Spectacular Write Off Of Fixed Assets Cash Flow Statement

Would have the following heading.

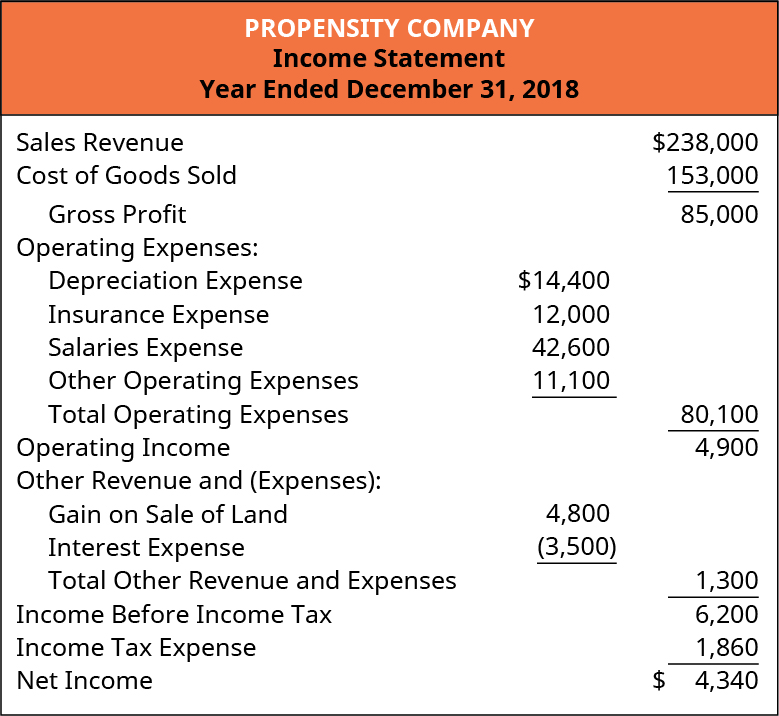

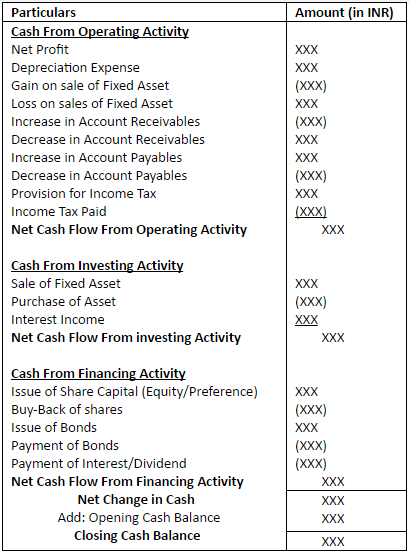

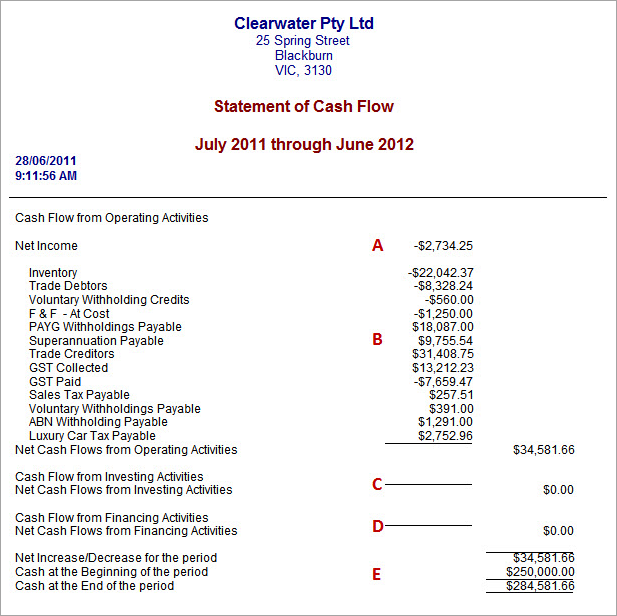

Write off of fixed assets cash flow statement. The last section on the statement of cash flows is a reconciliation of the total cash position Cash Equivalents Cash and cash equivalents are the most liquid of all assets on the balance sheet. When any fixed asset gains value as a result of a revaluation reserve this does not involve any exchange of cash and therefore revaluations dont make into the cash flow statements. However errors in the statement of cash flows continue to be causes of restatements and registrants continue to receive comments from the SEC staff on cash flow presentation matters.

List all cash receipts from the sale of fixed assets. Write-off is an accounting term referring to an action whereby the book value of an asset is declared to be 0. Few examples are as.

Writing off fixed assets affects a statement of cash flows that financial managers prepare under the indirect method. Cash equivalents include money market securities bankers acceptances which connects to the balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements. Elimination of non cash income eg.

Three Sections of the Statement of Cash Flows. The statement of cash flows primarily that in ASC 2301 The accounting principles related to the statement of cash flows have been in place for many years. This expense reduced net income but did not reduce the Cash account.

Elimination of non cash expenses eg. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how money moved in and out of the business. Note all purchases and sales of fixed assets primarily property plant and equipment.

The statement of cash flows relies on information from a companys general ledger and income statement for specific dollar amounts. A write off involves removing all traces of the fixed asset from the balance sheet so that the related fixed asset. Statement of Cash flow only deal with items which are cash based.

/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-02-c8ba3f8b48bc4dc3a460cd7ab6b6c9bd.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)