Unbelievable Cash Flow Statement Mandatory For Which Companies

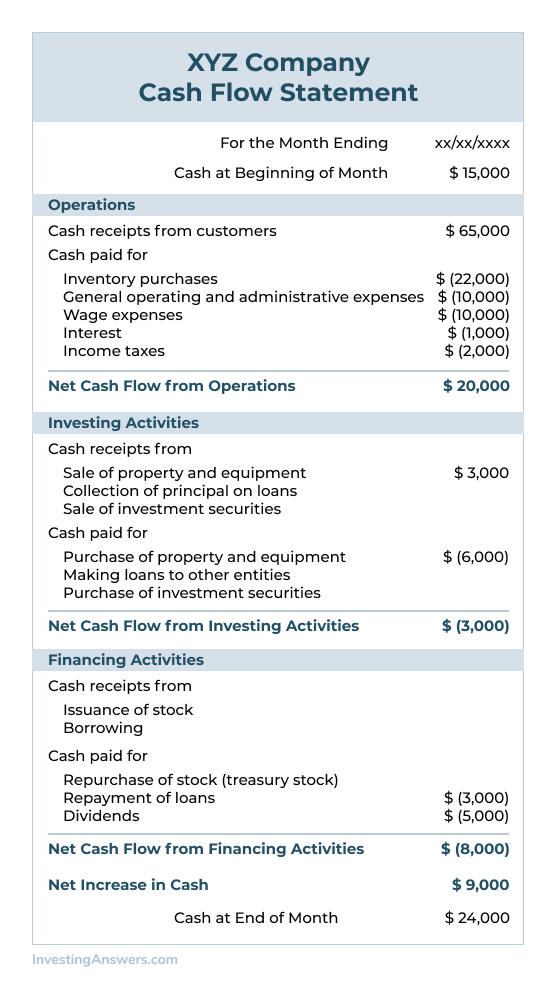

For example one could be spending cash on computer equipment on vehicles or even on a building one purchased.

Cash flow statement mandatory for which companies. Company Accounts and Analysis of Financial Statements Cash Outflows from financing activities Cash repayments of amounts borrowed. Simply We can state that the cash flow statement is applicable for all companies including Private Company however the certain exemption is provided to OPC Dormant Companies and Small Companies in respect of. Under the small entity provisions within S1A of FRS 102 small companies who are not subsidiaries can claim exemption from preparing a cash flow statement.

The inclusion of cash flow along with balance sheet and PL for all companies is a new requirement. Earlier only listed companies under listing agreement clause no. 32 are required to prepare cash flow statement as per AS 3 of Accounting standards issued by the ICAI.

Dividends paid on equity and preference capital. This means a small company is not required to prepare cash flow statement at the end of the financial year. A private limited company with paid up share capital of less than 50 lakh rupees or such higher amount as may be prescribed not exceeding 5 crore rupees or with a turnover of less than 2 crore rupees or such higher amount as may be prescribed not exceeding 20 crore rupees is not required to prepare cash flow statements while preparing financial statements at the end of the.

Yes the Subsidiary company or holding company is not considered as a small company hence preparation of Cash Flow Statement is mandatory for both. Do small companies required to prepare a Cash Flow Statement. As per the definition of financial statements Section 2 40 of the Act the cash flow statement is not applicable to small companies.

Where the entity voluntarily chooses to prepare a cash flow statement it must apply the provisions in Section 7. Provided that the financial statement with respect to One Person Company small company and dormant company may not include the cash flow statement. 32 are required to prepare cash flow statement as per AS 3 of Accounting standards issued by the ICAI.

As per Sec 2 40 for financial statement in relation to a company includes i a balance sheet as at the end of the financial year. Others treat interest received as investing cash flow and interest paid as a financing cash flow. Provided that the financial statement with respect to one person company small company and dormant company may not include the cash flow statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)