Perfect Short Income Statement Deferred Tax Asset Journal Entry Example

Thus the company would need to record a deferred tax asset at the end of the year as the consequences of the settlement of the liability will result.

Short income statement deferred tax asset journal entry example. Current Tax Expense accounting profittax rate DR. Present and disclose deferred tax in the financial statement of a company. It is a result of accrual accounting.

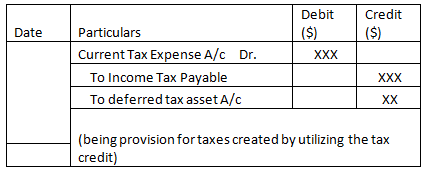

Deferred Tax Asset DR. The effect of accounting for the deferred tax liability is to apply the matching principle to the financial statements by ensuring. In future periods when the deferred tax liability would be used up the following journal entry needs to be posted.

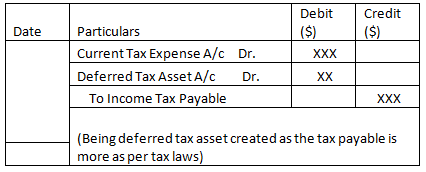

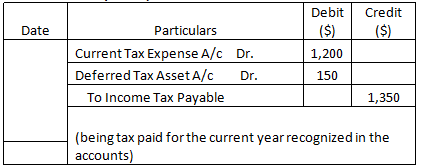

Based on the entries above note that the total income tax benefit is 34692 30300 4392 which equals 30 of the recorded book expense of 115639. The income tax payable account has a balance of 1850 representing the current tax payable to the tax authorities. Deferred tax asset is an asset recognized when taxable income and hence tax paid in current period is higher than the tax amount worked out based on accrual basis or where loss carryforward is available.

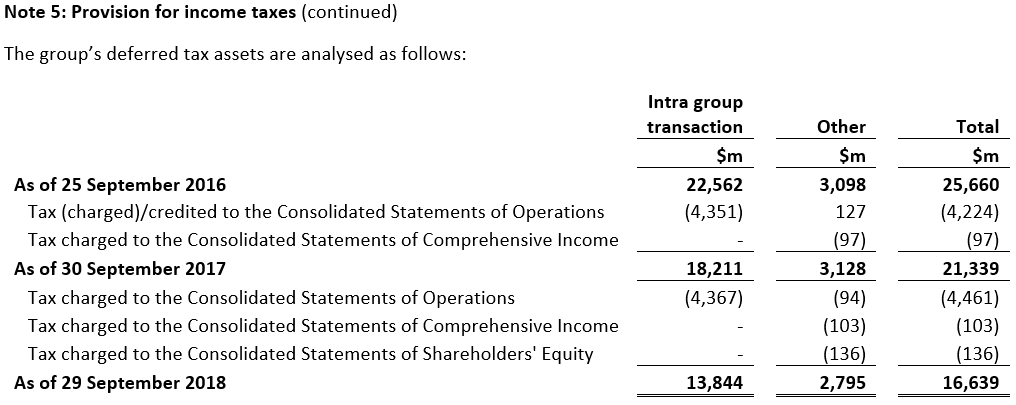

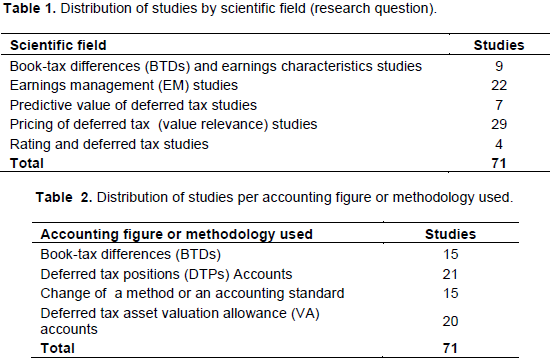

Example 2 Contract Liability and Receivable Resulting from a Non-Cancellable Contract with One Performance Obligation. Generally adjusting journal entries are made for accruals and deferrals as well as estimates. Firms carrying a full valuation allowance report no deferred tax assets on their balance sheets.

Thus deferred tax is the tax for those items which are accounted in Profit Loss Ac but not accounted in taxable income which may be accounted in future taxable income vice versa. And follows the matching and revenue recognition principles. Deferred Tax Asset.

It is a line item booked under the liability section of the balance sheet of a company. Deferred tax liability can be defined as an income tax liability to the IRS for having tax payable less than what you actually incurred due to temporary differences between accounting income and taxable income. If the tax rate for the company is 30 the difference of 18 60 x 30 between the taxes payable in the income statement and the actual taxes paid to the tax authorities is a deferred tax asset.

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)