Unique Outstanding Accounts Receivable Effect On Net Cash On Balance Sheet

This means that there are no accounts receivable or accounts payable to record on the balance sheet since they are not noticed until such time as they are paid by customers or paid by the company respectively.

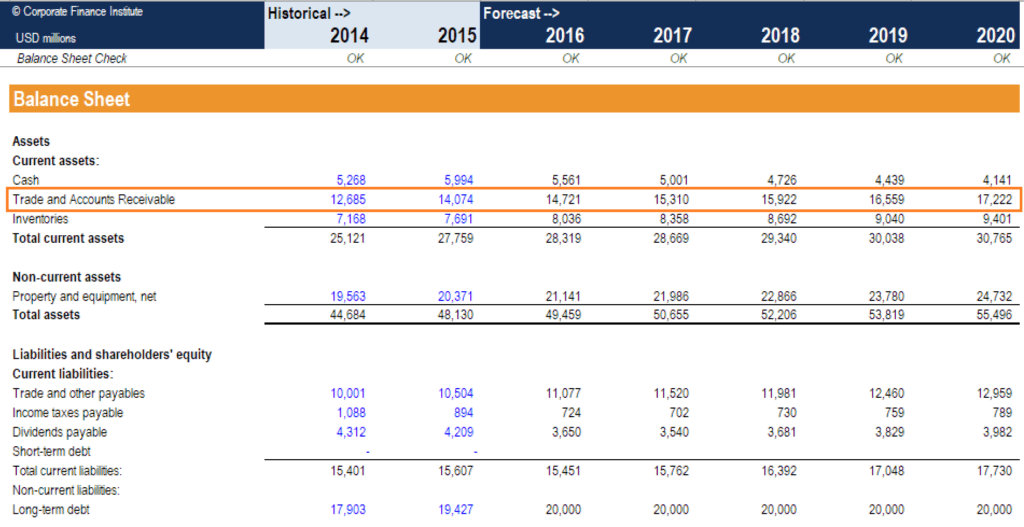

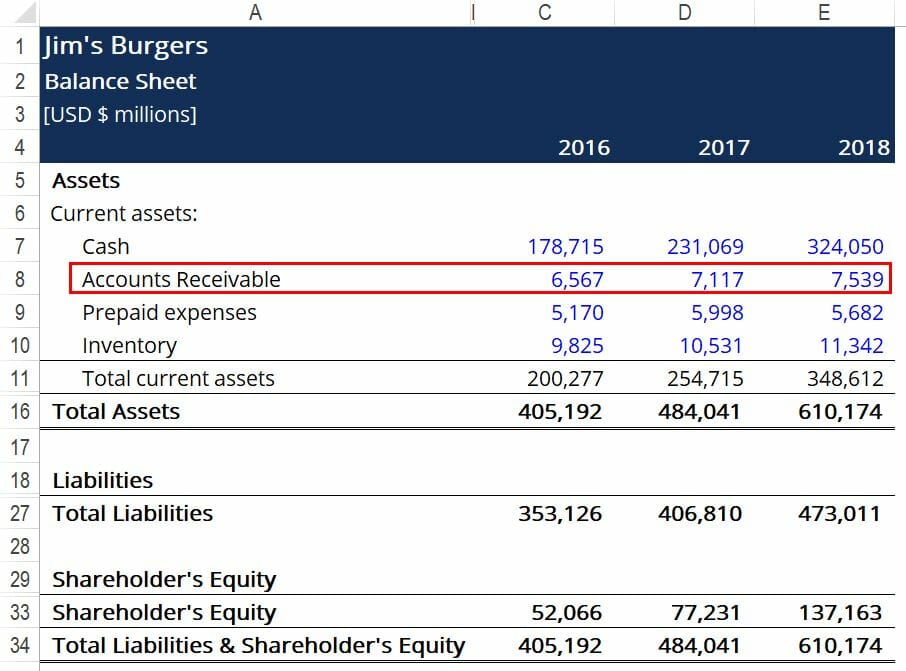

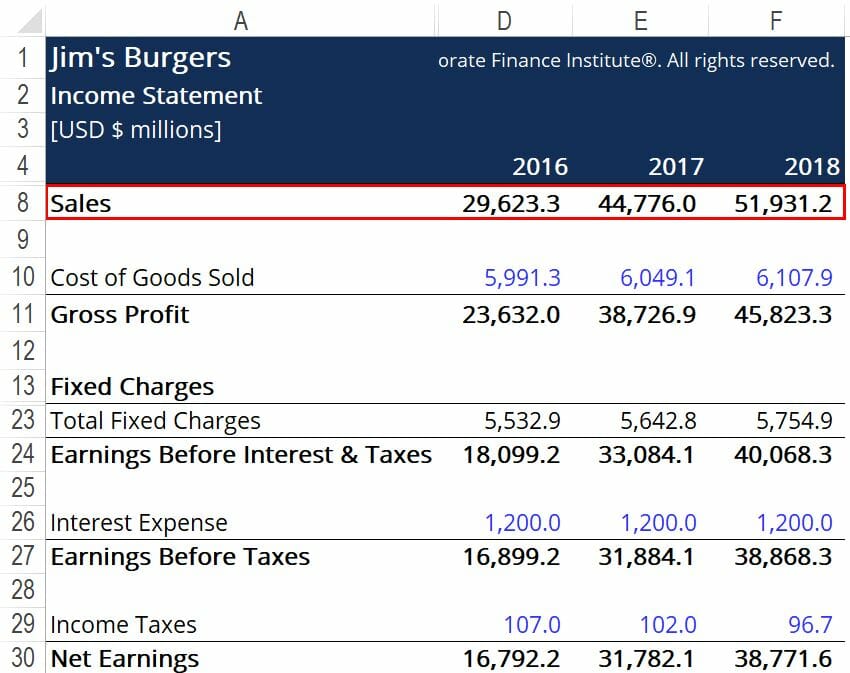

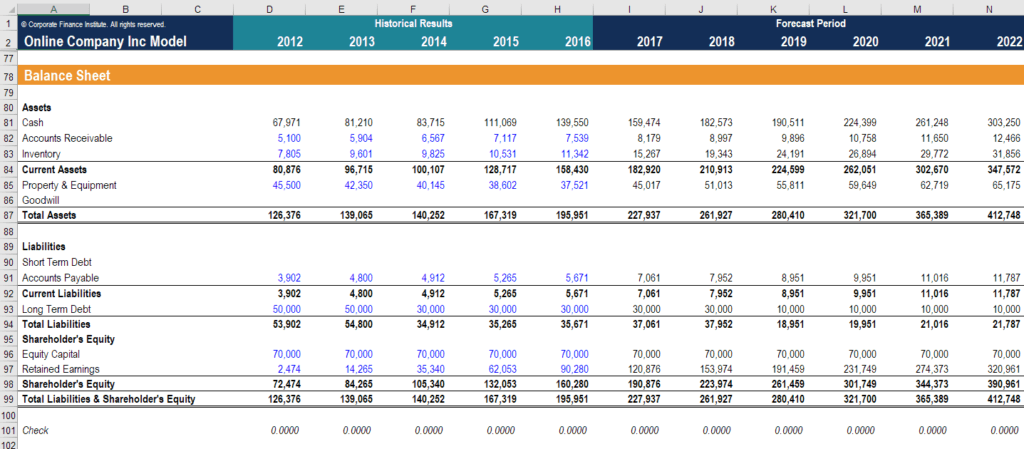

Outstanding accounts receivable effect on net cash on balance sheet. The third increases one asset decreases another asset and increases a liability but the total of the two sides of the balance sheet remain equal. The first increases assets and equities by the same amount. If accounts receivable increased from one year to the next the implication is that more people paid on credit during the year which represents a drain on cash for the company as some of the.

Accounts receivables represent the value of a companys outstanding invoices owed by customers for products andor services delivered. Property plant and equipment. The balance sheet method is another simple method for calculating bad debt but it too does not consider how long a debt has been outstanding and the role that plays in debt recovery.

December 31 last year Assets. For supplier ie. Click to see full answer.

The Cash Basis Balance Sheet CBBS shouldnt show Accounts Receivable AR or Accounts Payable AP balances because these accounts track open unpaid invoices and unpaid bills. When the customer pays off their accounts one debits cash and credits the receivable in the journal entry. Payment of the receivable is outside of your control until your customers payment clears.

George Michael International Limited reported a sales revenue for November 2016 amounting to 25 million out of which 15 million are credit sales and the remaining 1 million is cash sales. The ultimate effect of cash dividends on the companys balance sheet is a reduction in cash for 250000 on the asset side and a reduction in retained earnings for 250000 on the equity side. In this case the business doesnt record an account receivable but instead enters a liability on its balance sheet to an account known as unearned revenue or prepaid revenue.

Accounts receivable is reported on the balance sheet. As the money is earned either by shipping promised products using the percentage of completion method or simply as time passes it gets transferred from unearned revenue on the balance sheet to sales revenue on the. 170000 Total current assets.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)