Marvelous Balance Sheet Metrics

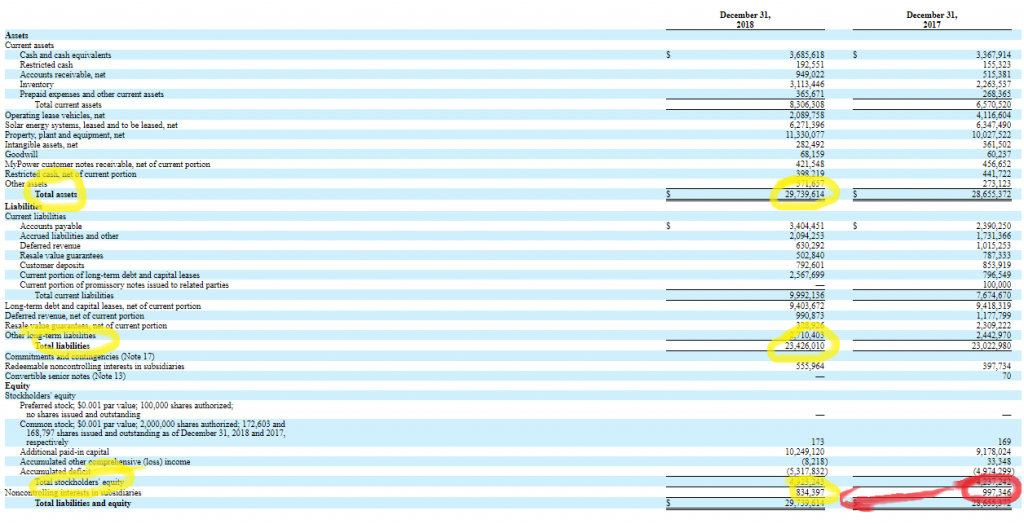

The liabilities section of the balance sheet contains the liability accounts of the.

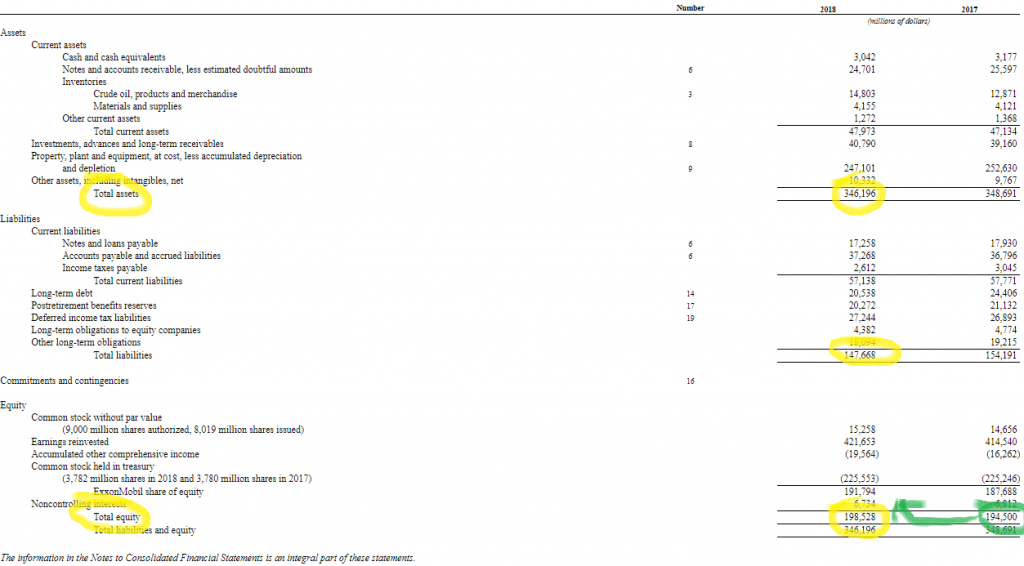

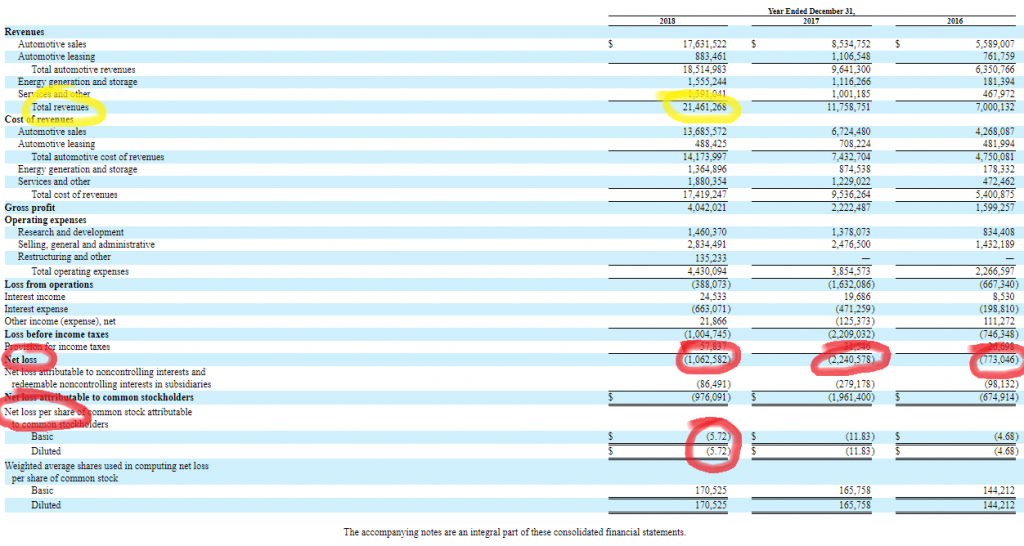

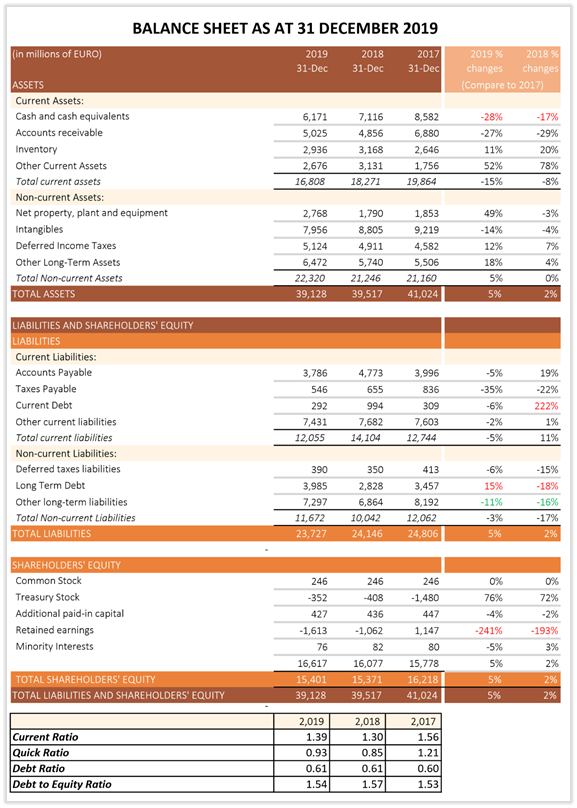

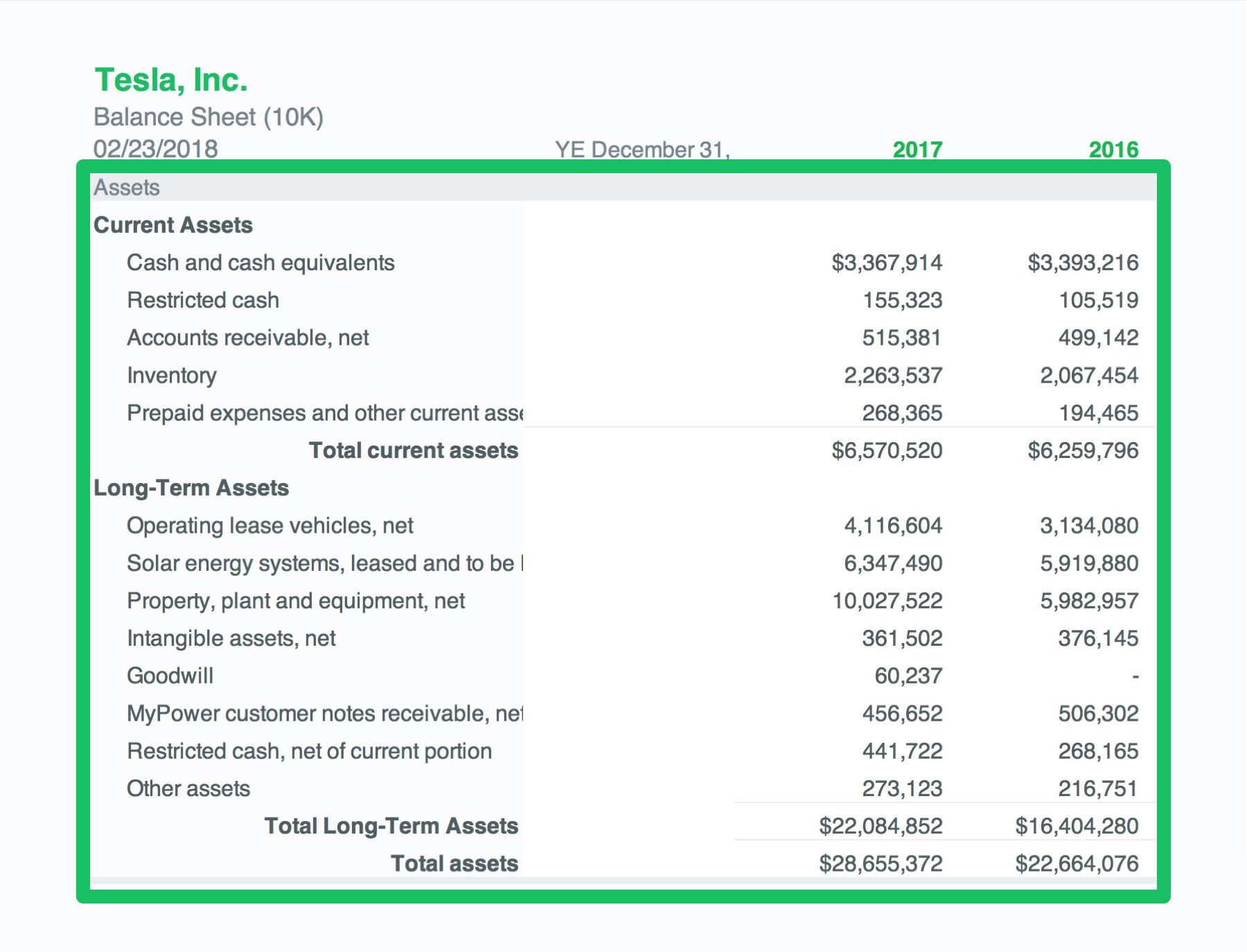

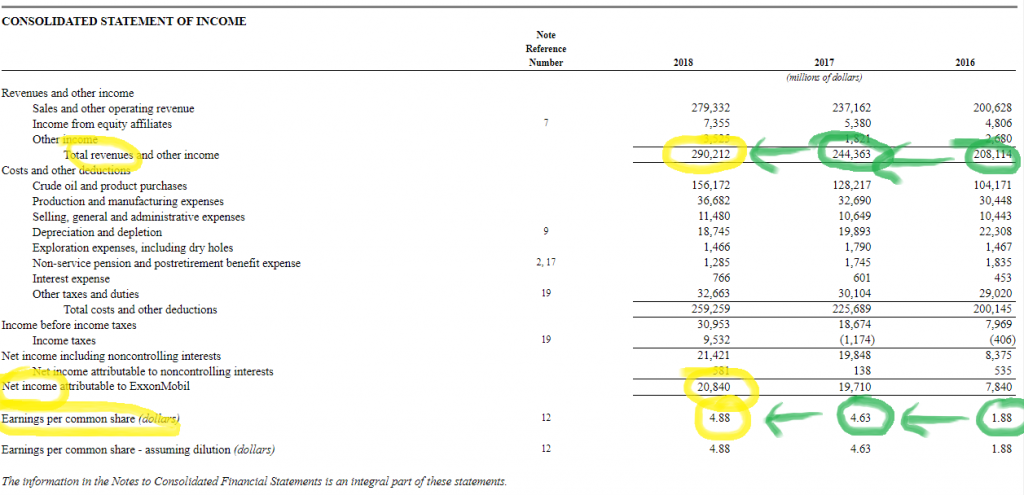

Balance sheet metrics. The following metrics can be used to analyze non-current assets. The Bottom Line To better understand a businesss financial situation and level of solvency you can do a few quick and easy calculations that use data found within the balance sheet. Balance sheet ratios are financial metrics that determine relationships between different aspects of a companys financial position ie.

We measure the strength of a balance sheet. The strength of a companys balance sheet can be evaluated by three broad. Continue reading Days Sales.

They require very little math yet lead to HUGE insights about your business. Keep in mind that as always with any financial analysis it is best practice not to just look at metrics at a specific point in time but also to analyze changes in a time series analysis. Capital Expenditure Ratio.

A healthy balance sheet reflects an intelligent business a business where there is the right balance between debt and equity and the management team is using debt to propel the business forward. We should care very much about Total Assets Total Liabilities and Shareholders Equity. 13 hours agoKinder Morgans Balance Sheet Is in Its Best Shape in 5 Years.

This ratio is a bit more conservative than the current ratio as it removes inventories from the calculation. While they are just some simple calculations they tell are story about how a company is doing. We will use the companys financial statements.

You can calculate three types of ratios from the balance sheetliquidity turn assets into cash solvency cash or equivalents to pay debts and profitability ratios. In the balance sheet assumptions section of the model see below we calculate each metric and then make assumptions about. They include only balance sheet items ie.