Perfect Disclosure Of Guarantees In Financial Statements

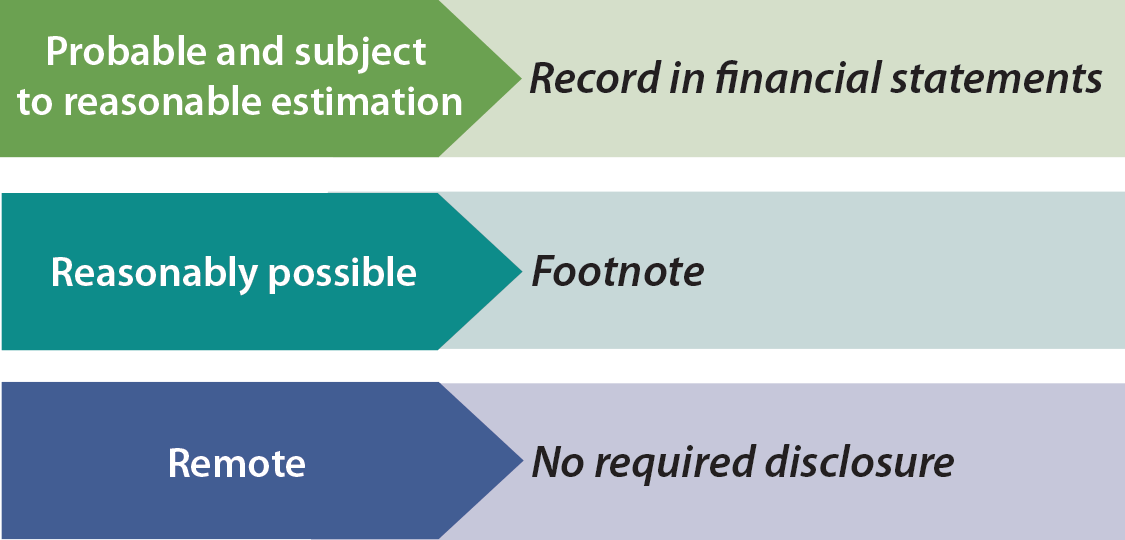

ASC 450 addresses these contingent liabilities.

Disclosure of guarantees in financial statements. 1 the parent guarantees obligations issued by a finance subsidiary. This Interpretation elaborates on the disclosures to be made by a guarantor in its interim and annual financial statements about its obligations under certain guarantees that it has issued. Each guarantor must file separate financial statements in accordance with Regulation S-X unless an exception specified in Rule 3-10b through f is available.

Under the new SEC amendments Rule 3-10 allows more companies to utilize the exemption and provide consolidated financial statements with alternative disclosures that include financial and non-financial information. Proposed Rules 13-01 and 13-02 would contain financial and non-financial disclosure requirements for certain types of securities registered or being registered that while material to investors need not be included in the audited and unaudited financial statements. Disclosures requires an entity to disclose a maturity analysis for non-derivative financial liabilities including issued financial guarantee contracts that shows the remaining contractual maturities.

The liability is subject to estimation you can calculate it It is probable that the liability will be paid. Rule 3-10b permits filing of parent guarantor financial statements without subsidiary financial statements when. A financial guarantee is a specific type of a financial liability defined in IFRS 9.

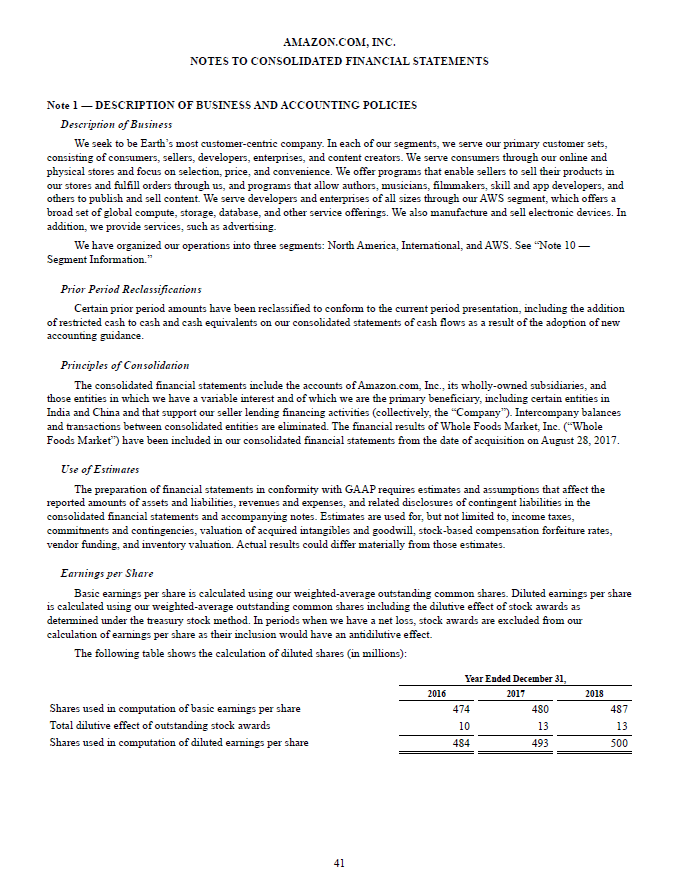

FASB 5 now ASC 450 has been with us for some time. Financial guarantees issued Financial guarantees issued by the Company and those companies within the consolidated entity Group are recognised as financial liabilities at the date the guarantee is issued. Historically financial guarantors disclosed the nature and size of their guarantees in the notes to their financial statements.

The Financial Statements disclose whether details of Guarantees are published in the annual budget presented to the Parliament and State Legislature as the case may be. It also clarifies that a guarantor is required to recognize at the inception of a guarantee a liability for the fair value of the obligation undertaken in issuing the guarantee. AcG-14 and attempt to disclose guarantees based on the guidance in Section 3290 Contingencies.

The objective of IAS 24 is to ensure that an entitys financial statements contain the disclosures necessary to draw attention to the possibility that its financial position and profit or loss may have been affected by the existence of related parties and by transactions. In order that a proper database is maintained for all Guarantees annually sanctioned annulled and outstanding a tracking unit for Guarantees is usually designated in the Ministry or Department of Finance in the respective. Paragraph 39a of MFRS 7 Financial Instruments.

:max_bytes(150000):strip_icc()/liabilities_-_resized-5bfc371146e0fb0051c0a014.jpg)