Divine The Accounting Cycle Requires Three Trial Balances

What effect does this have on the accounting equation.

The accounting cycle requires three trial balances. What Does Accounting Cycle. Financial statements are prepared. Unadjusted post-closing adjusted Unadjusted adjusted post-closing Post-closing unadjusted adjusted Post-closing adjusted unadjusted Which of the following is considered to be an accrued expense.

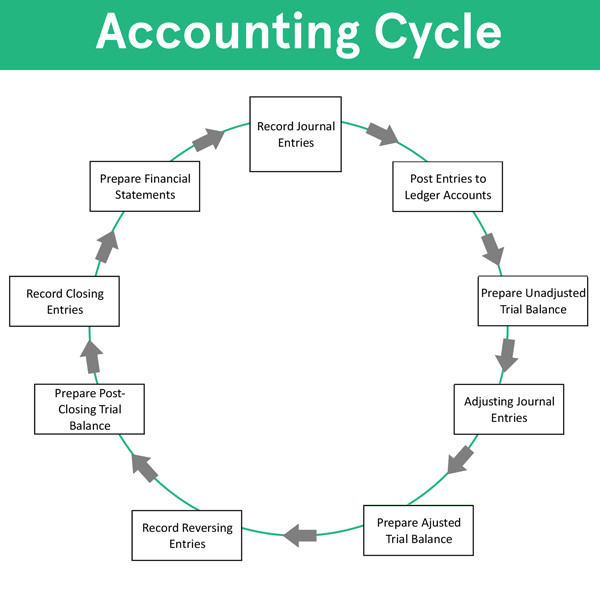

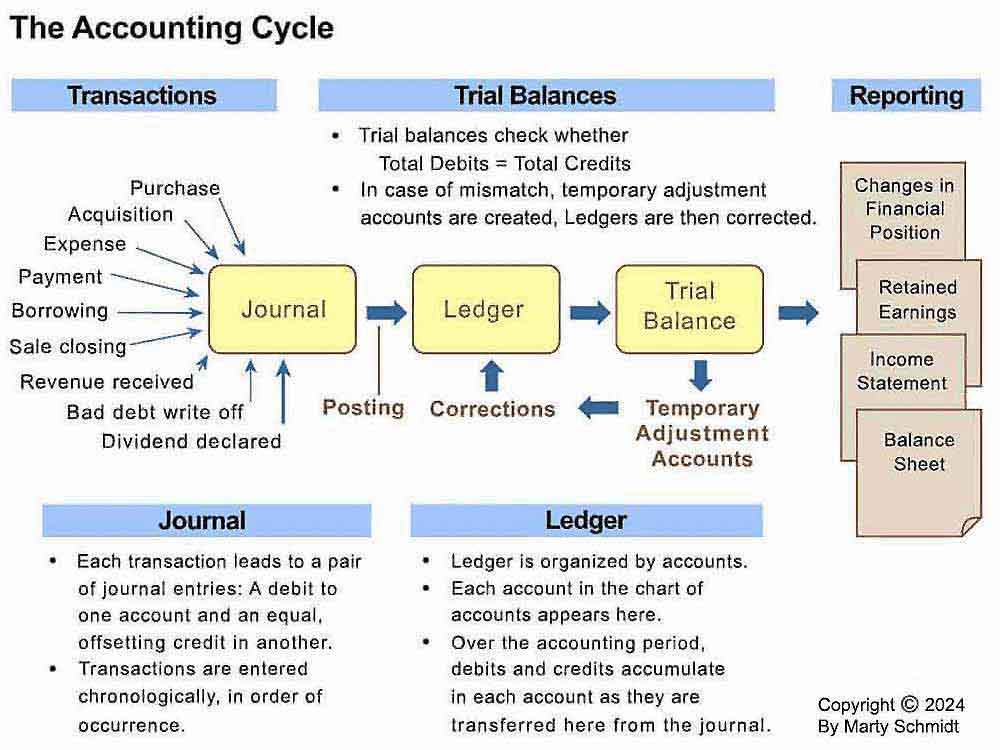

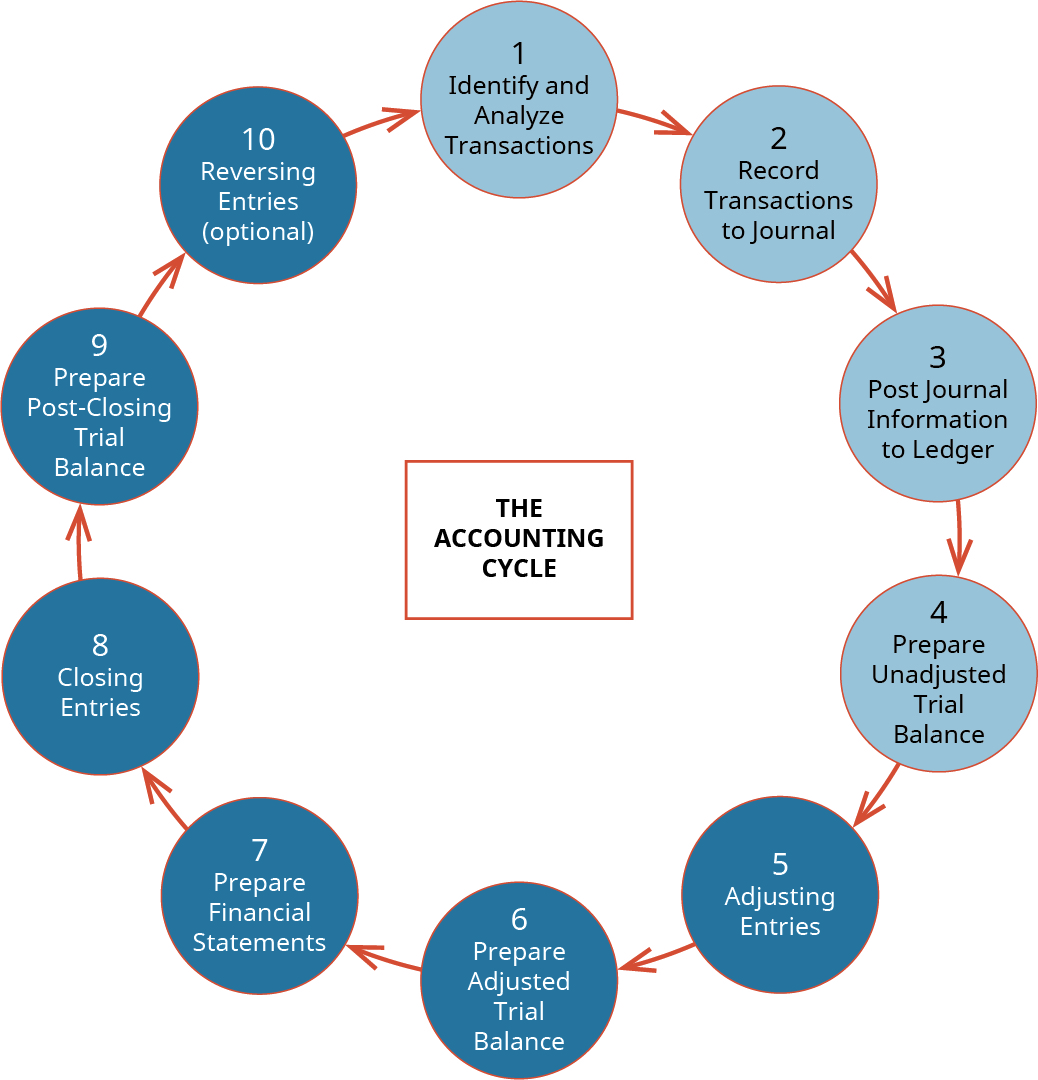

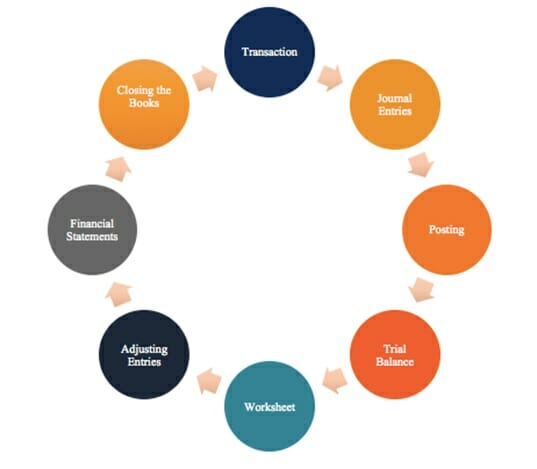

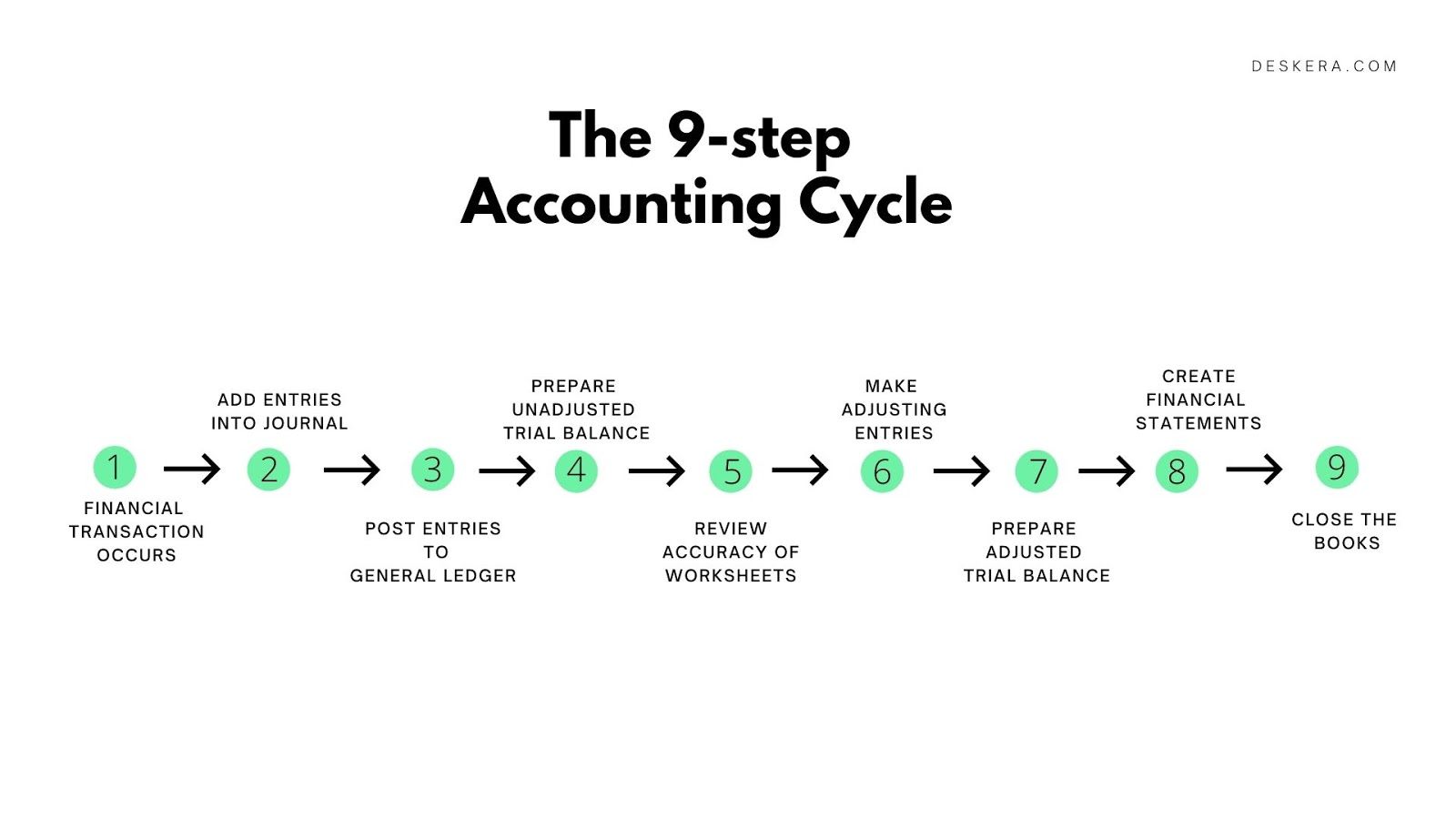

Adjusting entries are journalized and posted to the ledger. The accounting cycle requires three trial balances be done. The three trial balances in the accounting cycle are prepared in the following order ie.

The Adjusted Trial Balance includes the postings of the adjustments for the period in the balance of the accounts. These are divided into 3 types 1 VERTICAL TRIAL BALANCE 2 HORIGENATL TRIAL BALANCE 3 MULTI TRIAL BALANCES Explanation- What are the 6 steps of the accounting cycle. The unadjusted trial balance the adjusted trial balance and the post- closing trial balanceAll three have exactly the same format.

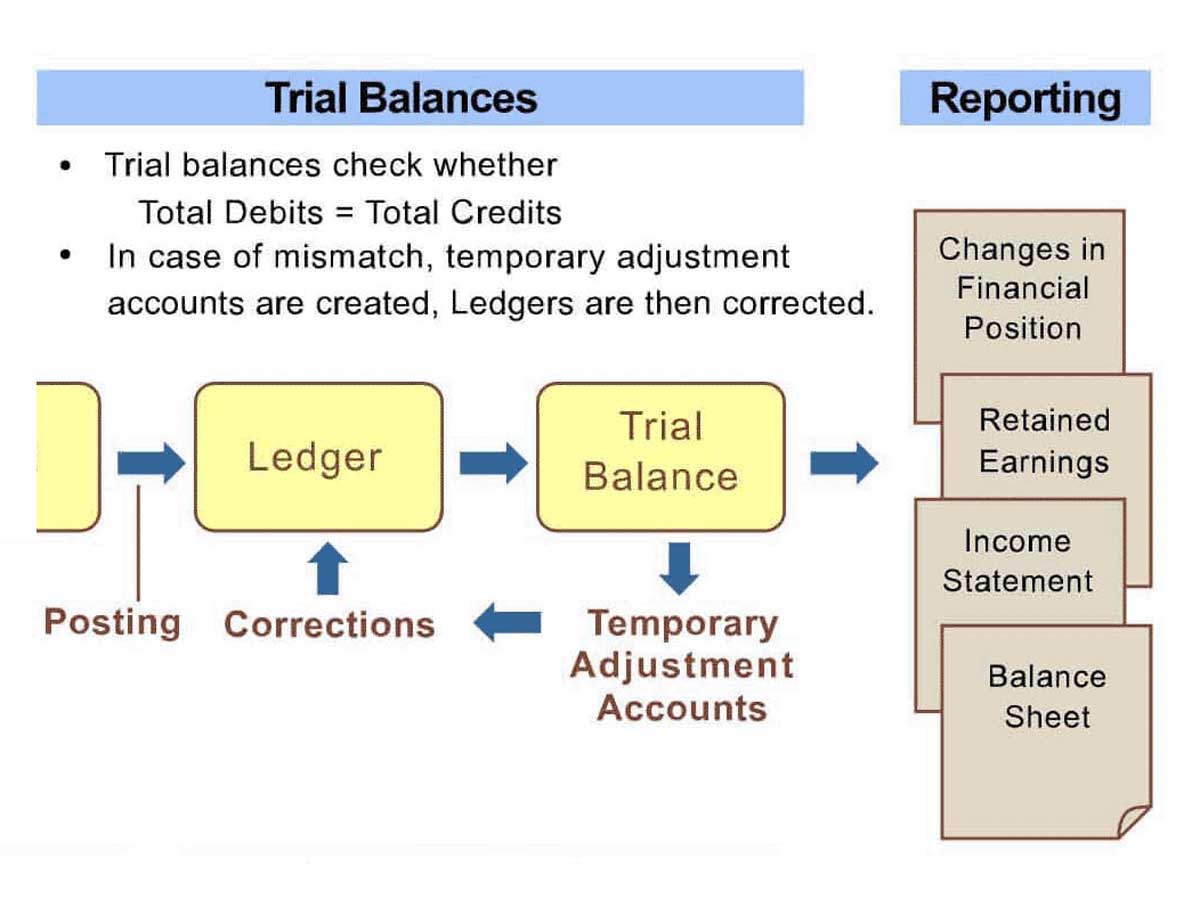

The three balances required in an accounting cycle include unadjusted adjusted and post-closing trial balances in that order. Trial Balance is prepared basically to check if debit or credit amounts recorded in the ledger accounts are accurate. This phase helps to verify whether sum of the debit balances is equal to the sum of the credit balances.

In what order should they be prepared. Closing entries are journalized and posted to the ledger. These three core statements are.

When ledger postings are completed and accounts are balanced the next phase in the accounting cycle is preparation of a Trial Balance. After posting all financial transactions to the accounting journals and summarizing them in the general ledger a trial balance is prepared to verify that the debits equal the credits on the chart of accountsThe trial balance is the next step in the accounting cycleIt is the first step in the end of the accounting period process. An adjusted trial balance is prepared.