Supreme Profit Comes On Which Side Of Balance Sheet

It is shown on assets side of balance sheet.

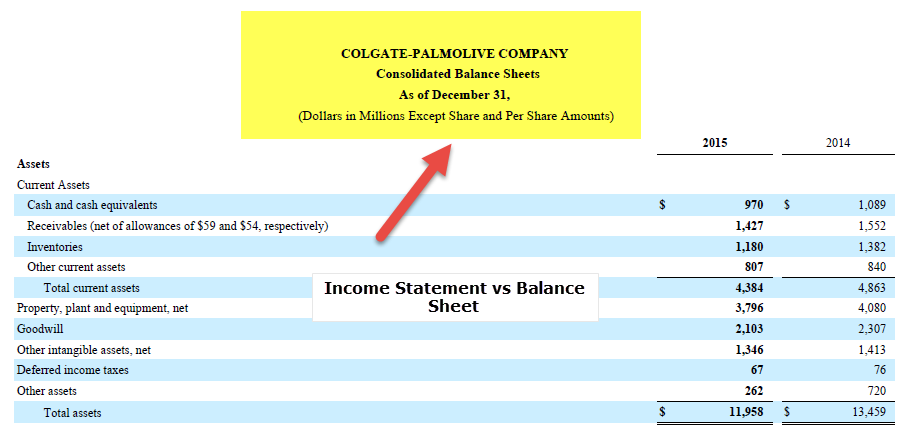

Profit comes on which side of balance sheet. A standard company balance sheet has three parts. The profit or net income belongs to the owner of a sole proprietorship or to the stockholders of a corporation. Unlike an income statement the full value of long-term investments or debts appears on the balance sheet.

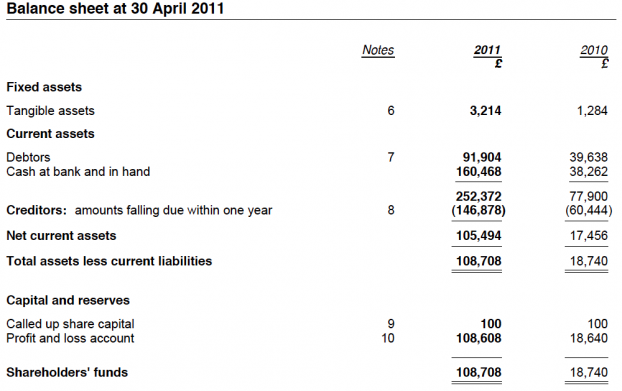

Capital and Profit are sources of fund. On the left side of a balance sheet assets will typically be classified into current assets and non-current long-term assets. Liability side balance sheet can be described as sources of fund.

When financially analyzing a company investors can use the retained earnings figure to decide how wisely management deploys the money it isnt distributing to shareholders. The name balance sheet is derived from. Side sales and sales return are written in the credit where sale return is deducted from sales.

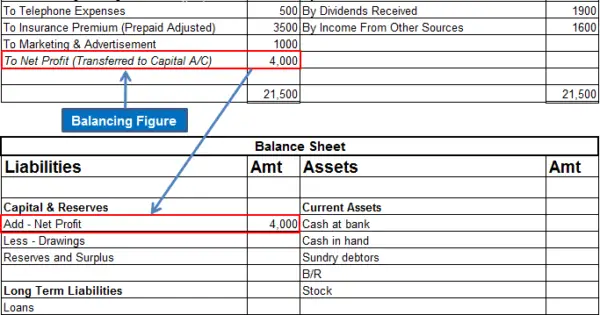

If there is loss then it is application of fund. If there is profit then capital will increase and vice-versa. Therefore profit is recorded on the liability side of balance sheet since it is the liability of the business towards the owner of the business.

A balance sheet gives a clear snapshot of a companys assets what it owns and its equity and liabilities at any given time or period. Profit is part of capital or net worth. So Assets are shown on the right-hand side and liabilities on the left-hand side of the balance sheet.

It is added to capital account and not on asset side of Balance sheet. So Assets are shown on the right-hand side and liabilities on the left-hand side of the balance sheet. A balance sheet provides a snapshot of the financial condition of a company showing how much it owns assets owes liabilities and the amount that is left over for its owners owners equity at a specific point in time.