Great Unbilled Revenue On Balance Sheet

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

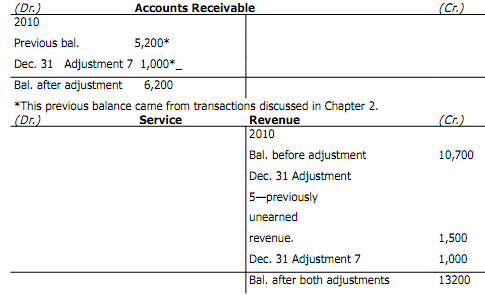

Scenario 1 This process is depicted in Figure 3.

Unbilled revenue on balance sheet. How do unbilled receivables occur. Unbilled accrual is effectively reversed when current month revenue is calculated. If a company completed a project for a client on 5 th September 2020 but the bill is invoiced to him on 10 th September 2020 then from 6 th September to 9 th September the company records unbilled revenue for the services rendered to client.

Unbilled receivables can be the result of a failure in the billing process or a built-in function of certain types of business relationships. This account holds job-to-date unbilled revenue for all projects. This billing would show up as an unbilled revenue asset on the balance sheet.

So to account for unbilled revenues companies should include a section in their balance sheets for unbilled receivables to recognize revenue for a given period and should count unbilled receivables toward their total revenue even if an invoice has not been generated or sent to the customer. Unbilled revenue could be treated in two ways depending on the concepts the company is adopting ie either accrual basis concepts or cash basis concept. If it is an accrual basis concept then you will Dr the Account receivable and Cr the Income or.

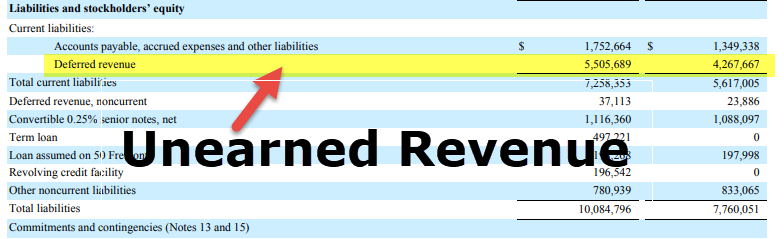

The recognition of unbilled revenue or often called accrued revenue is an important part of this end-of-period reporting and what we will be looking at in this article. Deferred revenue is listed as a liability on the balance sheet because under accrual accounting the revenue recognition process has not been completed. Unbilled Accounts Lists Examples.

Unearned Revenue is a Liability on the Balance Sheet. Usually this unearned revenue on the balance sheet is reported under current liabilities. Unbilled Fees Unbilled Legal fees Unbilled Accounting Fees etc.

The unbilled revenue disclosed as a separate line item in the balance sheet by software companies is a monetary asset similar to accounts receivable except that the right to receive cash may not have been established through billing as on the balance sheet date. Current Liabilities Current Liabilities are the payables which are likely to settled within twelve months of reporting. This can occur when you invoice in arrears or have any delay in billing relative to the revenue recognition trigger date.

%20(1).png?width=780&name=unbilled-receivable%20(1)%20(1).png)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

-19.png?width=780&name=image%20(1)-19.png)