Neat Accounting For Restructuring Costs

Overview of accounting differences.

Accounting for restructuring costs. A restructuring liability is recognized if a detailed formal plan is announced or implementation of such a plan has started. A Accounting Treatment for Simple and Internal Corporate Restructuring Following Steps will be useful in this accounting. Restructuring provisions should be recognised as follows.

Under IFRS 3 3 the cost of restructuring an acquiree is recognized as a liability as part of the acquisition accounting ie. IAS 3770 sale or termination of a line of business. These charges often include cash costs accrued liabilities asset write-offs and employee severance pay due to layoffs.

Under IAS 37 restructuring provisions include only direct costs arising from the restructuring eg. Some types of restructuring charges such as exit costs as defined in Emerging Issues Task Force 2 EITF Issue No. Restructuring provision on acquisition.

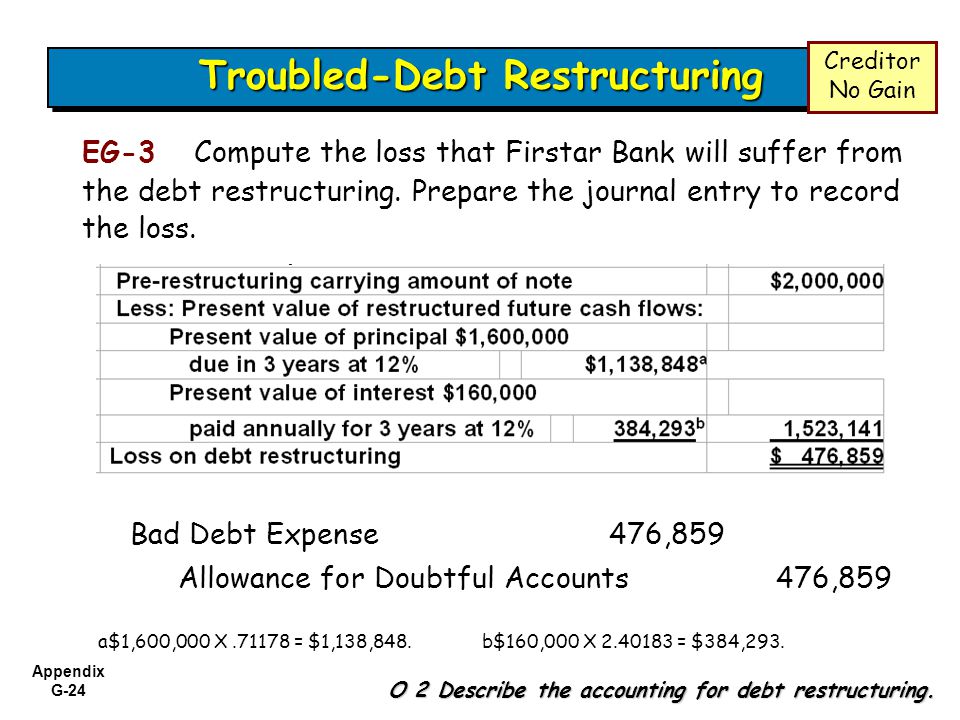

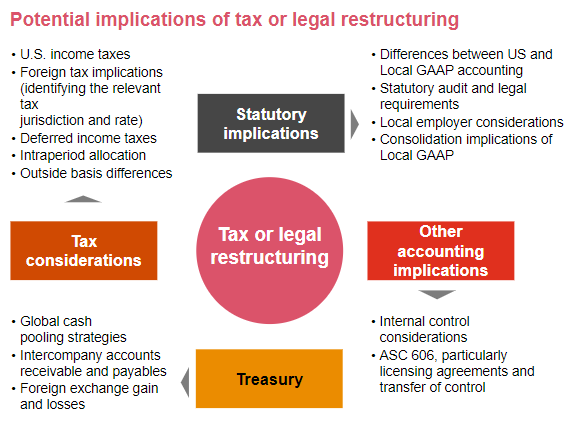

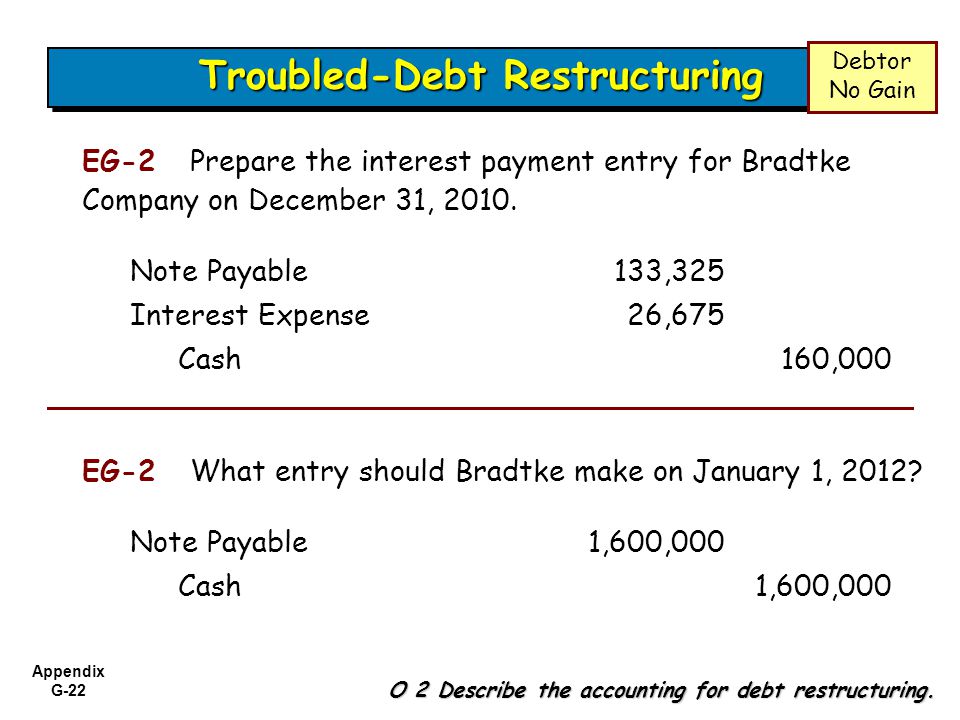

The accounting for the debt modification depends on whether it considered to be substantial or non-substantial. Although the accounting for some costs that have been included in restructuring charges such as employee severance and termination costs is addressed in existing accounting pronouncements it is not always clear when those costs should be recognized if they arise in connection with a restructuring. The Exit or Disposal Cost Obligations Topic addresses financial accounting and reporting for costs associated with exit or disposal activities.

2601 - Income statement presentation. There are two tests to check whether the modification is substantial and these are as follows. Pat and Jay explain some of the other restructuring or exit costs that are top of mind for companies.

A particularly challenging area during restructuring is the accounting for severance and other benefits provided to employees and to incentivize continued employment while exiting a business activity. The term restructuring expenses is also a footnote in the financial statements that describes the details relevant to the restructuring charges. Restructuring Cost refers to the one-time expenses or the infrequent expenses which are incurred by the company in the process of reorganizing its business operations with the motive of the overall improvement of the long term profitability and working efficiency of the company and are treated as the non-operating expenses in the financial statements.

:max_bytes(150000):strip_icc()/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)