Formidable Total Liabilities Divided By Net Worth

The solvency ratios of Patton Fuller both the coverage ratio of debt service.

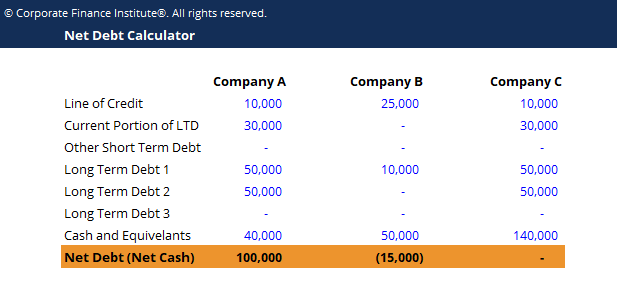

Total liabilities divided by net worth. Creditors are concerned to the extent that total liability levels exceed Net Worth. The 15 multiple in the ratio indicates a very high amount of leverage so ABC has placed itself in a risky position where it must repay the. Debt-to-net worth ratio total debts net worth So if you owe a total of 85000 and your assets are worth 155000.

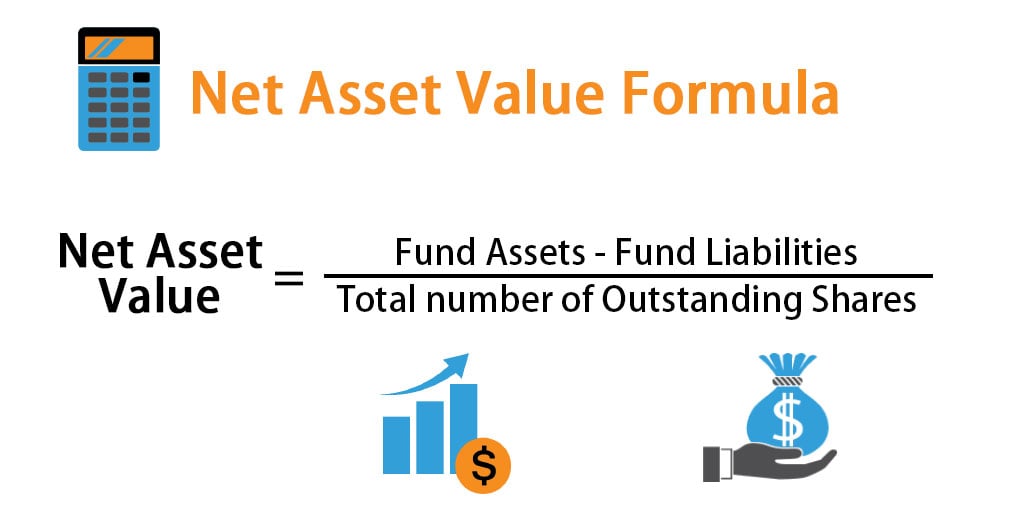

Both debt and equity will be found on a. Total Assets multiplied by Total Liabilities Net Worth. Total Assets divided by Total Liabilities Net Worth.

Total Liabilities to Net Worth Ratio means as of any date of determination i Total Liabilities divided by ii the Shareholders Equity based on the most recent audited annual financial statements or limited review quarterly financial statements as applicable. Next use this formula to determine your personal debt-to-net worth ratio. The total liabilities is the sum of all the monies owed to creditors.

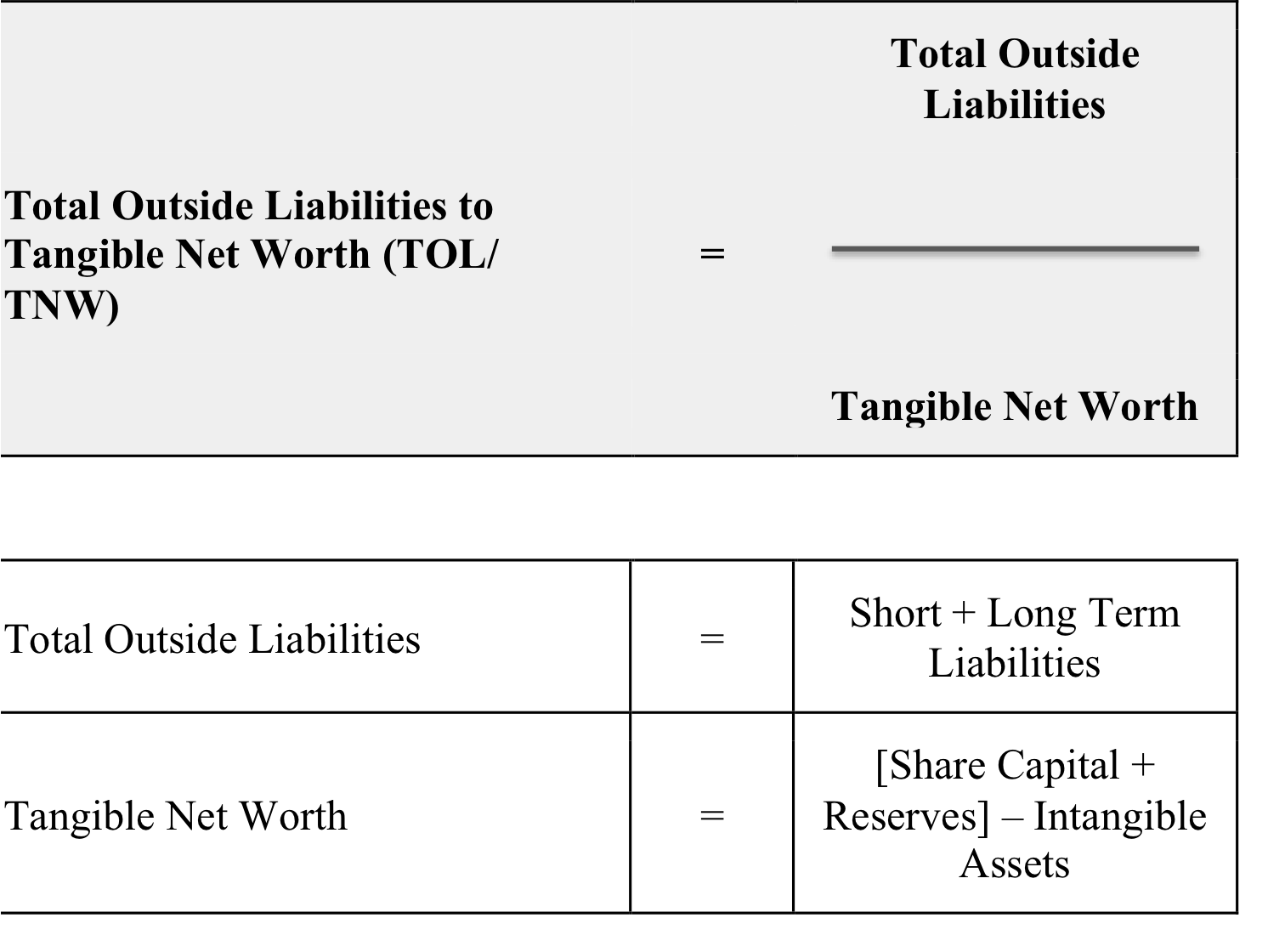

The net worth is the difference between the sum of all assets and the liabilities. Tangible net worth can also be calculated for individuals using the same formula. Debt to Tangible Net Worth Ratio Year 1 464 853 334 089 89.

Net sales divided by net working capital current assets less current liabilities equals net working capital. Total Liabilities to Tangible Net Worth Ratio. Market Value of EquityBook Value of Total Liabilities simply compares the market value of equity to the book value of total liabilities.

ABC Company has total liabilities of 1500000 and total assets of 1000000. Net worth is the amount of assets a business holds less all outstanding obligations. This measures the extent to which the firms assets can decline in value measured by market value of equity plus debt before the liabilities exceed the assets and the firm becomes insolvent.

/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Calculate_Return_on_Assets_ROA_With_Examples_Sep_2020-01-43bbd8c00ab24868899a202af2f7ba30.jpg)