Formidable Members Equity Balance Sheet

Therefore owners equity can be calculated as follows.

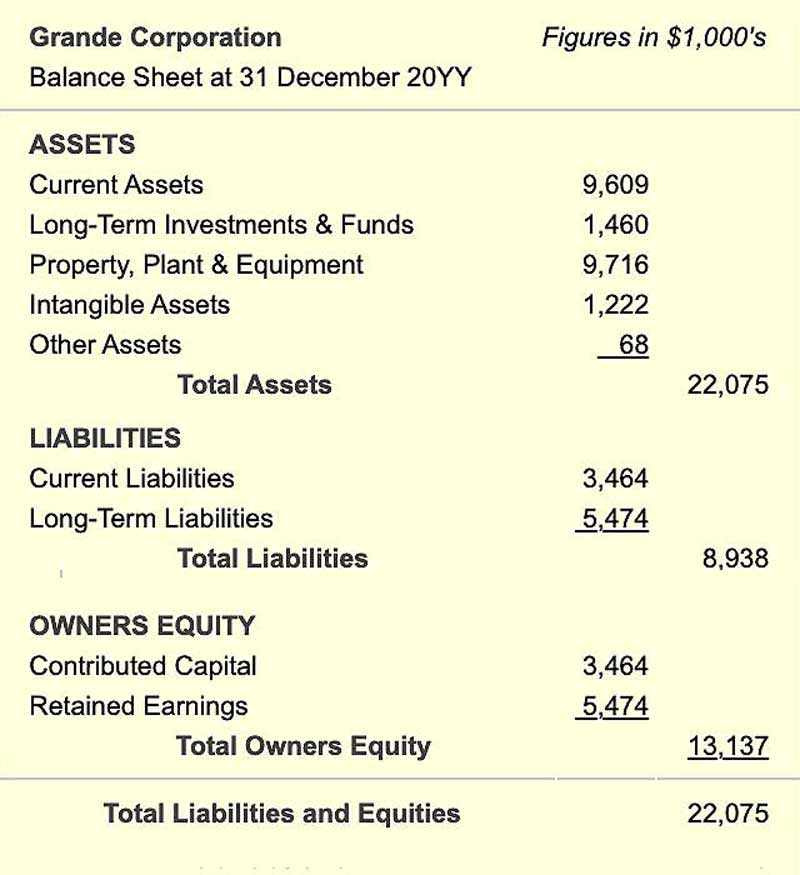

Members equity balance sheet. The owners equity section of a companys balance sheet displays the balances of owners equity accounts at a given point in time. Owners Equity Initial Investment of the Owner Donated Capital If any Subsequent Gains. Quickbooks will automatically calculate your Members Equity every time you run a balance sheet similar to Retained Earnings.

This report shows the retained. The balance sheet of a sole proprietorship will report owners equity instead of a corporations stockholders equity. Owners equity represents the value that the owner can catch up after selling its assets and settling all the debts.

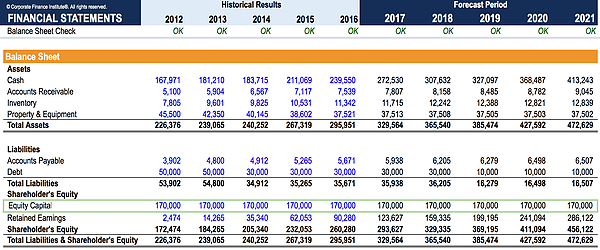

Total Reserve Funds refers to the sum of all reserve accounts that are listed on the balance sheet. If a business owns 10. Member equity is usually divided into Prior Year and Current Year.

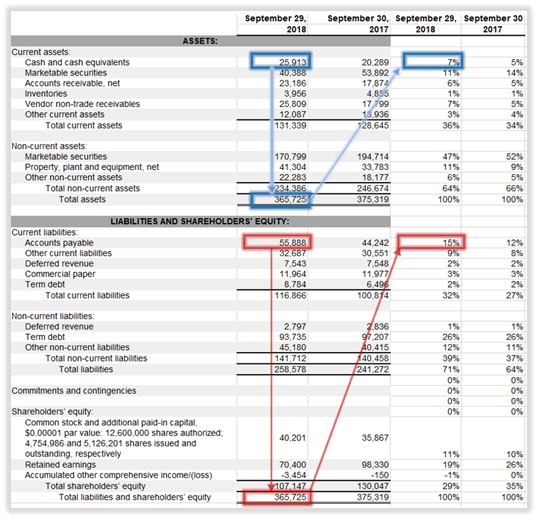

The term equity or net assets is a section on your balance sheet that reflects the difference between your total business assets which are all the resources your company owns and its liabilities which are all the claims against your company. Members equity refers to the net worth of the business and how it allocates to each partner. In a balance sheet this usually is depicted separately along with two other entities which are known as assets and liabilities.

While a financial statement may include a considerable amount of information the balance sheet is the most important part for a member to look at each year. Assets - Liabilities Owners Equity. Members Equity Members Equity can be understood as monetary value that has been built up over time.

Assets liabilities owners equity. At its most basic adds the companys liabilities to the amount held in members equity to arrive at the companys asset amount. So the simple answer of how to calculate owners equity on a balance sheet is to subtract a business liabilities from its assets.

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)

/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)