Top Notch Cash And Cash Equivalents Frs

The fundamental nature of cash equivalents is described in the opening sentence of paragraph 7 of IAS 7.

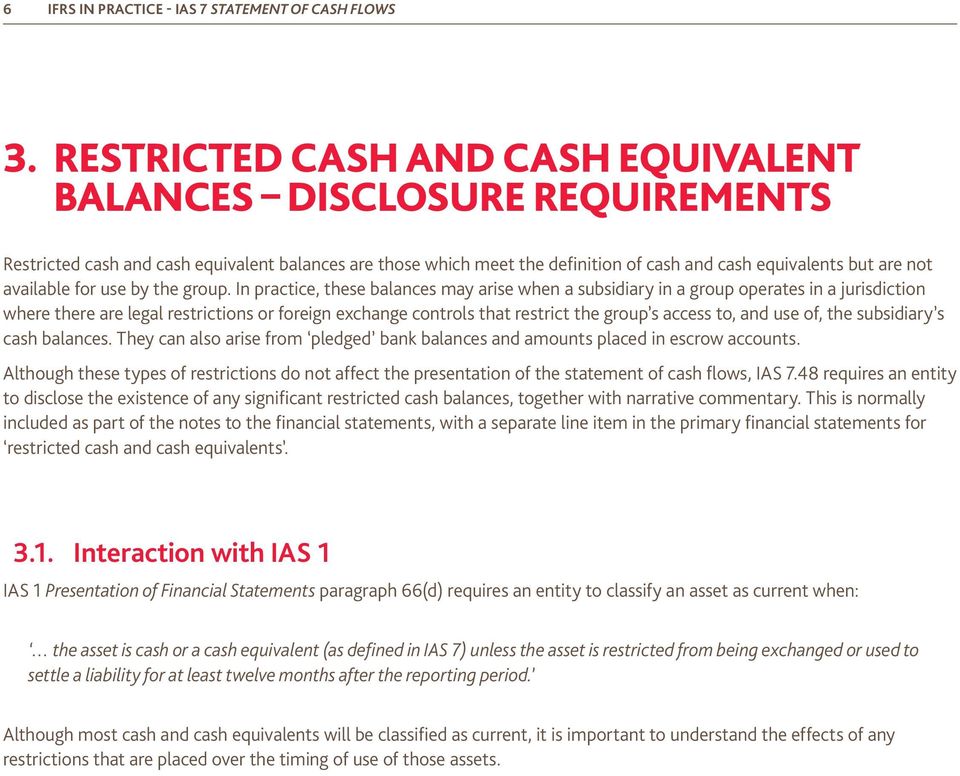

Cash and cash equivalents frs. Groups cash flows into three headings - cash flows from operating investing and financing activities. Cash and cash equivalents will include both cash and balances at the central bank ie Bank of England and short-term deposits with other financial institutions. Cash and cash equivalents in current assets 4483382 Restricted cash and cash equivalents 92675 Total cash and cash equivalents 4576057 Reconciliation of operating income to net cash provided by operating activities.

Benefits of statement of cash flow 1. 1 can be immediately exchange for known amount 2 very close to maturity maximum 3 months Cash and cash equivalents are recognised as a short term asset. Components of cash and cash equivalents Paragraph 720 of FRS 102 requires an entity to present the components of cash and cash equivalents together with a reconciliation of the amounts presented in the cash flow statement to the equivalents items in the balance sheet.

Keep in mind that cash and cash equivalents consist of demand deposits and cash on hand and greatly liquid financial investments. The Interpretations Committee noted that on the basis of paragraph 7 of IAS 7 financial assets held as cash equivalents are held for the purpose of meeting short-term cash commitments rather than for investment or other purposes. Cash and cash equivalents refers to the line item on the balance sheet that reports the value of a companys assets that are cash or can be converted into cash immediately.

Short-term highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in value. It is also can be used to evaluate the needs of a company to utilize cash flows. CASH EQUIVALENTS Investment securities that are short-term have high credit quality and are highly liquid.

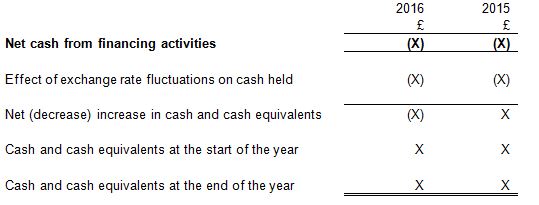

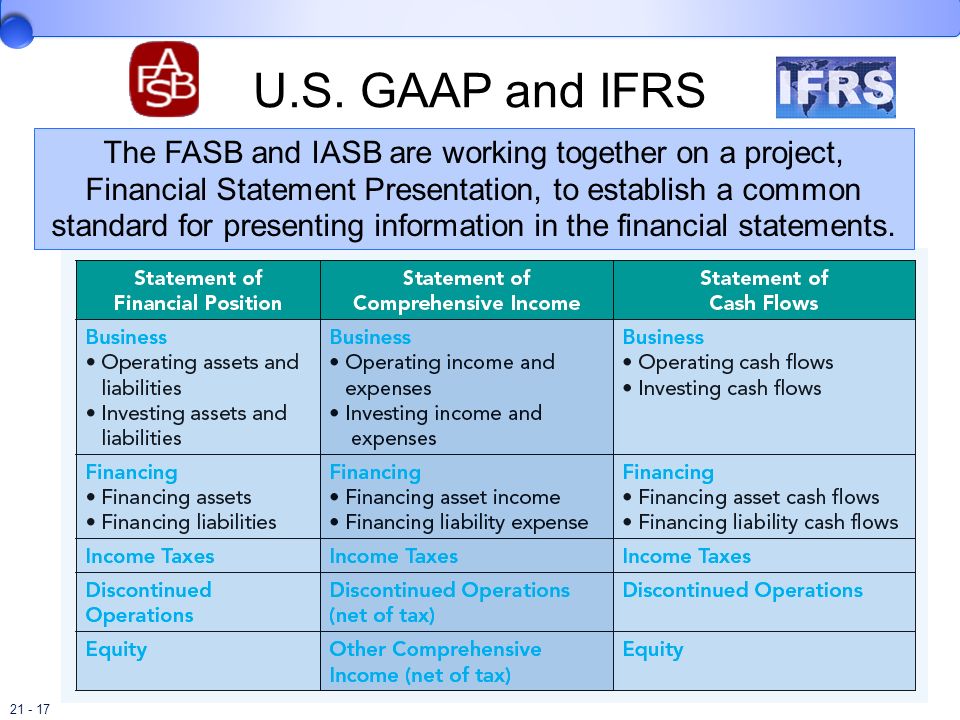

A statement of cash flows prepared under FRS 102. In accordance with FRS 102 paragraph 72 the cash flow statement reconciles cash and cash equivalents which are highly liquid investments with a short-term maturity three-months or less. The main aim of FRS 7 is to ensure that the information regarding historical changes in cash flow and cash equivalents of a business is presented using cash flow statement that categorize cash flows into operating investing and financing activities and therefore provide insight of different quality of cash received or paid.

Reconciles the movement in cash and cash equivalents not just cash year on year. FRS 743 744 Non-cash transactions According to FRS 743 investing and financing transactions that do not require the use of cash or cash equivalents should be excluded from a cash flow statement. Statement of cash flow is used to assess the ability of a company to generate cash and cash equivalents.