Out Of This World Foreign Exchange Gains And Losses Accounting Treatment

Next month its 41.

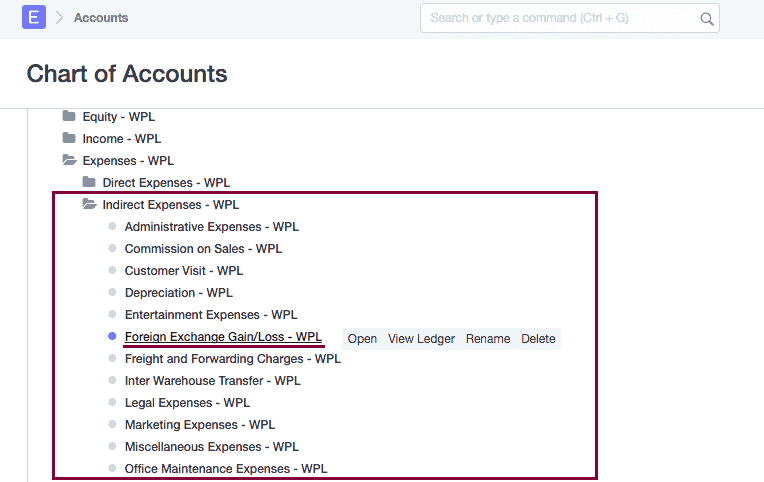

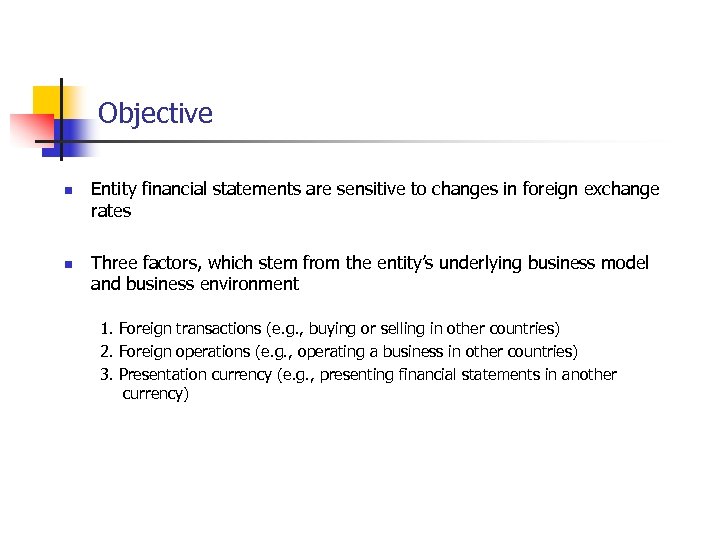

Foreign exchange gains and losses accounting treatment. At each balance sheet date you revalue outstanding balances that are denominated in foreign currencies. Intercompany balances denominated in a currency other than the functional currency of the parties to the transaction create foreign currency gains and losses that survive consolidation even though the intercompany balances do not. It can create differences in value in the monetary assets and liabilities which must be recognized periodically until they are ultimately settled.

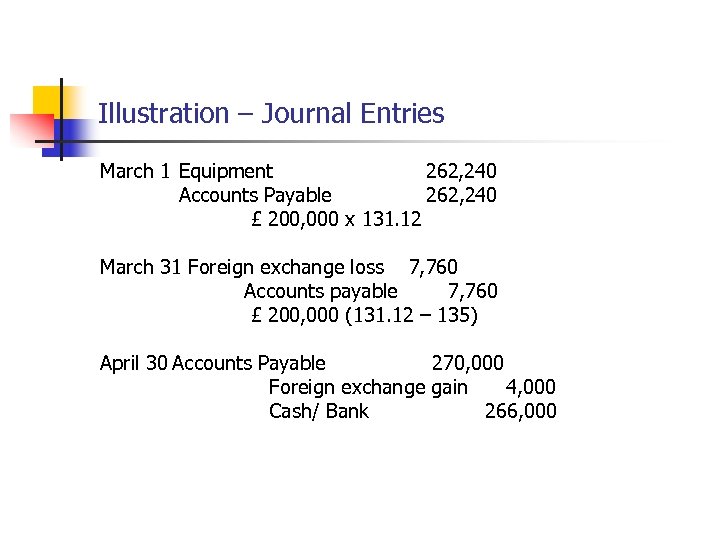

In that case an unrealized gain or unrealized loss report represents a currency gain for liability or equity account. If there is a change in the expected exchange rate between the functional currency of the entity and the currency in which a transaction is denominated record a gain or loss in earnings in the period when the exchange rate changes. Unrealized exchange rate gains or losses are calculated the same way that realized exchange rate gains and losses are calculated.

A foreign currency gain or loss could occur on an export sale or an im. Someone owes you 100. Gains and Losses are defined and an example is provided to distinguish Gains a.

If the exchange rate changes between the conversion dates youll record the difference as a foreign currency transaction gain or loss. Foreign exchange gain loss accounting entry can be created when the account is a liability or equity account. This e-Tax Guide provides details on the tax treatment of foreign exchange gains or losses for businesses banks and businesses other than banks.

IAS 2128 The exception is that exchange differences arising on monetary items that form part of the reporting entitys net investment in a foreign operation are recognised in the consolidated financial statements that include the foreign operation in other comprehensive income. DR Unrealised losses 25. How Exchange Rates Affect Your Business.

This e-Tax Guide consolidates the two e-Tax guides issued previously on the income tax treatment of foreign exchange gains or losses1. This video shows how to calculate the gain or loss on a foreign currency transaction. This cookie is set by GDPR Cookie Consent plugin.