Formidable Ratio Analysis Of Steel Industry

If it falls to between 1 to 15 then the company needs to take very strong actions.

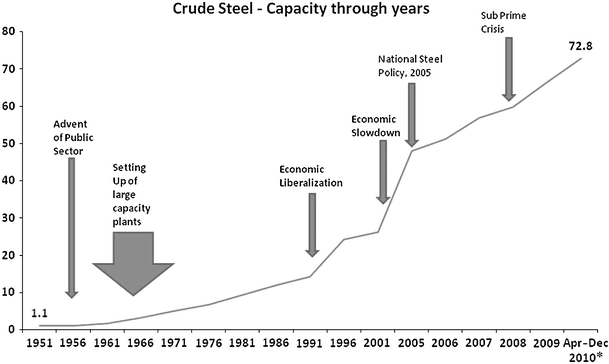

Ratio analysis of steel industry. Over the last 35 years the iron and steel industry has seen significant changes. And if the interest ratio of a company is below 1 then the company is not even able to service their interests. By using the ratio analysis tool we can analyse the performance of both the steel industry of India and we can easily find out the strength and weakness of the companies and their position in the market.

The more the interact coverage ratio the better it is for the company. 22 rows Solvency Ratios. The research findings are that the steel industry inventory or stock turnover ratio debtors turnover ratio was in good financial performance in spite of the impact creditor turnover ratio gross profit margin net profit of sluggish demand and global economic slowdown with margin operating ratio return on investment and earning an exception of two companies in the study period.

This implies that there is oligopoly in the industry as it is dominated my few major players. Dividend Payout Ratio NP 000. From the ANOVA analysis it is concluded that there is a significant difference between the mean quick ratios of the selected steel companies.

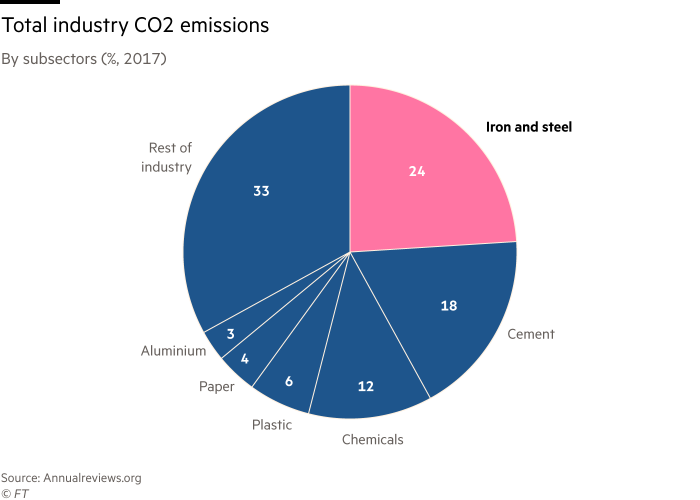

Different ratios are used in this study and particularly those which are related to the financial statement for this. Global iron and steel market Production. Within Basic Materials sector.

USSR 21 of global steel production Japan 16 USA 14 Germany 6 China 5 Italy 4 France and Poland 3 Canada and Brazil 2. The valuation analyst should then compare the aforementioned ratios for the subject company to those for other specific businesses or to an appropriate industry average. Much faster than the market value of the steel industry total capitalisation more than doubled it increased by 2301 between 1992 and 1999 while for the steel industry it increased by 5 leading to a combined relative loss of 682.

This overall indicates moderate liquidity and solvency position for the company. Financial risk leverage analysis ratios 7. On the trailing twelve months basis Due to increase in Current Liabilities in the 2 Q 2021 Working Capital Ratio fell to 282 above Iron Steel Industry average.