Stunning Treatment Of Excise Duty In Profit And Loss Account

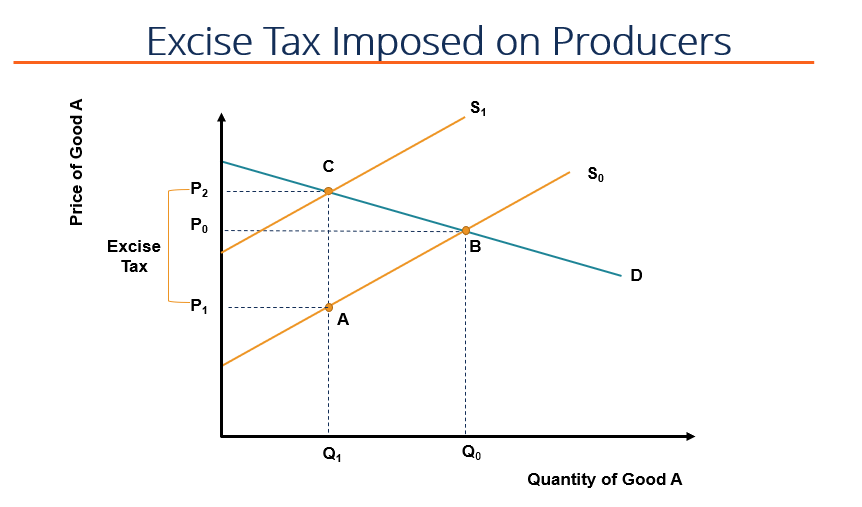

Excise Duty collected on sales is credited to liability account excise duty paid on purchases and paid through PLA is accounted in current assets.

Treatment of excise duty in profit and loss account. It can be debited to ProfitLoss account and would be treated as capital expenditure only. Below the line as a separate items. Structure of the Profit and Loss Statement.

Advertisement expenses software expenses etc. It also helps the Excise authorities to assess the excise duties of business firms. In cases of controversy auditor should report by way of abundant caution.

In short accounting of Excise and VAT is routed through Balancesheet and Profit Loss Ac. When we purchase goods with Excise duty on Purchase. Similarly CDT should be equally treated in the accounts.

Profit and Loss Account Dr. The main categories that can be found on the PL include. The profit and loss account but not paid during the previous year are to be specified where it is the practice of the company to maintain a separate sales-taxexcise duty account and treat the sales taxexcise duty collected as a liability it would be necessary to show by way of note under this.

Excise duty cannot be treated as a period cost. To ensure that amount of capital nature are not claimed as revenue. A companys statement of profit and loss is portrayed over a period of time typically a month quarter or fiscal year.

You will not be able to claim the deduction for the above expenditure under the Income Tax Act 1961. In the Books of Manufacturer. First Step First of all go to Tally 9 Gateway Press F11 and go to Statuary Taxation and Set Enable TDS as YES.