Stunning Consolidation Of Accounts Of Associate Company

Therefore in Nutshell a company having only associates need not to account for their investment in accordance AS-23 as the same is not required so in accordance with AS 23.

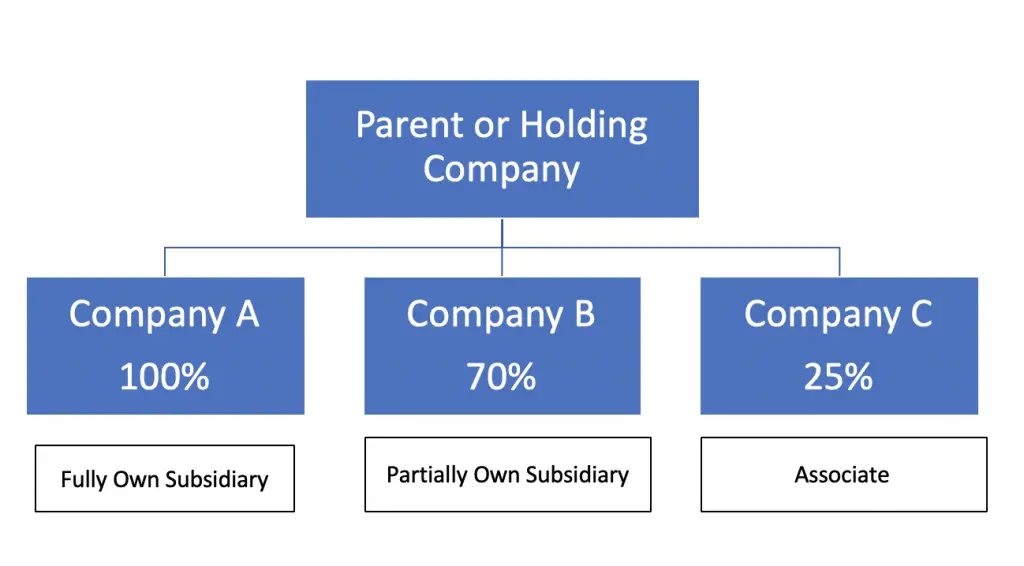

Consolidation of accounts of associate company. Consolidation of group accounts and Internal control over financial reporting. Where a company has one or more subsidiaries it shall in addition to financial. A group is a parent and all its subsidiaries.

The accounting standard sets out principles and procedures on recognising in the consolidated financial statements the effect of investment in associates on the. As per the scope of AS-23 and AS-27 the application of equity methodproportionate method for consolidation of accounts of associate joint ventures respectively is required only when a company prepares consolidation under AS 21 The term group has been defined in AS 21 as follows. Accounting for investment in associates Part 2 Under the equity method an.

Rendering accounting business financial investment legal tax. The treatment required is to just make one line entry into the financial statements as follows. I As per rule 6 of Companies Accounts Rules 2014 under the heading Manner of consolidation of accounts it is provided that consolidation of financial statements of a company shall be done in accordance with the provisions of Schedule III to the Companies Act 2013 and the applicable Accounting Standards.

An associate company may be partly owned by another company or group of companies. Unrealised losses should also be eliminated unless cost cannot be recovered. An associate is an entity over which an investor has significant influence being the power to participate in the financial and operating policy decisions of the investee but not control or joint control and investments in associates are with limited exceptions required to be accounted for using the equity method.

Ind AS that matter for Consolidation The financial statements of a group in which the assets liabilities equity income expenses and cash flows of the parent and its subsidiaries are presented as those of a single economic entity. Standalone financial statements of the Company and consolidated financial statements of the Company and of its subsidiary or subsidiaries associate companys and joint ventures as per the explanation given under Section 129 3 of the Act 2013 the word subsidiary shall also include associate. Where acquisition made in a step-by-step manner consolidation to be done from date when the parent actually acquires control of the subsidiary Intra group balances and intra-group transactions and resulting unrealised profits should be eliminated in full.

453 Consolidation of Limited Liability Partnership LLP which is an associate or joint venture If LLP or a partnership firm is an associate or joint venture of holding company even then the LLP and the partnership firm need to be consolidated in accordance with the. In the consolidated statement of profit or loss any dividend income received from the associate is replaced by bringing in one line that shows the parents share of the associates profit. Control requires exposure or rights to variable returns and the ability to affect those returns through power over an investee.

/dotdash_Final_Subsidiary_Jul_2020-01-5cb00a7e65ed43618112f2f94829fc03.jpg)