Beautiful Work Gain And Loss Recognition Principle

Gains normally result from the sale of long-term assets for more than their book value.

Gain and loss recognition principle. For example lets say Mike purchased 100 shares of Sallys Software Inc. Gains are not generally recognised until an exchange or sale has taken place. Giving rise to gainloss.

Tax Basics ICO Initial Coin Offering is an unregulated means. For example if a company bought land for 20000 many years ago and today the company continues to hold the land and its value is now 175000 the company has a holding gain of 155000. It is prepared based on.

4 Gain and loss recognition principle states that we record gains only when realized but losses when they first become evident. That is a fundamental rule of financial accounting. Like gains there can also be unrealized losses.

Product costs can be tied directly to products and in turn revenues. Generally no gain or loss is recognized if stock or securities in a corporation that is a party to a reorganization are in pursuance of the plan of reorganization exchanged solely for stock or securities in that corporation or in another corporation that is a party to the reorganization Sec. The gain and loss recognition principle states that we record gains merely when realized but losses when they first become evident.

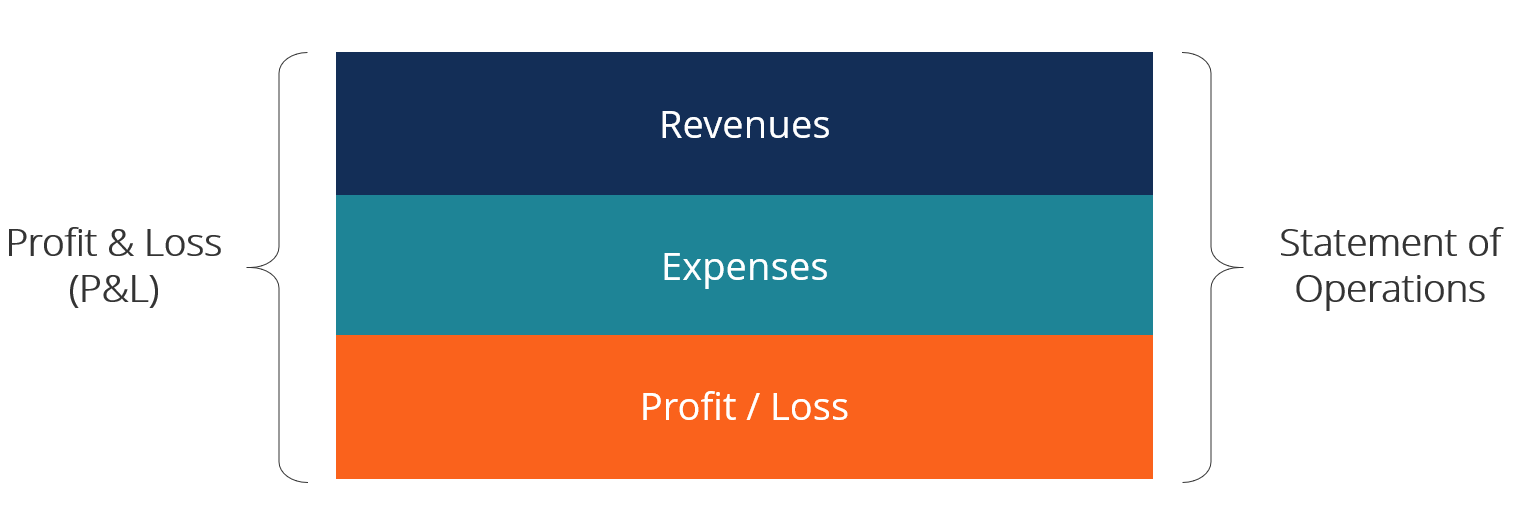

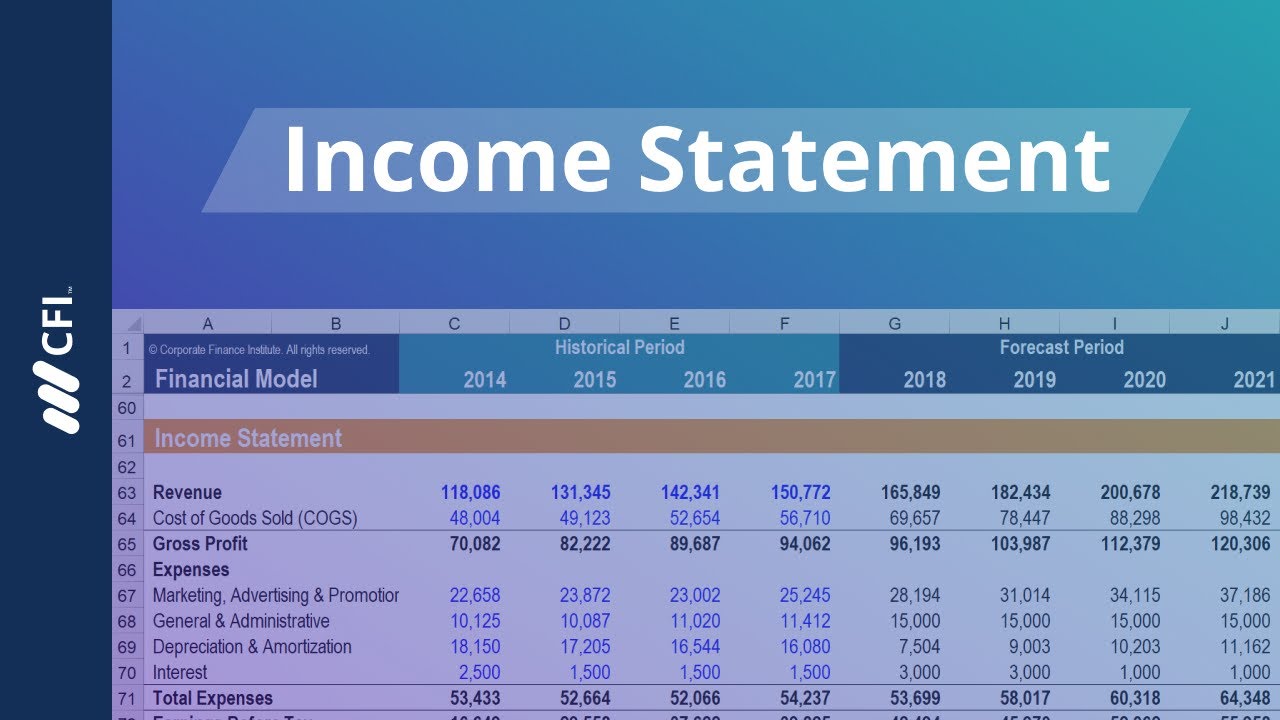

However the company cannot record the holding gain on its financial statements because of the cost principle and the revenue recognition principle. For example if a company sells its old delivery truck for cash and the amount received is greater than the trucks book value there is no uncertainty and a gain is reported If there is uncertainty about whether or not there is a loss the rule directs you to record the loss. The PL statement shows a companys ability to generate sales manage expenses and create profits.

Presented by Matt H. Recognition of Gains and Losses. Nonrecognition transactions under IRC 367a1 and.