Amazing Intercompany Receivables Balance Sheet

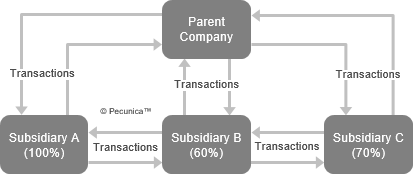

For example if one subsidiary has sold goods to another subsidiary this is not a valid sale transaction from the perspective of the parent company since the transaction occurred internally.

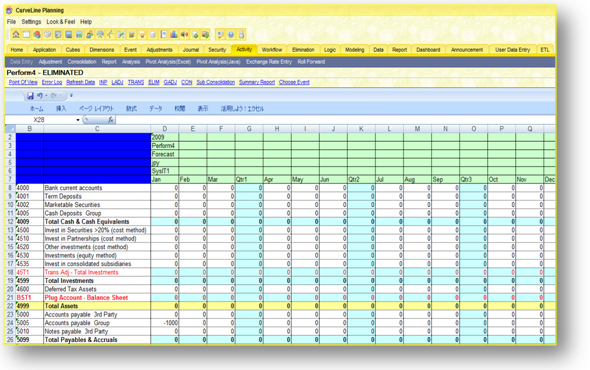

Intercompany receivables balance sheet. Need web management software adapted to your company and that meets your needs. In the consolidated balance sheet eliminate intercompany payable and receivable purchase cost of sales and profitloss arising from transaction. Often we can work around these shortcomings with reports.

Which drains efficiency and often leads to rolling intercompany balances. Downstream intercompany loan interest charged is recognised as an expense by a borrower. The intercompany balances are reported on specific accounts which are reconciled with each other according to one or more predefined control tables.

Thus the parent company recognises that part of the interest income. In consolidated income statements eliminate intercompany revenue and cost of sales arising from the transaction. Ad Discover our tailor-made solutions adapted to your company and your sector.

It is typically used in conjunction with a due to. Click to see full answer. A company keeps track of its AR as a current asset on whats called a balance sheet which shows how much money a company has the assets and how much it owes the liabilities.

Also know is receivables a current asset. You create intercompany settlements to ensure that each companys net balance equals zero that is debits equal credits. In this case non-controlling interests bear their share for the interest expense.

Also is intercompany an asset. In the subsidiarys financial statements intercompany was presented on the balance sheet within liabilities. The ability to determine the appropriate account is often not allowed through software packages.