Simple Significant Account Audit

Audit Procedures and Sampling Audit sampling is the method of audit procedure where auditors test less than 100 of items within the population of account balance or class of transaction.

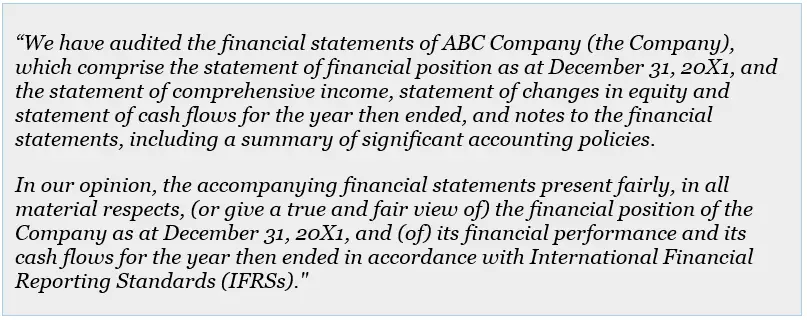

Significant account audit. While selecting significant accounts is only one of several crucial decisions companies must make for their Sarbanes-Oxley compliance processes the selection of accounts and the disclosures that accompany them is considered paramount since it affects the overall scope of the companys evaluation of internal controls. Paragraph 31 says that the significant accounts and disclosures are relevant for both the audit of financial statements and the audit of internal controls. Significant accounting estimates are management estimates included in the financial statements.

Here are some of the accounts receivable audit. PERFORMING RISK ASSESSMENT PROCEDURES FOR CASH ACCOUNTS. Consolidated Financial Statements To explain paragraph 33 further consider a billion dollar multi-national company with lots of location or lots of business units or even if its a smaller company but there are locations that may add up to become.

Significant accounts and disclosures and their relevant assertions are the same in the audit of internal control over financial reporting and the audit of the financial statements. Auditors should direct audit work to the key risks sometimes also described as significant risks where it is more likely that errors in transactions and balances will lead to. Increase the substantive testing of the valuation of numerous significant accounts at year end because of significantly deteriorating market conditions and Obtain more persuasive audit evidence from substantive procedures due to the identification of pervasive weaknesses in the companys control environment.

The existenceoccurence and completeness assertions are usually the most relevant for auditing cash. Audit insights provides a platform for auditors to share their expert knowledge and experiences of a market sector or business issue to a diverse range of stakeholders. If your company is subject to an annual audit the auditors will review its accounts receivable in some detail.

Presentation and disclosure cash is classified on the BS sheet and disclosed. E Significant risk An identified and assessed risk of material misstatement that in the auditors judgment requires special audit consideration. Typing difficult significant account to audit in Google shows this Reddit thread for me.

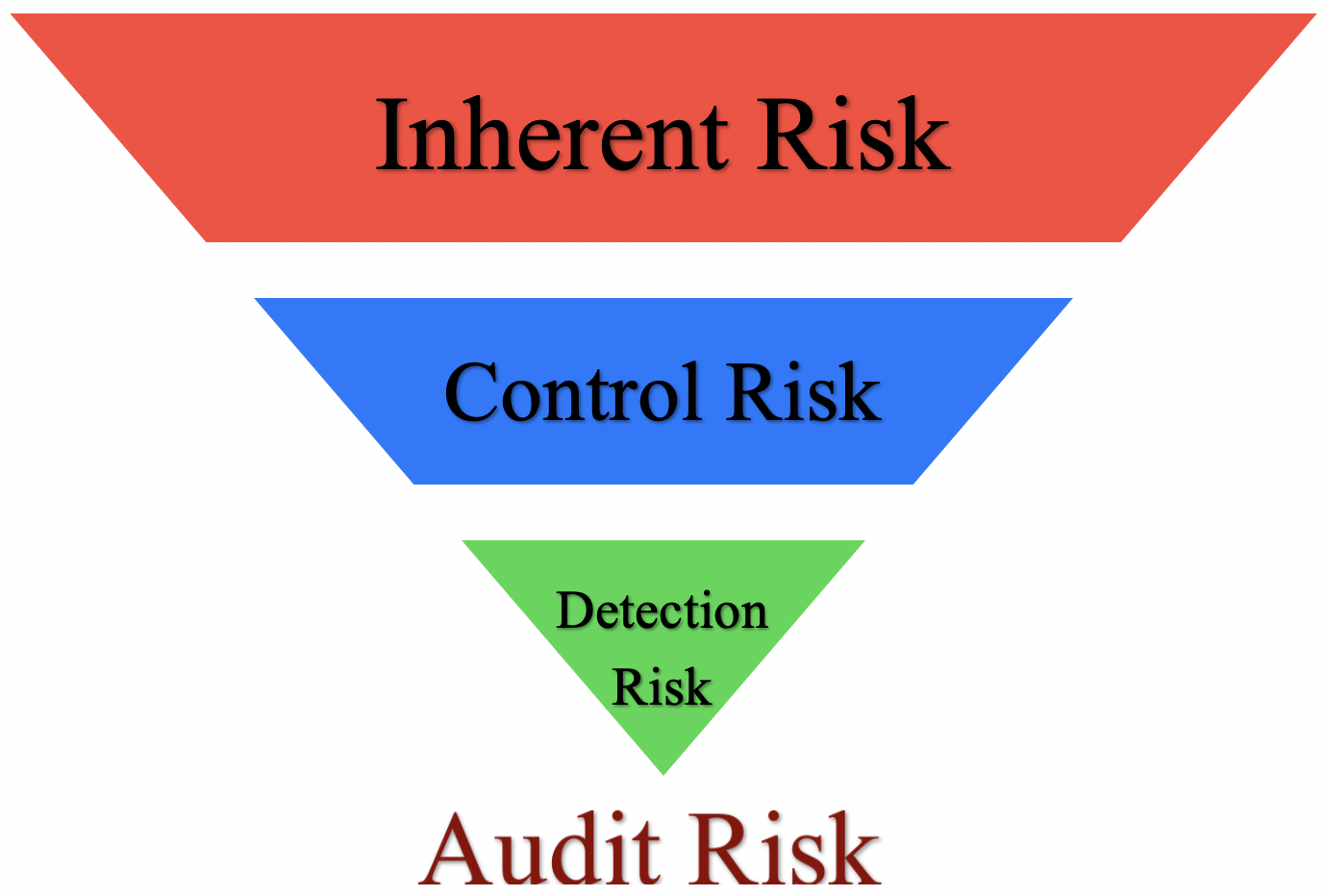

Audit Legal Implications Accounting Accounting is a term that describes the process of consolidating financial information to make it clear and understandable for all. Financial Statement Level Risks Financial statement level risks are risks that relate pervasively to the financial statements as a whole and potentially impact many relevant assertions. Since financial statements cannot be held to a lie detector test to determine whether they are factual or not other methods must be used to establish the truth of the financial statements.