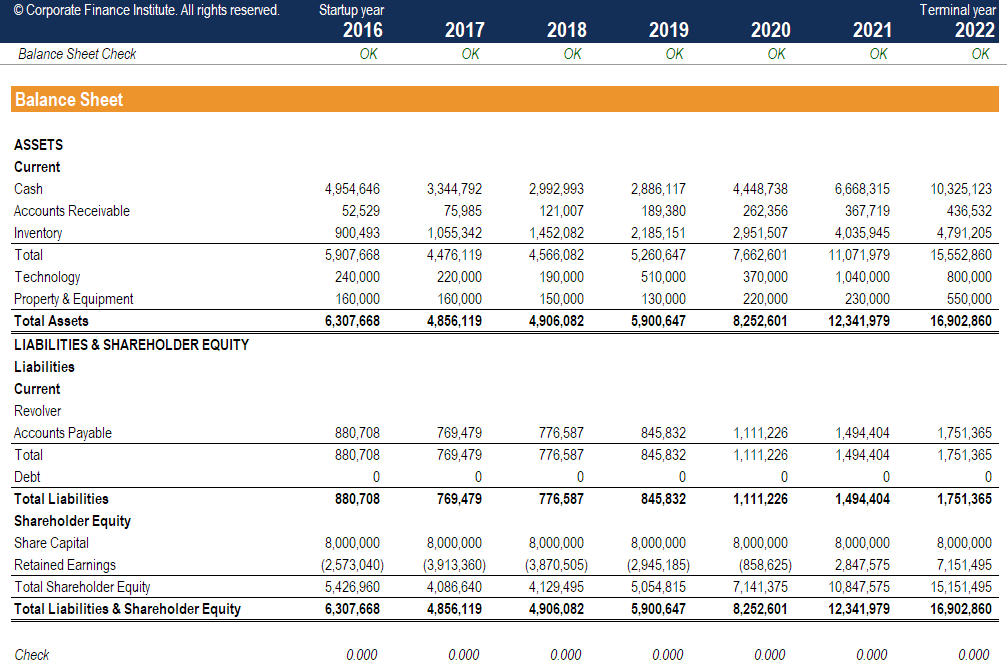

Awesome Capital Injection Balance Sheet

Typically an initial cash injection share capital plus retained profits to date.

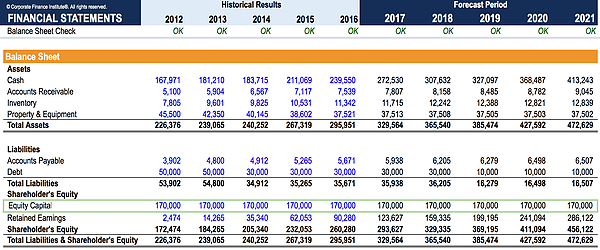

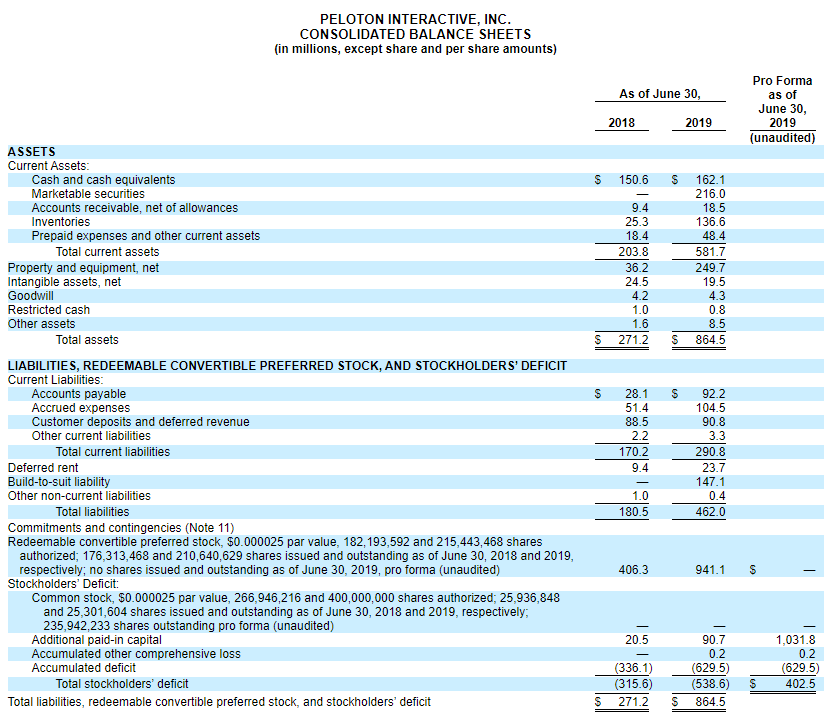

Capital injection balance sheet. Capital injections can be obtained for a variety of purposes including startup. Common stock account and additional paid-in capital. Working capital is straightforward to calculate.

Debit What came into the business Cash was deposited into the business bank account with the introduction of capital. Capital Introduction Bookkeeping Entries Explained. This is not limited to cashrather it includes cash equivalents as well such as stocks and investments.

In order to move the asset off the balance sheet over time it must be expensed and move through the income statement. Your capital expenditures and other investments go down on your balance sheet. Capital and reserves how the business is funded.

What is capital on a balance sheet. The latter is also known as the book value and is the difference. Cash increases and common stock increases Cash increases and liabilities increase Capital account increases No change in the overall level of assets BOOK Pre A customer who had previously bought a product on.

Asset specific growth assumptions and new business allowance 3. Which answer best describes how this transaction would be reflected in the balance sheet. Contributed capital is reported in the shareholders equity section of the balance sheet and usually split into two different accounts.

Simple movement assumption eg. If a Director of the business was to inject a sum of money into an established company ie. A capital injection is a lump-sum investment typically in the form of cash but may also consist of equity or debt.

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)