Spectacular Comparative Statement Accounting Sheet Format

It can also be used to compare two different companies operating metrics as well.

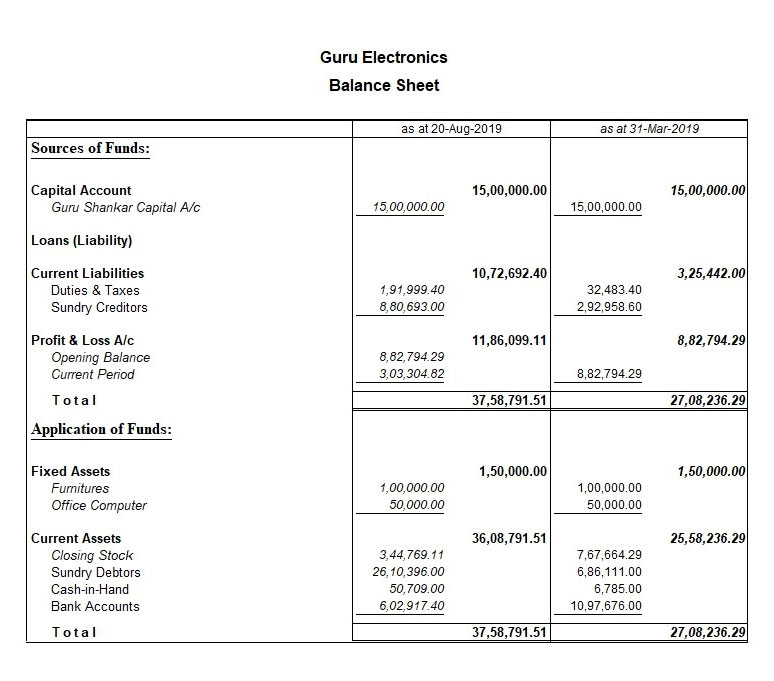

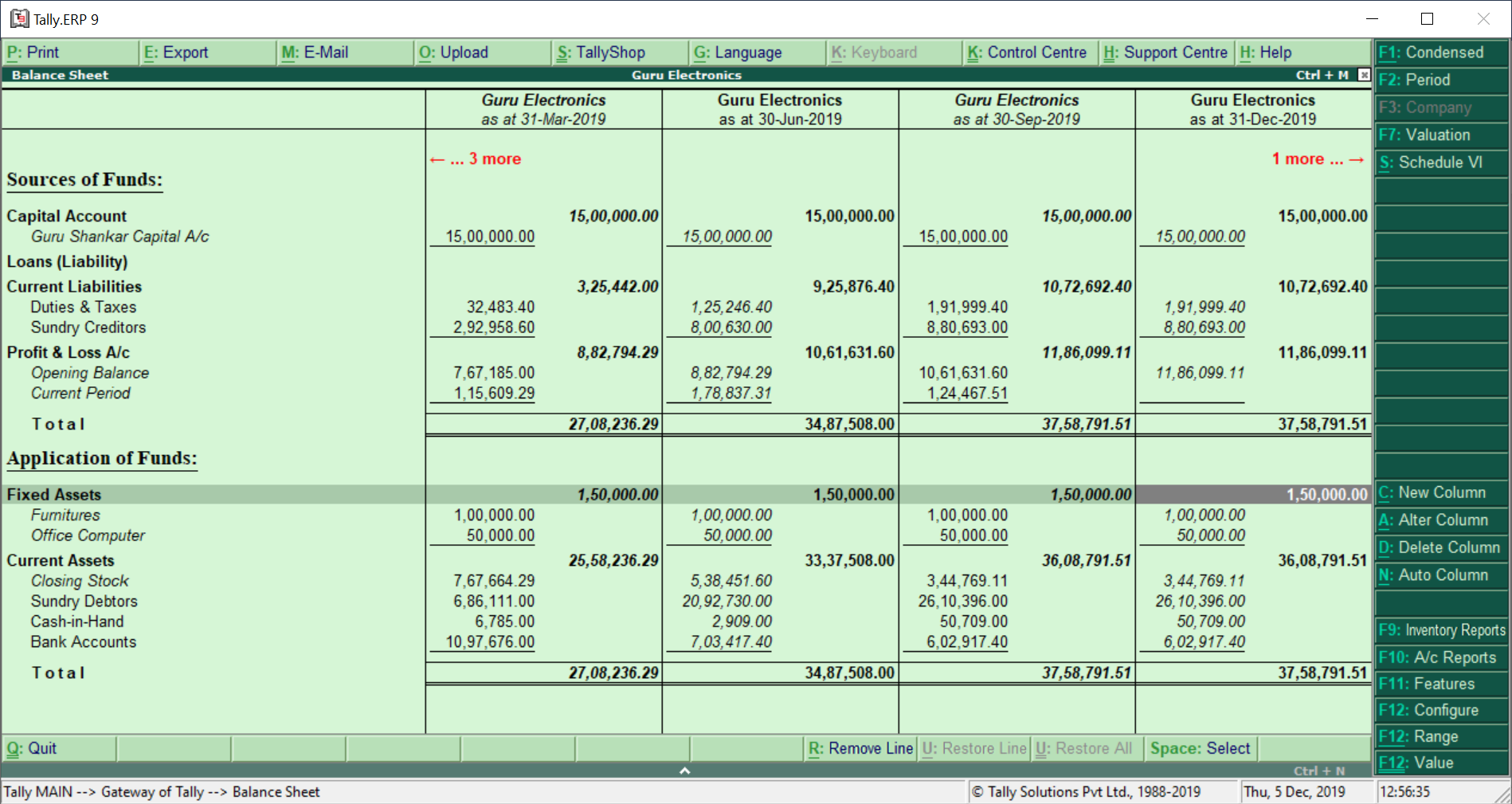

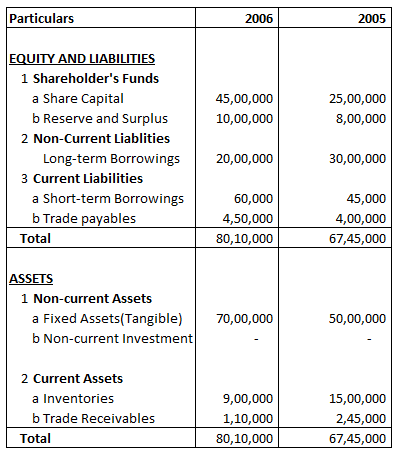

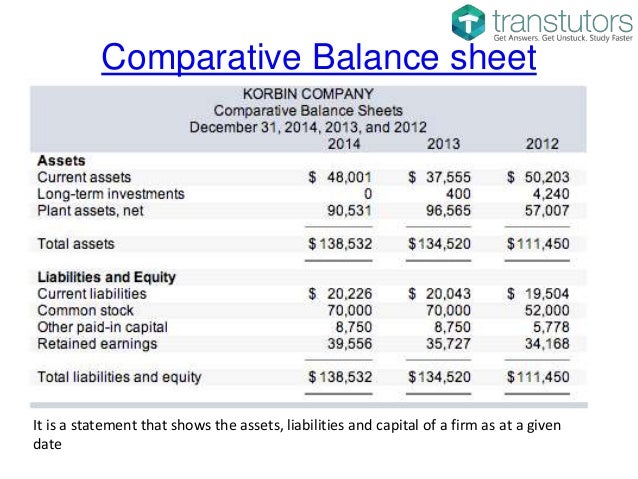

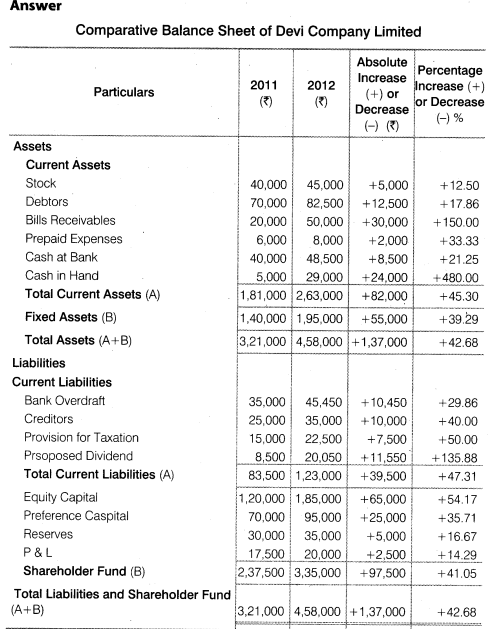

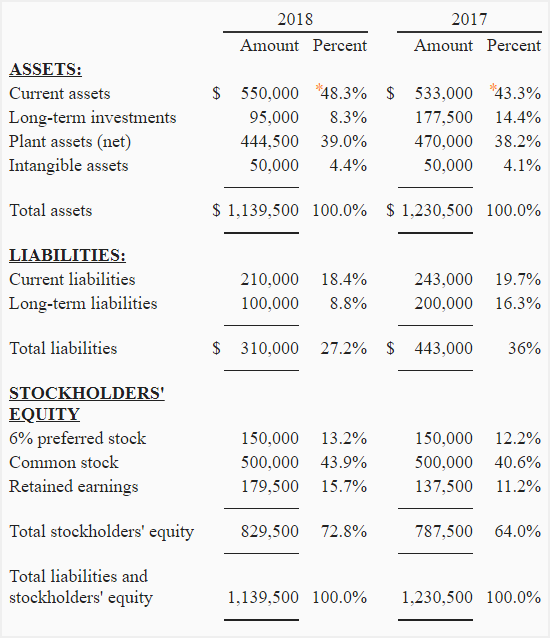

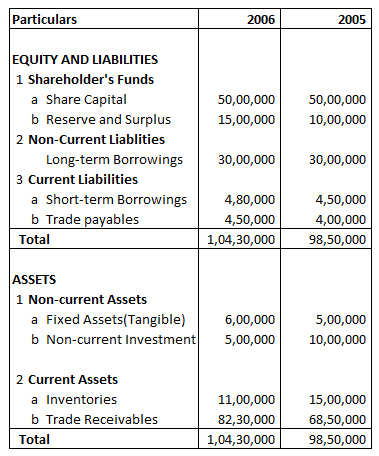

Comparative statement accounting sheet format. What is a Cost Sheet. These are the statements showing the profitability and financial position of a firm for different periods of time in a comparative form to give an idea about the position of two or more periods. A comparative balance sheet is a statement that shows the financial position of an organization over different periods for which comparison is made or required.

Comparative Statement of Profit and Loss is the horizontal analysis of Statement of profit and Loss which shows i the operating results for the compared accounting periods ii changes in data in terms of absolute amount and iii percentage from one period to another. The calculation of dollar changes or percentage changes in the statement items or totals is horizontal analysis. A cost sheet is a statement designed to show the output of a particular accounting period along with its break-up of costs.

In order to analyze the financial statements for a business information is needed from the balance sheets. The financial position is compared with 2 or more periods to depict the trend direction of. Comparative financial statements are the complete set of financial statements that an entity issues revealing information for more than one reporting period.

The financial statements that may be included in this package are. By Sathish ARJul 24 20199 mins to read. Illustration 1 An Accountants Review Report on Comparative Financial Statements Prepared in Accordance With Accounting Principles Generally Accepted in the United States of America When a Review Has Been Performed for Both Periods Circumstances include the following.

Tools or techniques of financial statements analysis. A comparative statement is a document that compares a particular financial statement with prior period statements. Review of a complete set of comparative financial statements.

Assume all items involve cash unless there is information to the contrary. Then create columns for each accounting period with the most current closest to the left. A date-to-date comparison within the company helps a business owner or investor identify financial performance trends over time.