Impressive Unrealised Profit Double Entry

Hs closing inventory EOP contains unrealised profits of 100000 from current period transactions 30 Low has no unrealised profits Sale s.

Unrealised profit double entry. Inventory on which the unrealised profit is accrued. Unrealized GainLoss on Investment debit Interest Income. Profit is only unrealised if it remains within the group.

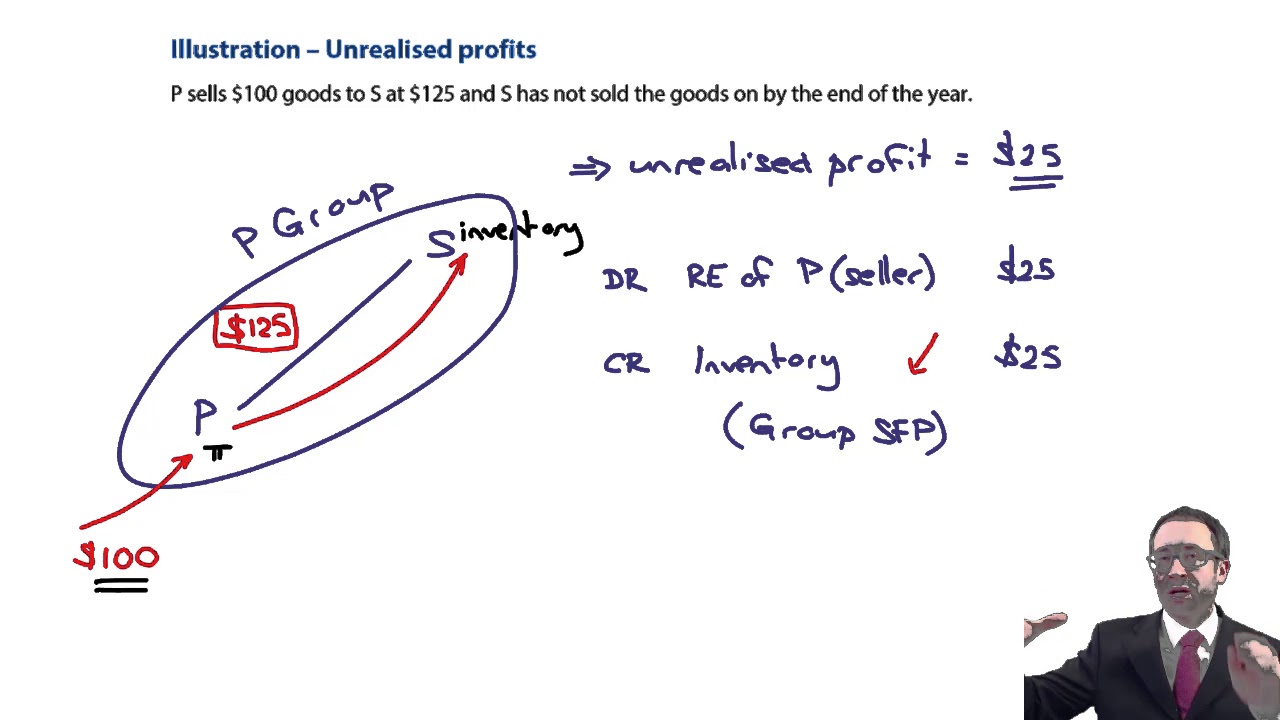

Despite the previous elimination unrealized gross profits created by such sales can still exist in the accounting records at year-end. Next month its 41. Since the asset had a net book value of 3000 the profit on disposal is calculated as follows.

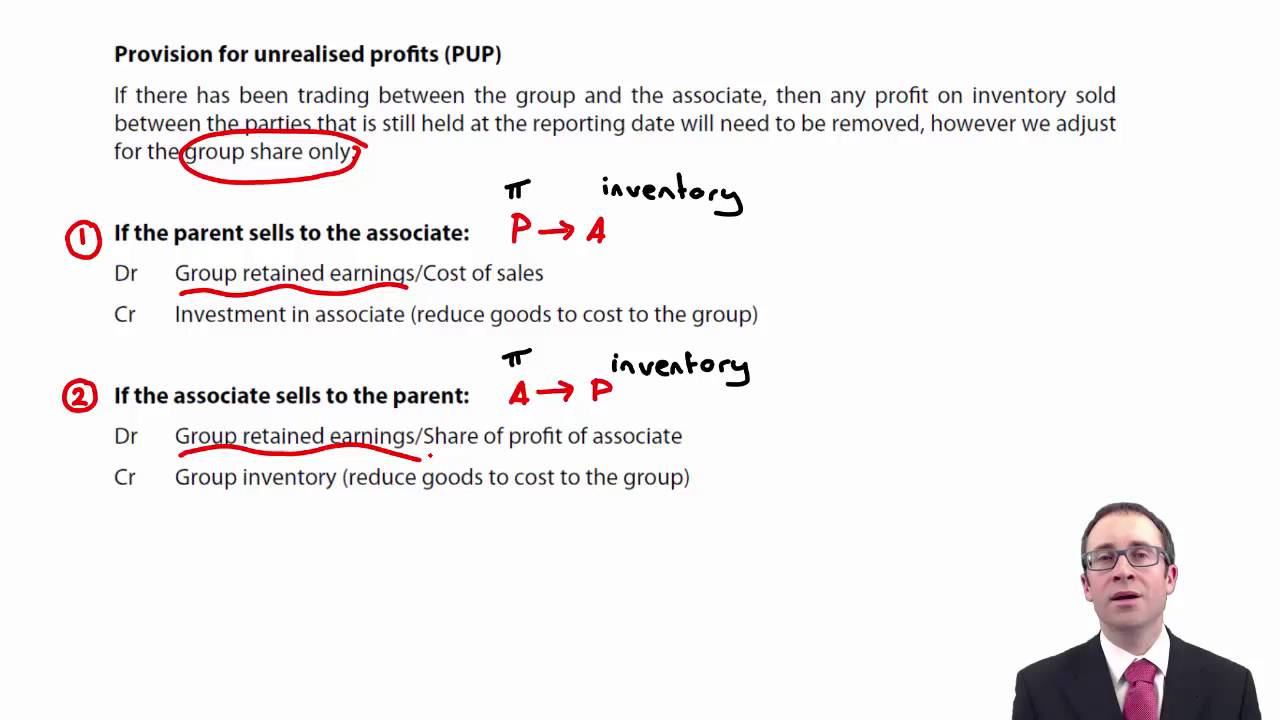

You will have to make other calculations in the consolidated statements as cost of salespurchases etc will change depending on how much of the original. Then when we calculate the groups share of the associates results we are automatically eliminating the groups share of that unrealised profit. Calculate the full unrealised profit and deduct that full amount from the associates results.

An entry is thus required to reverse the unrealized profit and the overstatement in closing inventory. No intercompany receivables payables investments capital revenue cost of sales or profits and losses are recognised in consolidated financial statements until they are realised through a transaction with an unrelated party. Profit margin included in the closing inventory is 650.

Record realized income or losses on the income statement. An unrealized or paper gain or loss is a theoretical profit or deficit that exists on balance resulting from an investment that has not yet been sold for cash. Unrealised profit - more detail.

In the first year this whole amount is written off as an expense taken off the FactoryManufacturing profit figure. Someone owes you 100. The total amount of unrealised profitsloss to be eliminated in intercompany transactions does not vary regardless.