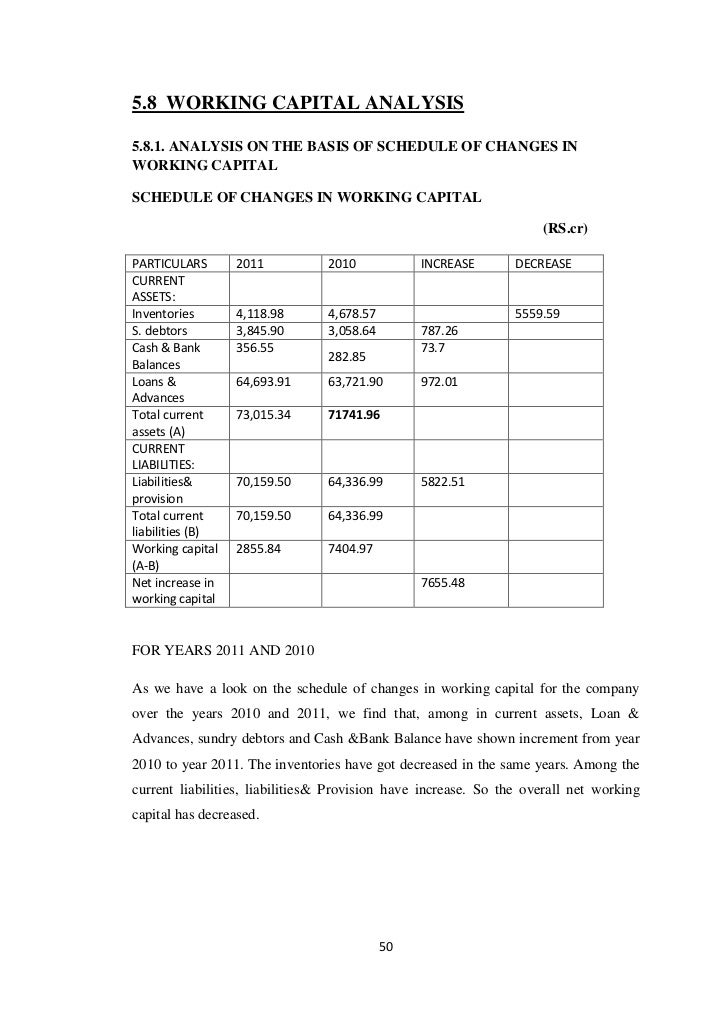

Inventory Turnover Ratio X 804. Working CapitalSalesx-1157-1079-818-731 1966 8461. SalesFixed Assetx 116 151 151 148 045 046.

ONGC has an Inventory turnover ratio of 118267201571822 which shows that the management is inefficient in relation to its Inventory and working capital management. Ratio Analysis 11 Definition of Ratio Analysis A tool used by individuals to conduct a quantitative analysis of information in a companys financial statements. Share Holding Pattern BSE Shareholding fillings.

ONGC has the expertise for any services needed for oil exploration and drilling. Net Profit Margin 1721. Fixed CapitalSalesx 086 066 066 068 222 219.

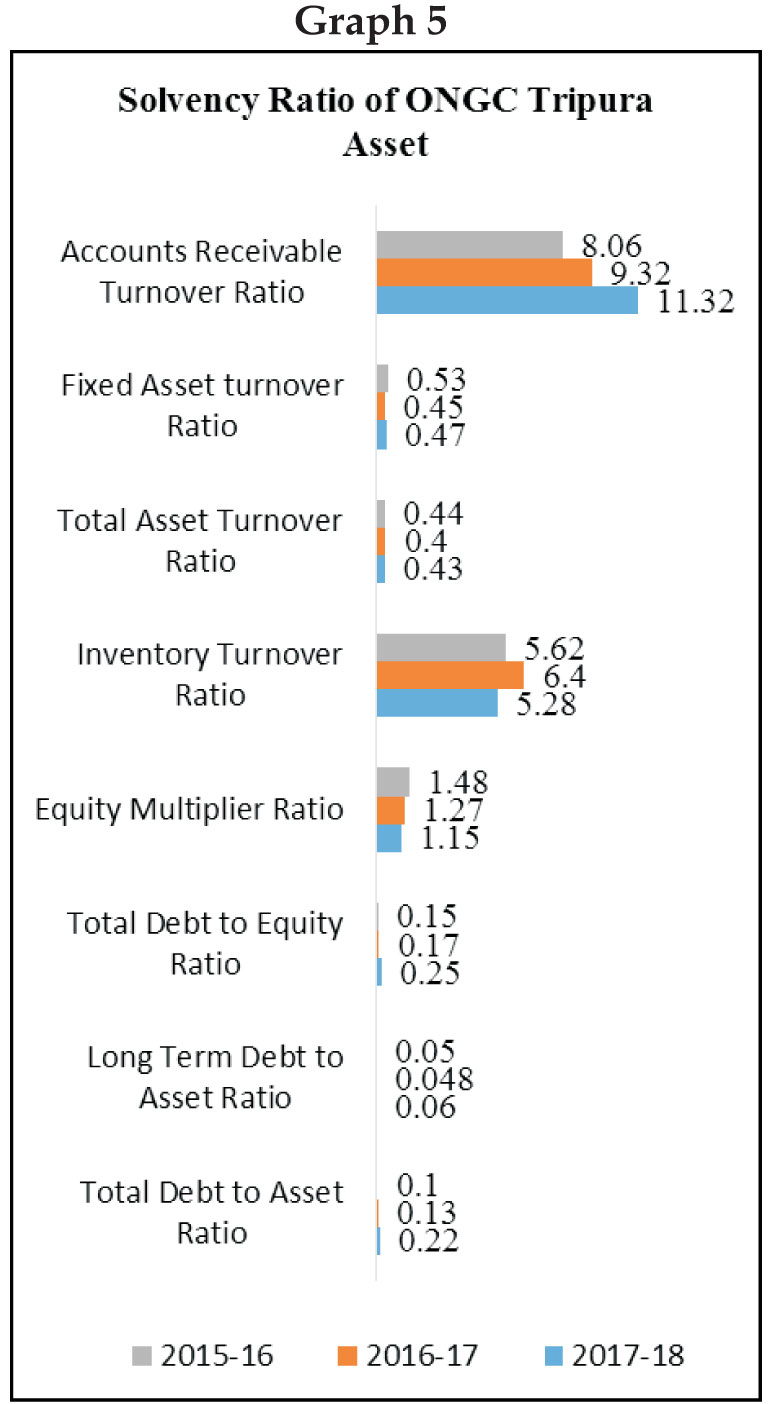

Tripura Financial Performance ONGC Comparative Ratio Analysis organisations. ONGC alone manages to produce 126 million barrel oil per day. ROE 496 1450 1172 1344 648 1006.

An analysis of stocks based on price performance financials the Piotroski score and shareholding. Return on Capital Employed 1139. GAIL Misses Earnings Estimates.