Casual Modified Cash Basis Of Accounting Companies House Balance Sheet Explained

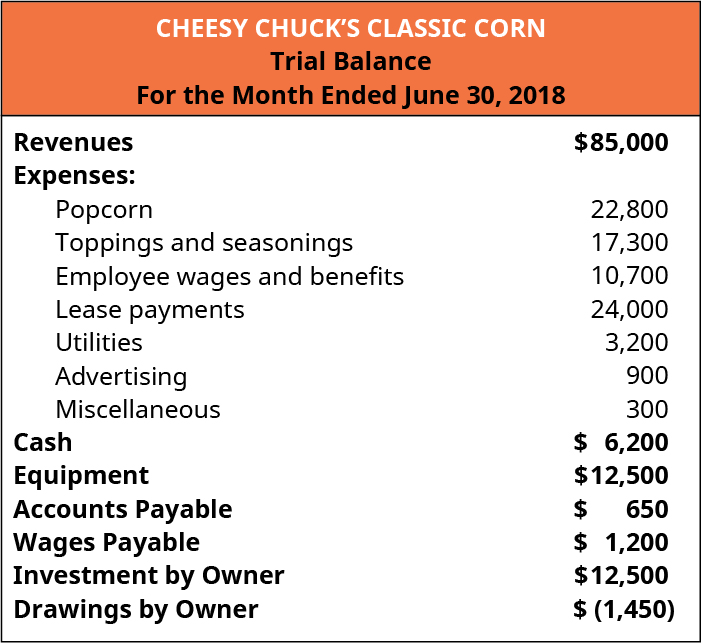

Usually the cash-basis method is for small nonmanufacturing businesses.

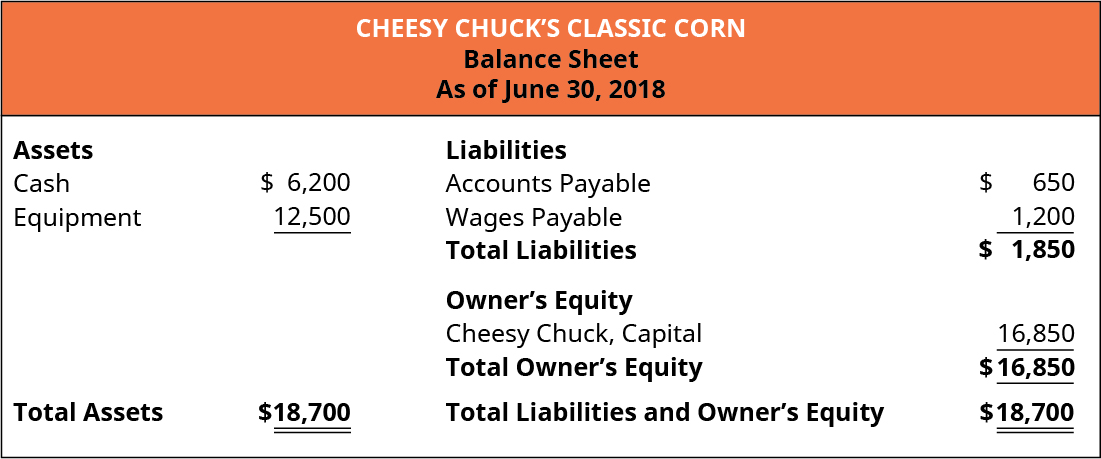

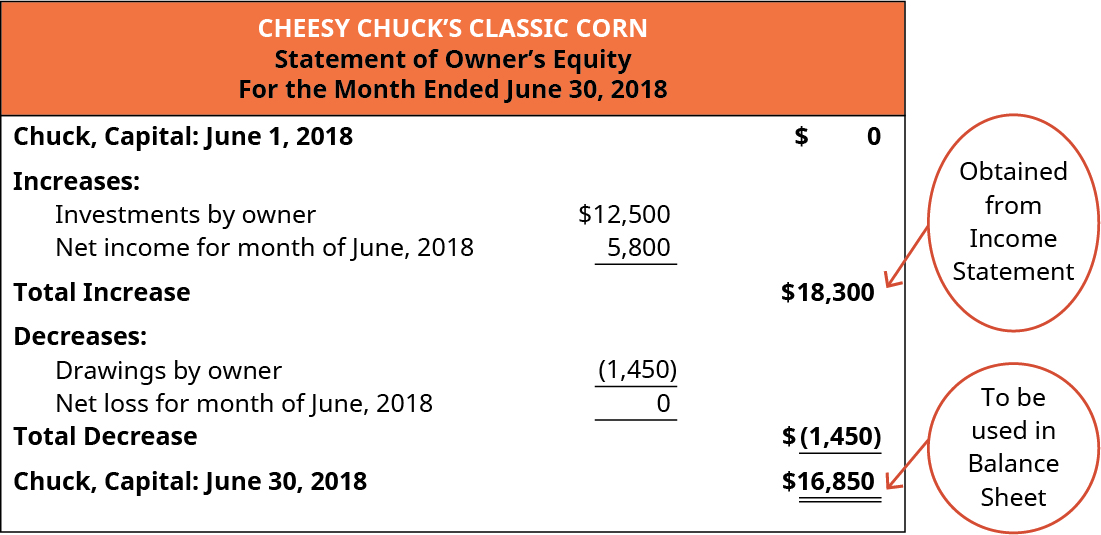

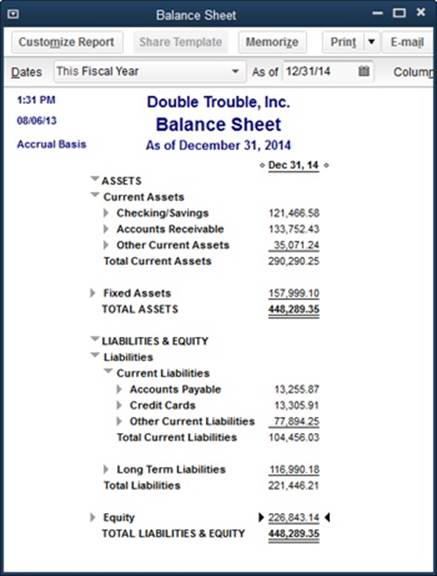

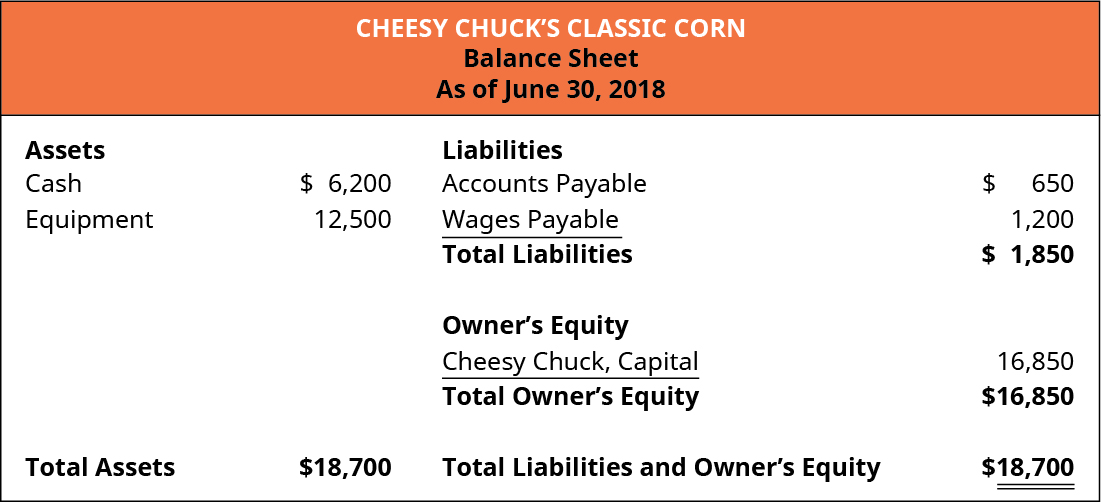

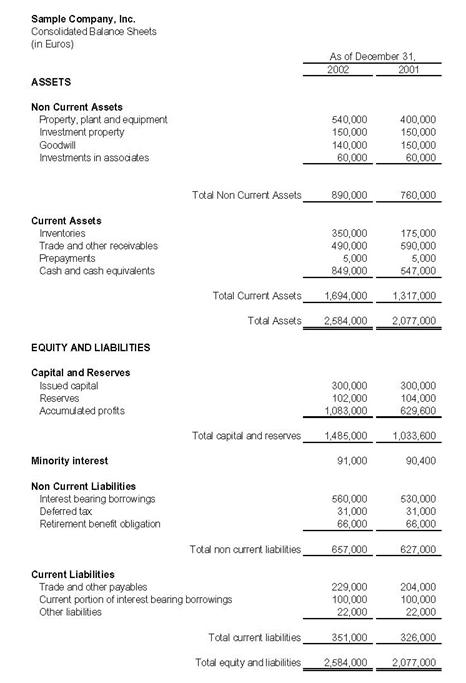

Modified cash basis of accounting companies house balance sheet explained. Abridged accounts must contain a simpler balance sheet along with any notes. The modified basis has the following features. The balance sheet is separated with assets on one side and liabilities and owners equity on the other.

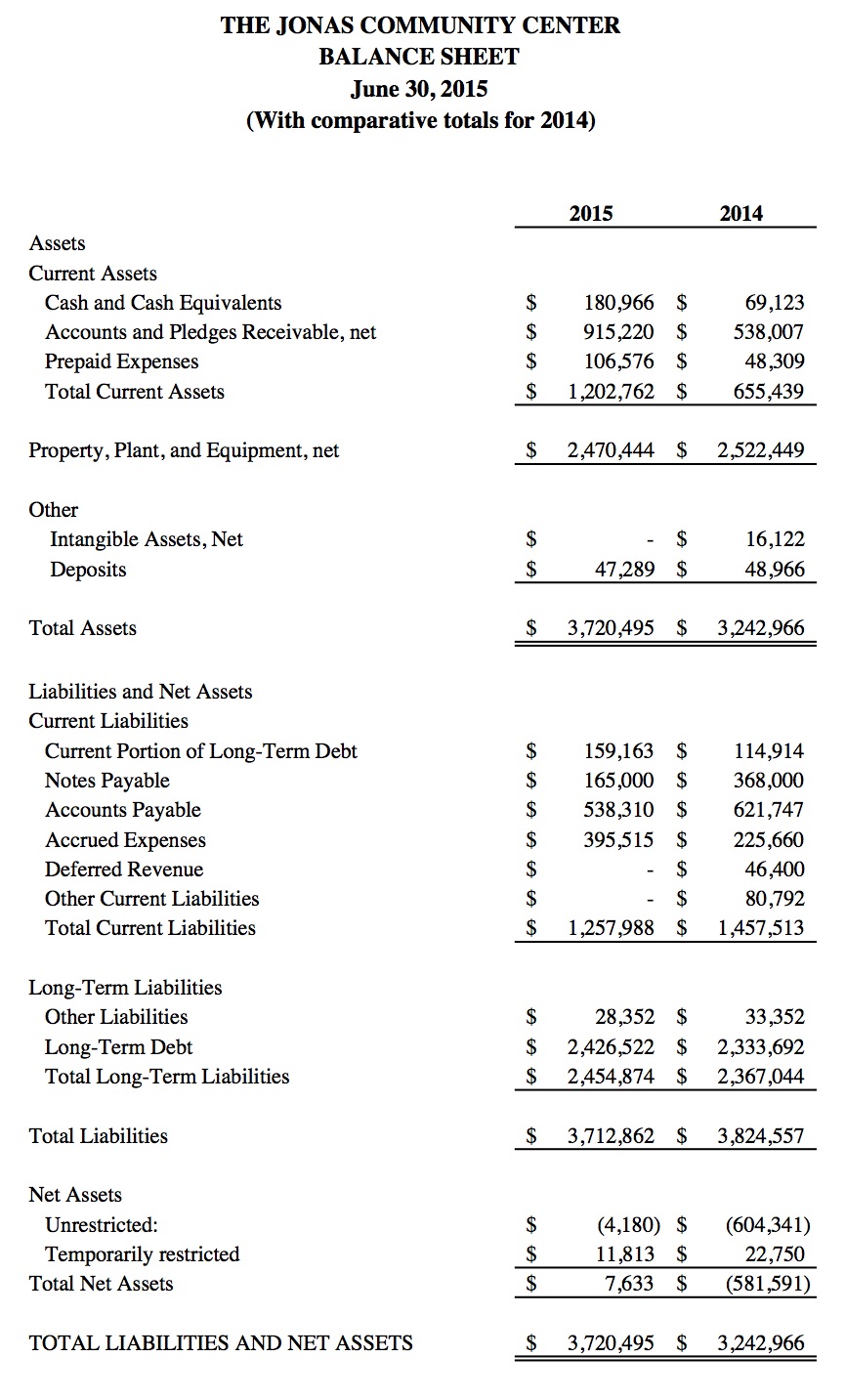

Fixed Assets include machinery equipment buildings and also intellectual property rights such as patents and trademarks. As an economy device the Companies Amendment Act 1988 introduced the concept of Abridged Balance Sheet vide Section 2191 b iv. The profit and loss shows what has happened over a certain period of time whilst the balance sheet is a snapshot of the.

You can also choose to include a simpler profit and loss account and a copy of the directors report. This one unbreakable balance sheet formula. Cash basis refers to a major accounting method that recognizes revenues and expenses at the time cash is received or paid out.

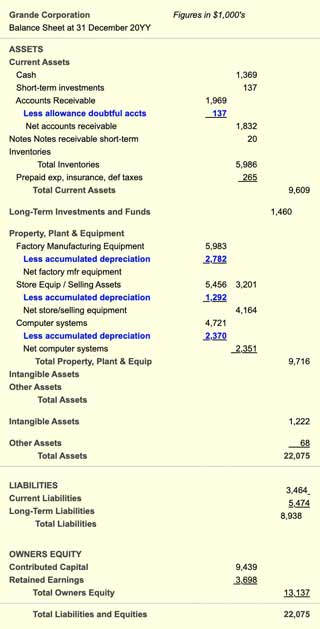

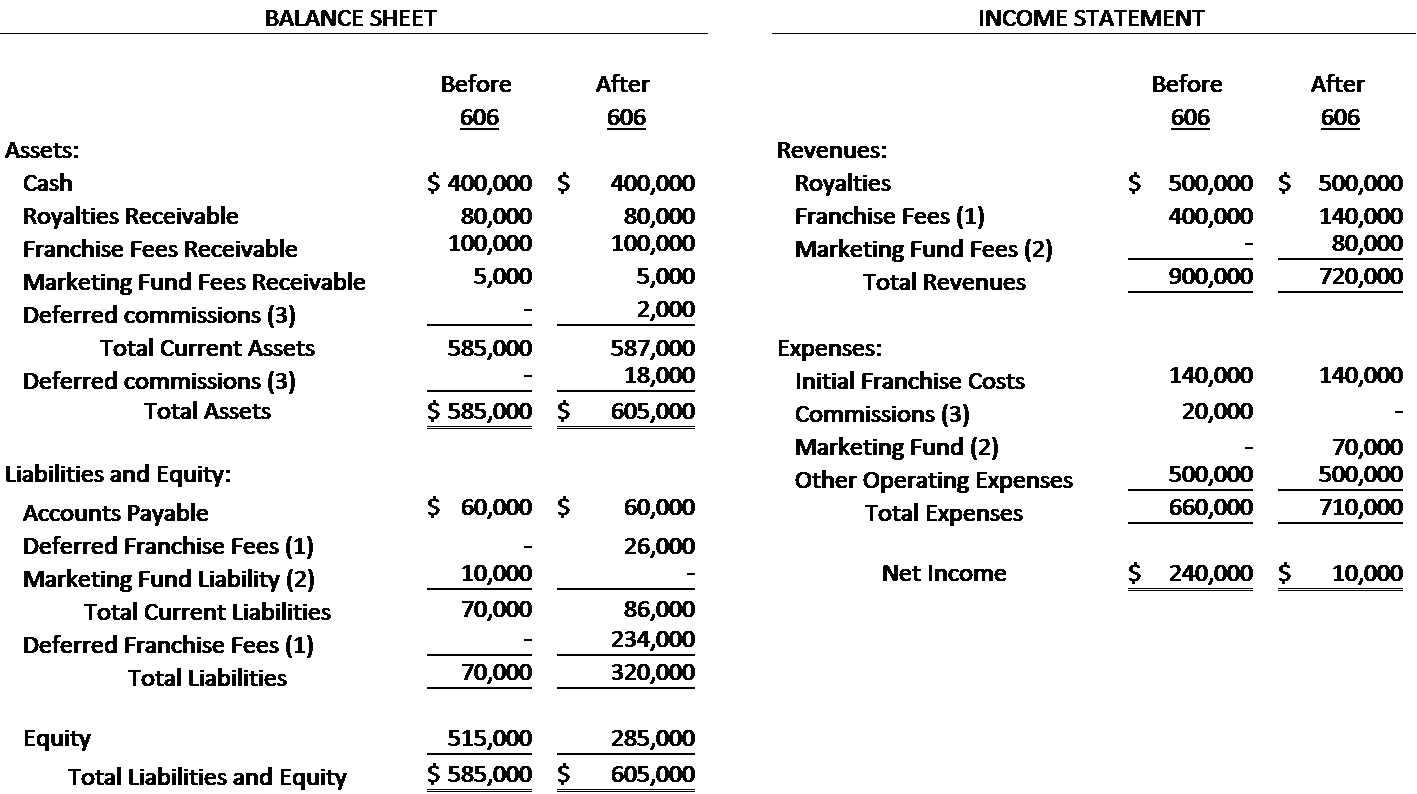

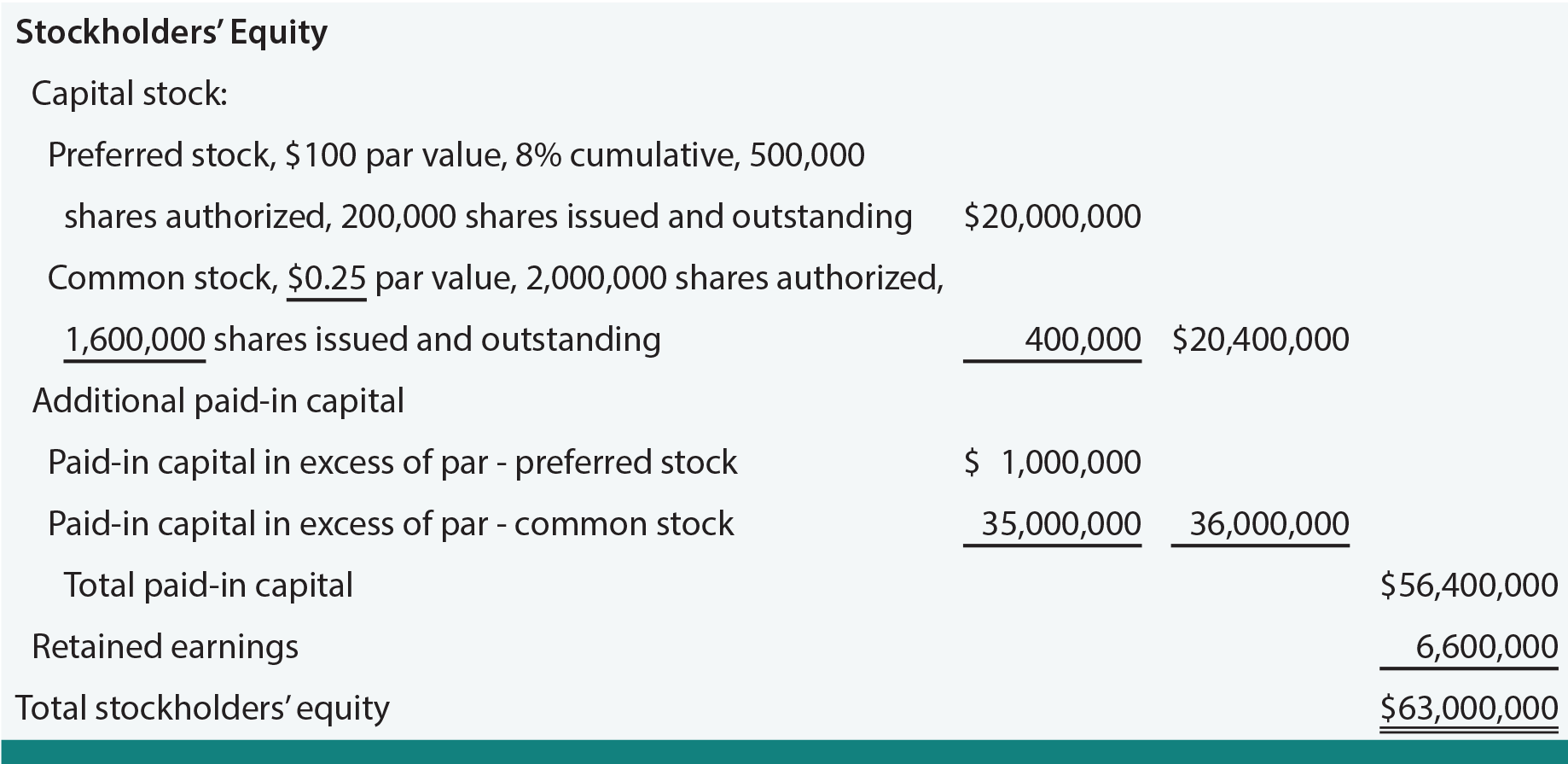

Records revenues and expenses as they are earned or incurred irrespective of changes in cash. Features of the Modified Cash Basis of Accounting. The balance sheet also known as the statement of financial position reports a corporations assets liabilities and stockholders equity as of the final moment of an accounting period.

The first cash in hand means physical cash your business has in its possession notes and coins. As you grow larger the IRS expects you to switch to accrual. These sections look at each part of the equation.

Secondly they may choose accrual basis accounting instead. It includes details of. It includes your companys current and savings accounts.