Beautiful Financial Statement Analysis Is Primarily Management By

In mergers and acquisitions due diligence includes financial analysis.

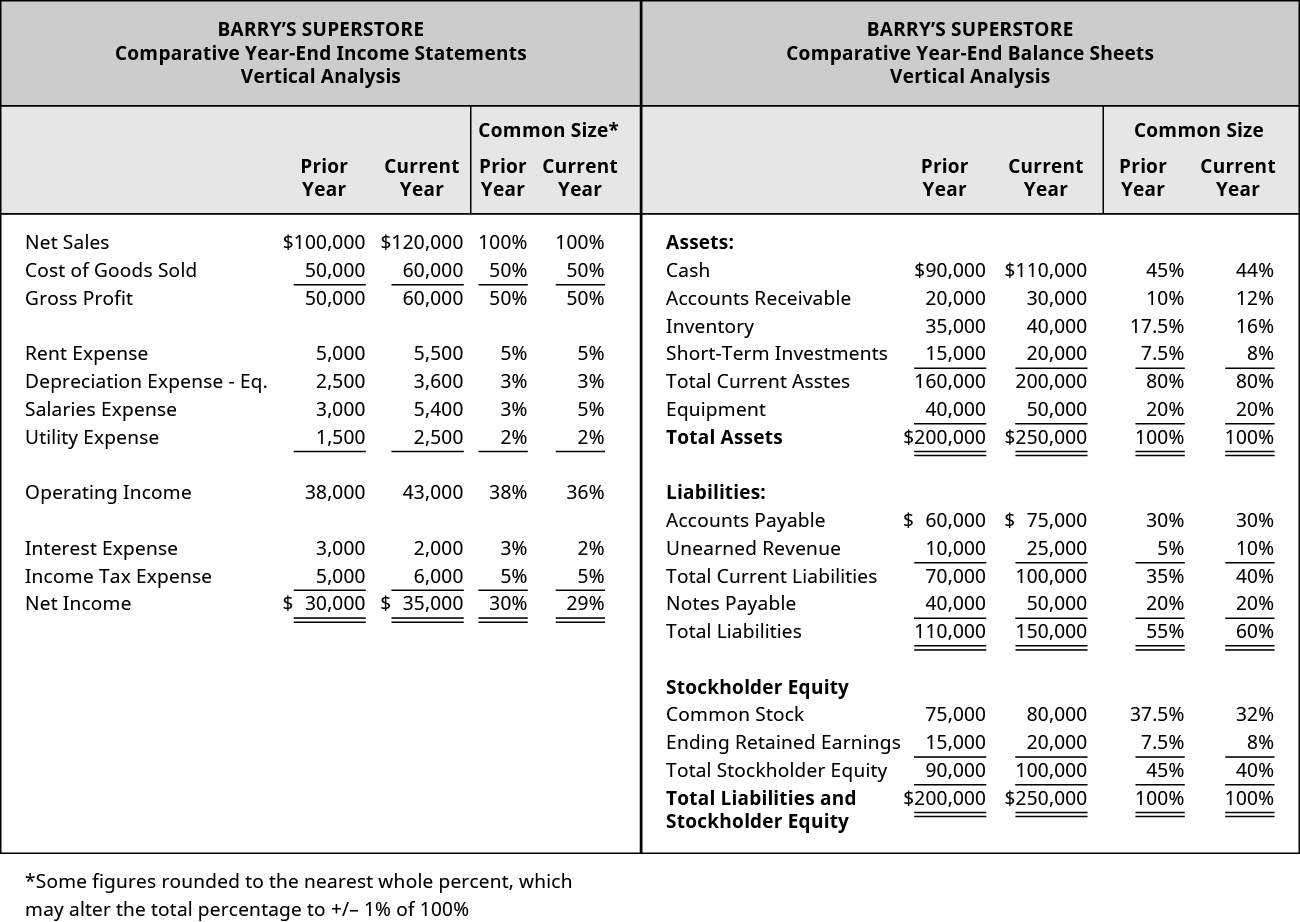

Financial statement analysis is primarily management by. Both internal management and external users such as analysts creditors and investors of the financial statements need to evaluate a companys profitability liquidity and solvency. O A material financial statement item is used as a base value and all other accounts of financial statement are compared to it. As you progress to the highest designation of CCE you will review material in such courses as Credit Law Business Law and Advanced Financial Statement Analysis.

Management accounting analyses incorporate forecasted data B. The results can be used to make investment and lending decisions. Financial statements are used as a management tool primarily by company executive and investors in assessing the overall position and operating results of the company.

The information found on the financial statements of an organization is the foundation of corporate accounting. Financial statement analysis involves gaining an understanding of an organizations financial situation by reviewing its financial reports. Investors Investors and prospective investors in the equity of the firm are interested in its valuation in particular in the valuation of the equity.

Here are the main financial sheets that are prepared by. Management accounting information is primarily prepared for internal use C. Once all the operating financing and investing activities are added to the beginning balance sheet investors creditors and management can analyze the ending balance sheet and see how well the company performed during the period.

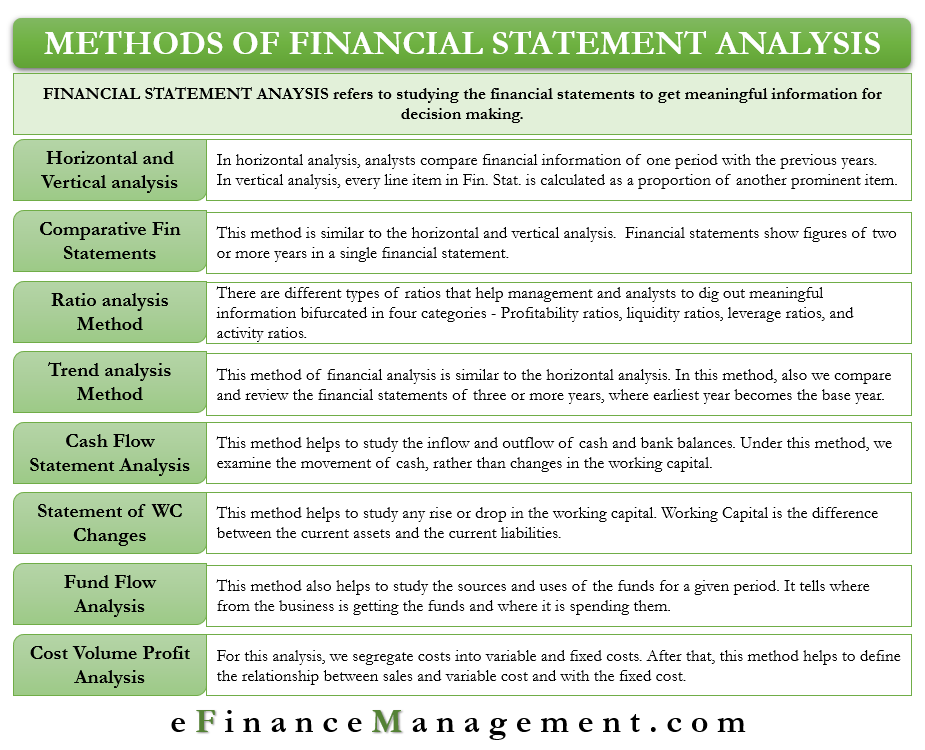

Financial statement analysisinvolves the examination of both the relationships among financial statement numbers and the trends in those numbers over time. This review involves identifying the following items for a companys financial statements over a series of reporting periods. Objectives of Financial Statement Analysis.

Analysts with mutual funds hedge funds. Based on these financial statements the companys background industry statistics and other market and company information prepare a financial statement analysis report covering the following points. This data is reviewed by management investors and lenders for the purpose of.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)