Fun Comparing Financial Ratios Between Companies Examples

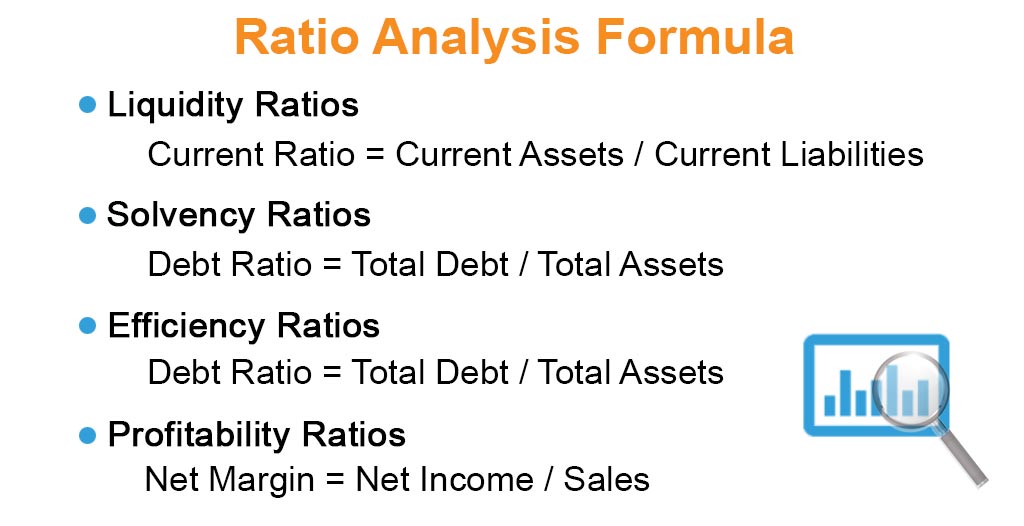

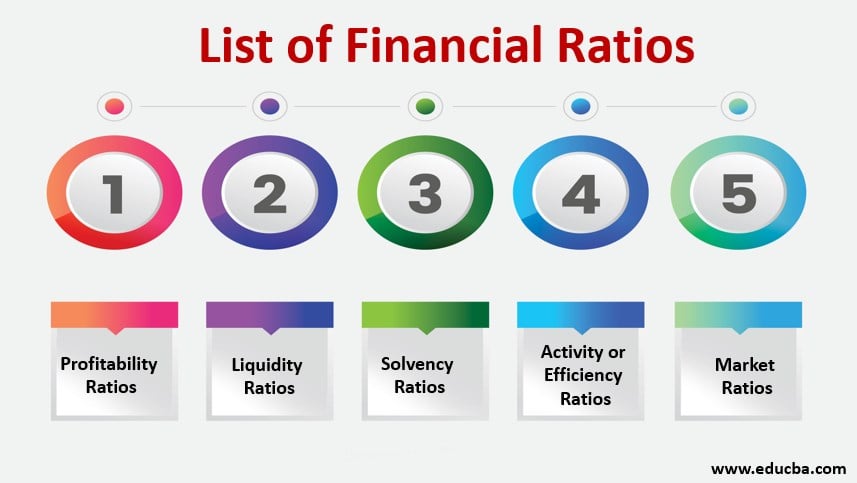

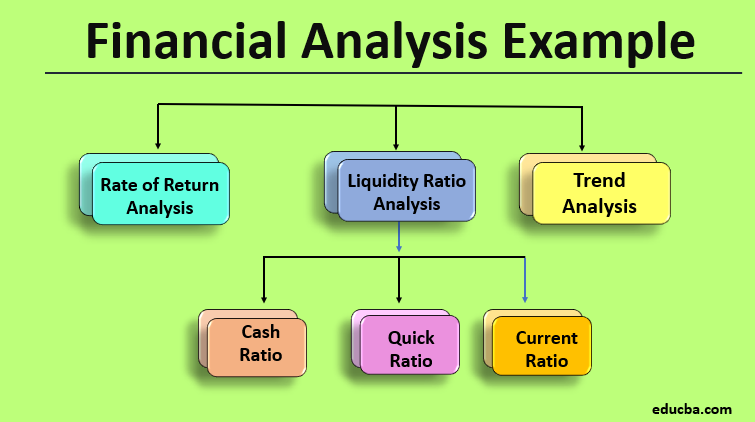

For instance financial ratio can be divided into several categories such as market debt ratio liquidity ratio profitability ratio investment ratio.

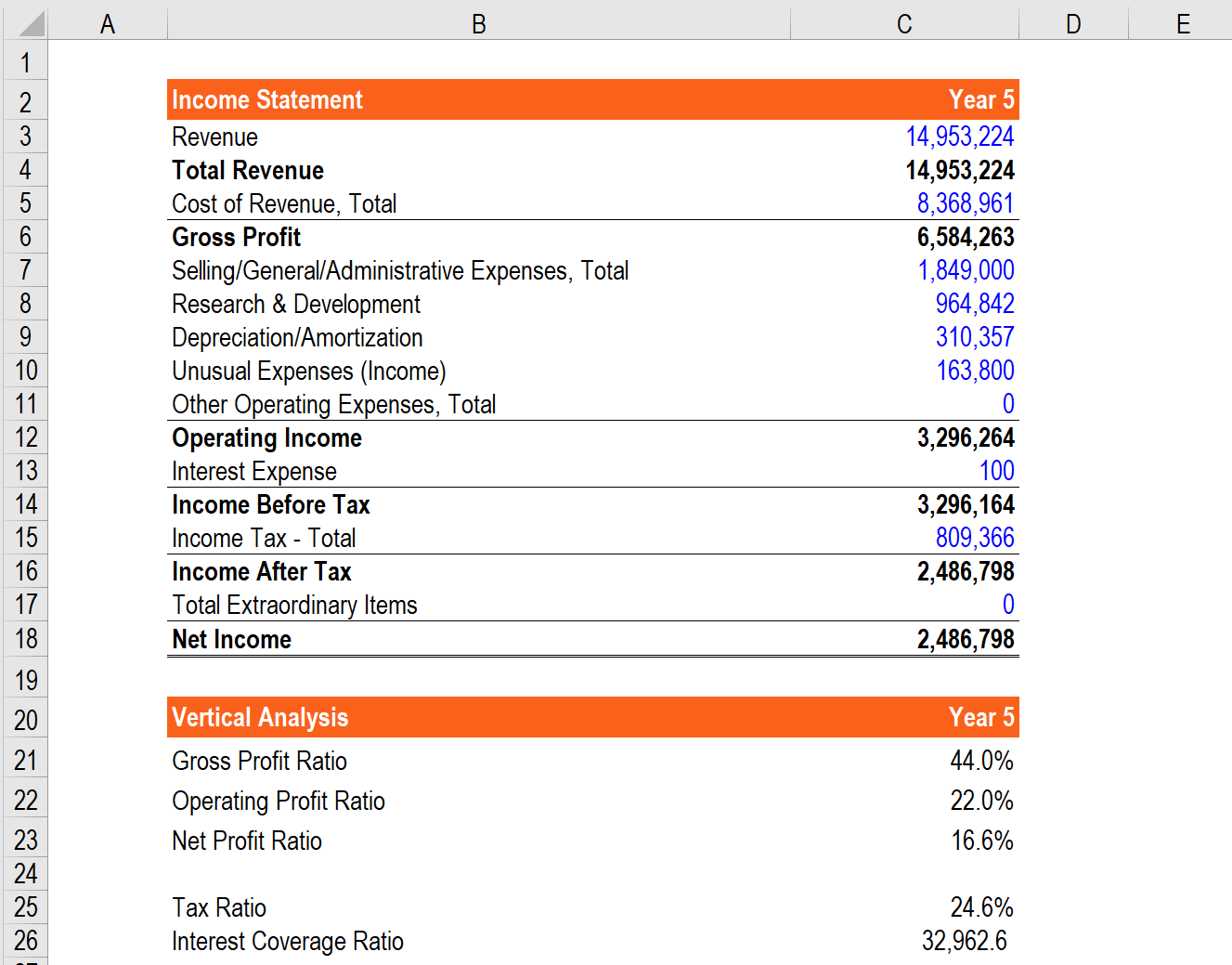

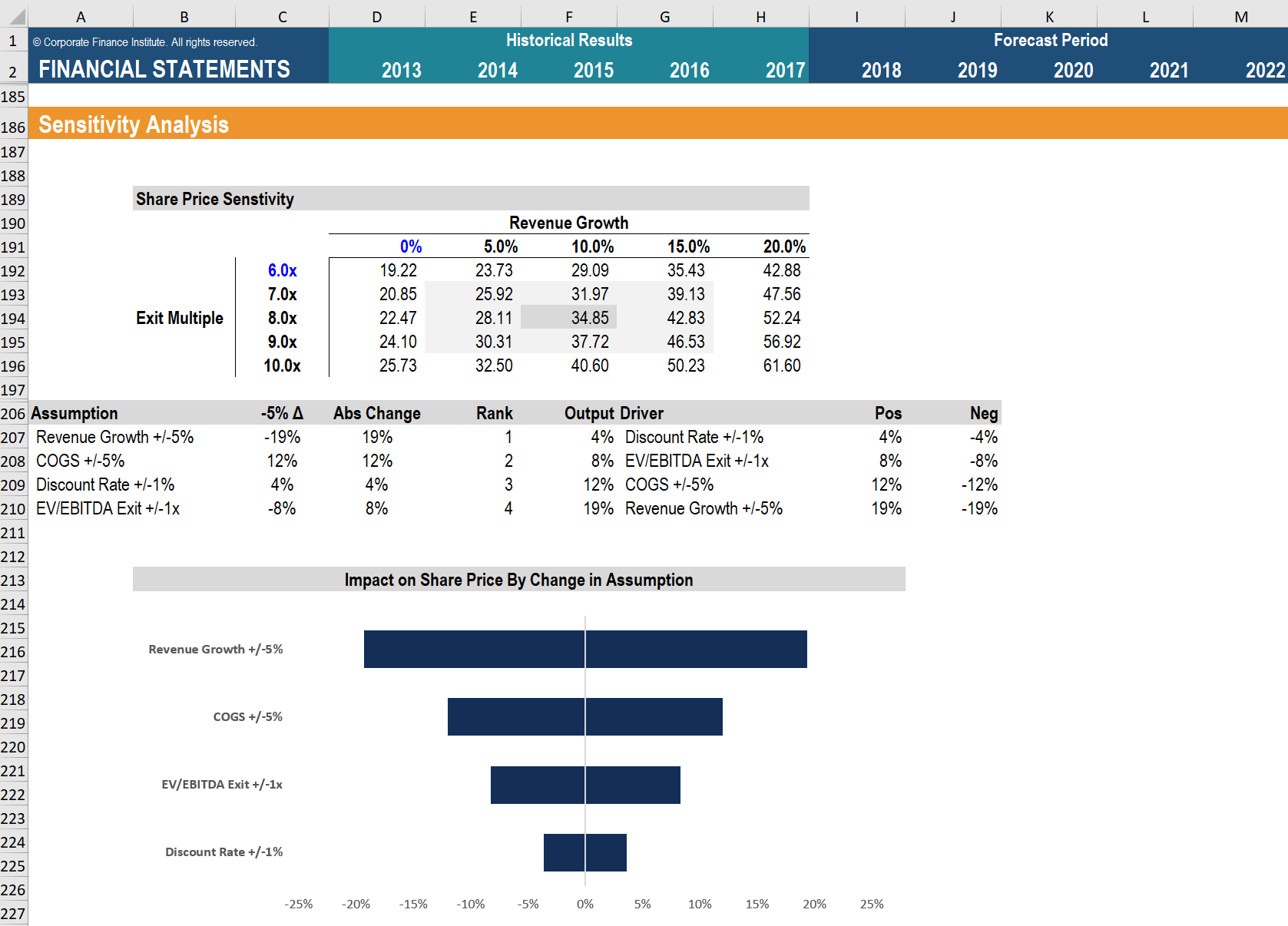

Comparing financial ratios between companies examples. For example comparing PE ratios of companies is a common point of reference for investors. In the British English also including the United Kingdom company rule. Financial ratio analysis compares relationships between financial statement accounts to identify the strengths and weaknesses of a company.

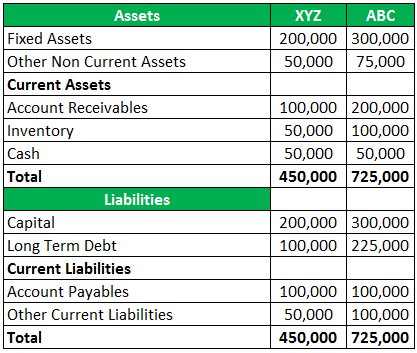

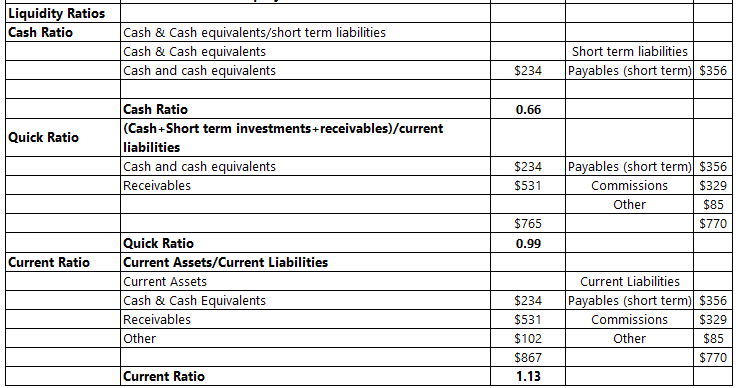

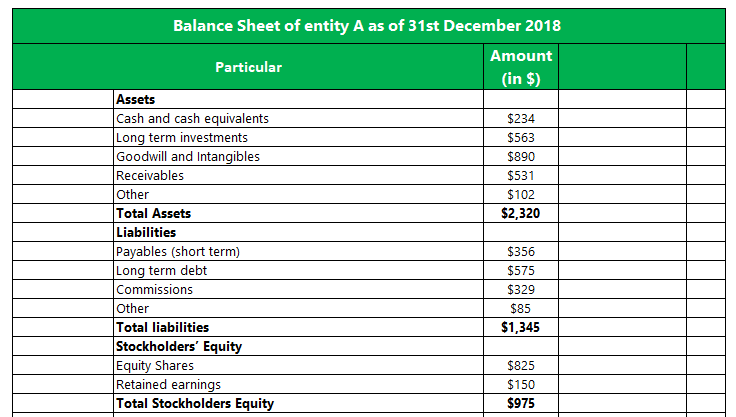

Asset size is calculated as follows. When comparing two companies in theory the entity with the higher current ratio is more liquid than the other. The cash ratio will tell you the amount of cash a company has compared to its total assets.

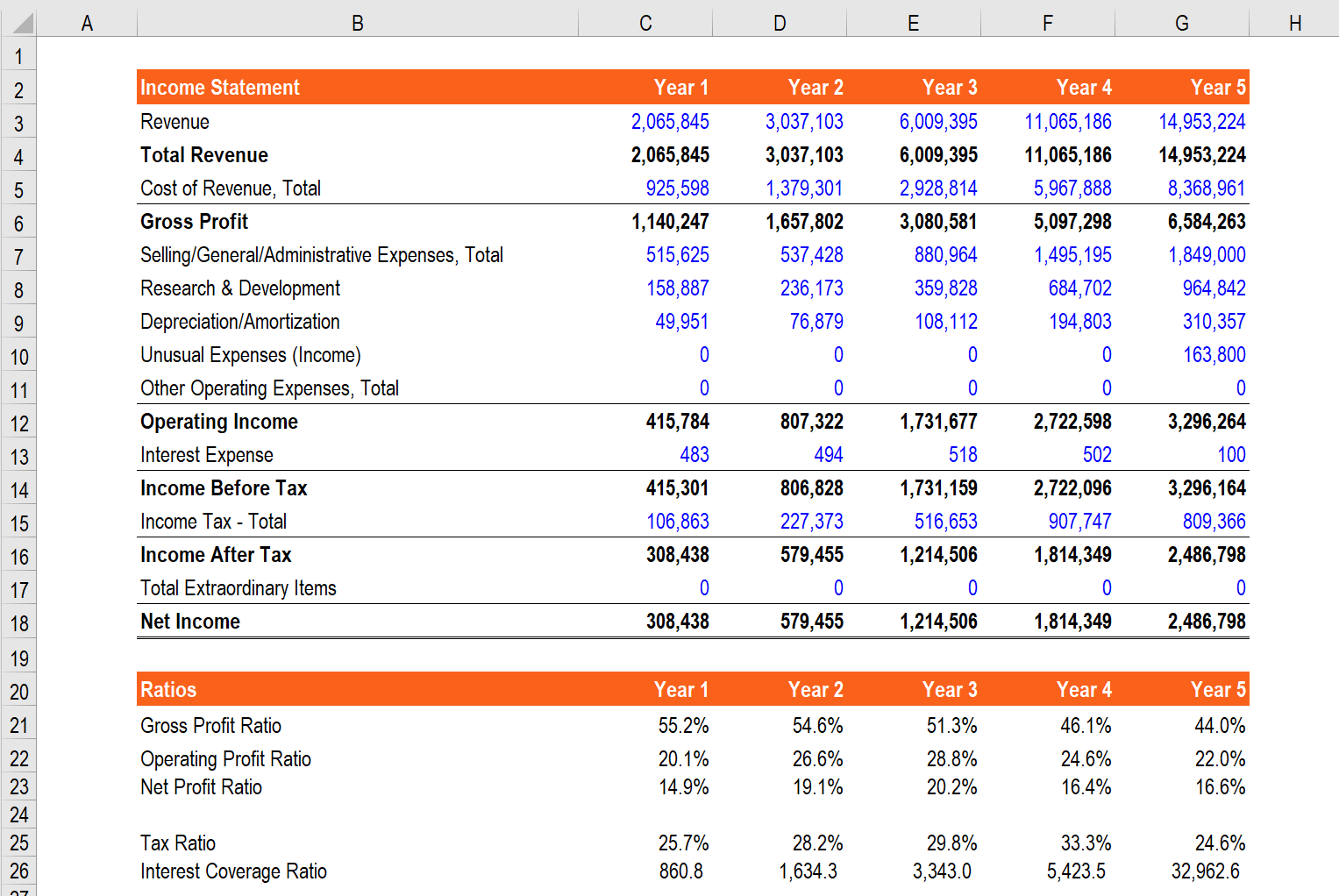

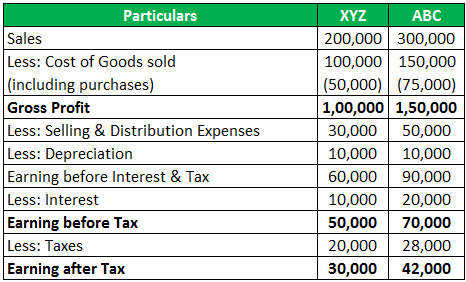

1 which is more then the ideal ratio of 2. Any ratio shows the relative size of the two items compared just as a fraction compares the numerator to the denominator or a percentage compares a part to the whole. Instead of dissecting financial statements to compare how profitable companies are an investor can use this ratio instead.

A financial statement is frequently mentioned as an account even though the word financial statement is also mostly. A financial report or the financial statement is known as an official record of the financial activities of a person a business or any other entity. For example return on investment and return on assets are two commonly calculated financial ratios that are used in multiple ways to judge a companys return on certain financial.

Asset size total asset. When comparing companies the differences in the choice of inventory valuation method may significantly affect the comparability of financial ratios between companies. A financial ratio alone provides limited information.

If the stock is selling for 60 per share and the companys earnings are 2 per share the ratio of price 60 to earnings 2 is 30 to 1. It measures the return on the money the investors have put into the company. Although ratio calculation is relatively straightforward it is not just the base number that matters.

/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg)