Ideal Vat In Income Statement

Using this method also allows companies to estimate their income tax liabilities.

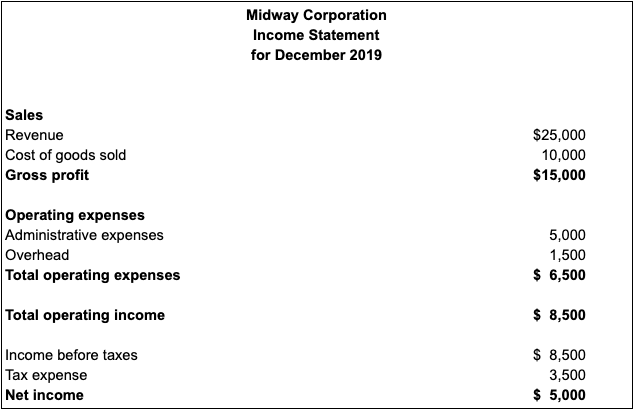

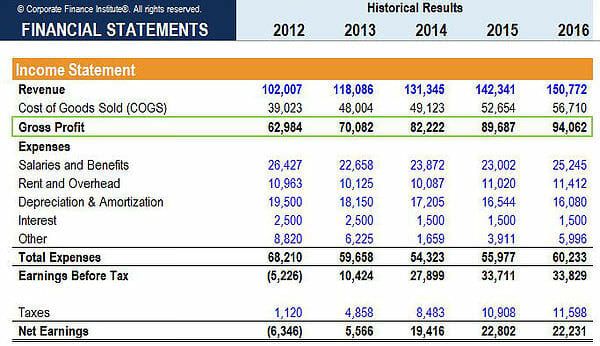

Vat in income statement. Vat is just a tax that you collect for govrnment. Income statement and Debitoor In the larger Debitoor plans you have access to several reports including your VAT report balance sheet and the profit loss income statement. These consolidated financial statements were authorized for issue by the Groups Board of Direc-tors on March 2 2020.

Adventurous Large Cap High Flyer. My reading of the guidance notes on the Simpler Income Tax cash basis rules are that you have to include figures receipts or payments inclusive of VAT and also include as receipts payments the VAT repaymentpayment. Enterprise Value 706bn.

Accordingly it should not be recognised as an income of the enterprise. My reading of the guidance notes on the simpler income tax cash basis rules are that you have to include figures receipts or payments inclusive of vat and also include as receipts payments the vat. Cash or Bank or Name of Customer Account Dr.

Your statements will usually be. VAT registered businesses will act as collecting agents for Customs and Excise authority in the country. VACN CHF2944-04 -01 170621.

So from the Companys point of view as a seller it is neither income or expense but a pass through charge. Market Cap 696bn. VAT is levied on goods or services collected by the Seller from the Buyer and deposited with the Govt.

The consolidated financial statements as at and for the year ended December 31 2019 comprise VAT Group AG and all companies under its control together referred to as VAT or Group. I n a VAT registered persons books of account VAT should not be included in income or expenditure account. Since registered businesses in effect act as a collecting agent for HM Customs and Excise VAT charged by them does not form part of their turnover nor VAT payable part of their costs.