Stunning Balance Sheet Negative Cash

The following will illustrate why a negative cash balance is reported as a liability instead of being reported as a negative asset amount.

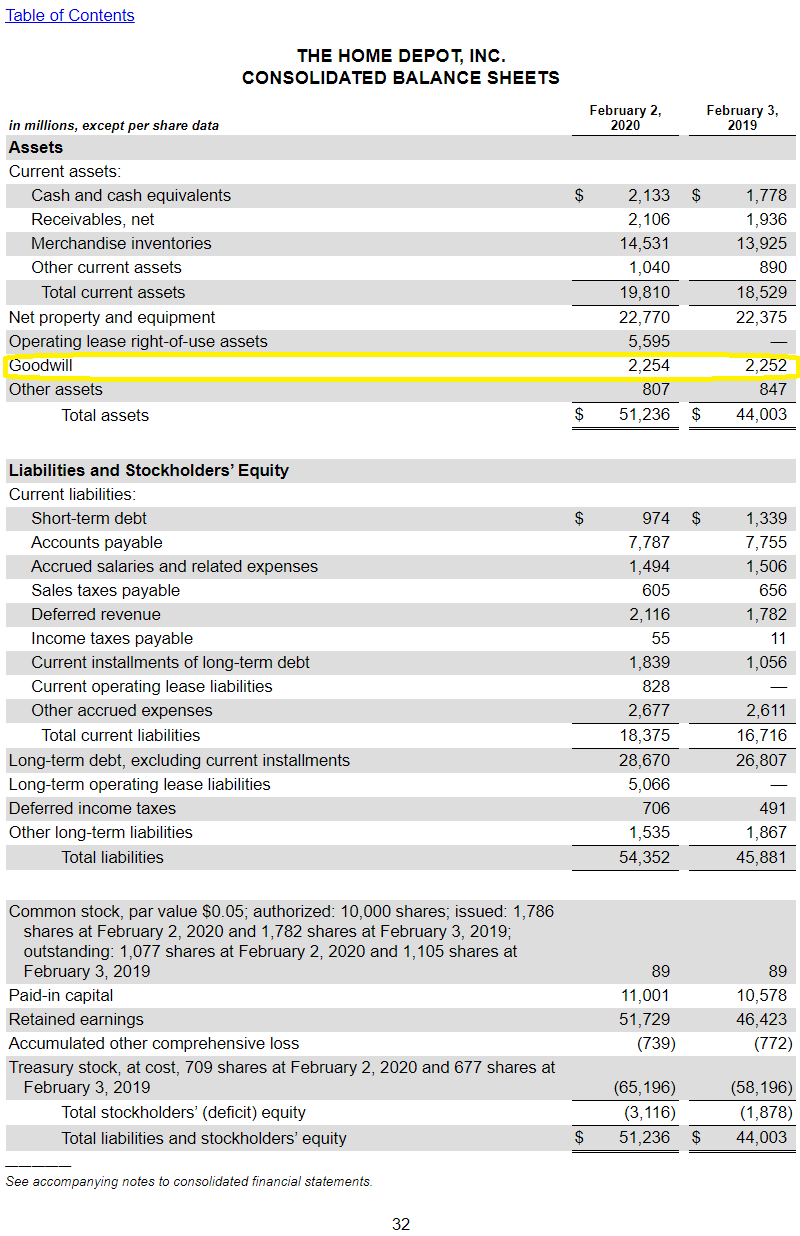

Balance sheet negative cash. When does a negative cash balance appear on the balance sheet. The concept of negative working capital on a companys balance sheet might seem strange but its something you run into many times as an investor especially when analyzing certain sectors and industriesNegative working capital does not necessarily indicate a problem with the company and in some cases can actually be a good thingHeres how it works. Presentation of negative cash balances on balance sheet In both scenarios the company had a negative cash of 5000.

In some cases having negative cash flow investments could be a warning sign that management is not efficient at using the companys assets to generate revenue. Can a balance sheet have a negative cash balance. The accounting entries to increase and decrease the cash.

For example if you had 5000 in revenue and 10000 in expenses in April you had negative cash flow. In both cases the negative cash balance should be presented in the liabilities section of the balance sheet not in the assets section. The operating statement the balance sheet and the statement of cash flows.

27 September 2011 Better show some expenses as Credit expenses as it is a company merchantile accounting is allowedBetter youu can also show cash realisation from any of your debtor even though you have not realised it in cash. Also check the net debt note which. IDC Financial Publishing IDCFP utilizes the acronym CAMEL to represent the financial ratios used to evaluate the safety and soundness of commercial banks savings institutions and credit unions.

Cash in hand in negative balance. The credit or negative balance in the checking account is usually caused by a company writing checks for more than it has in its checking account. Definition of Negative Cash Balance.

1 First inform to the Management regarding negative cash balance with notice of highest negative cash balance and period of negative cash balances. A negative cash balance results when the cash account in a companys general ledger has a credit balance. 2 verify the cash book with the available date ie with the available vouchers with the help of that vouchers if you found the mistake and adjusted it and then cash.