Supreme Five Types Of Financial Ratios

All the above ratios the higher they are the better the companys performance is when compared with the prior period or with other companies in.

Five types of financial ratios. These three core statements are. When you combine various values and information the merits or lack thereof of the underlying company show clearlyFor example the fact that the share price of an investment is 213 tells you very littleHowever if you know the PriceEarnings ratio is 85 it relays much more context. Financial ratios are created with the use of numerical values taken from financial statements.

If you want to check whether your unit economics are sound then download your free guide here. Three Financial Statements The three financial statements are the income statement the balance sheet and the statement of cash flows. Please perform each of the above five types of analysis using two ratios from each for any publicly traded company that you wish except Pepsico Apple and Kroger.

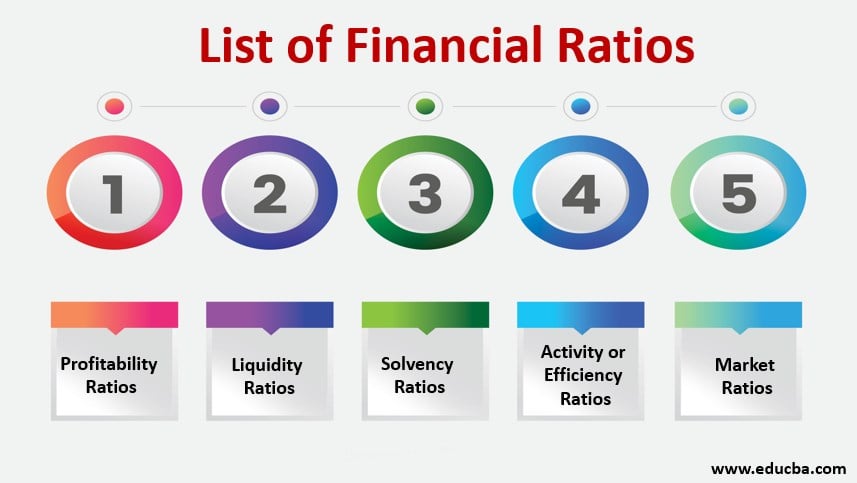

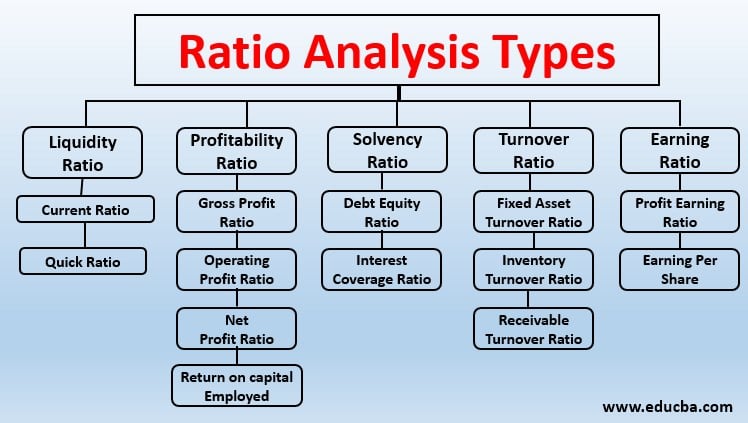

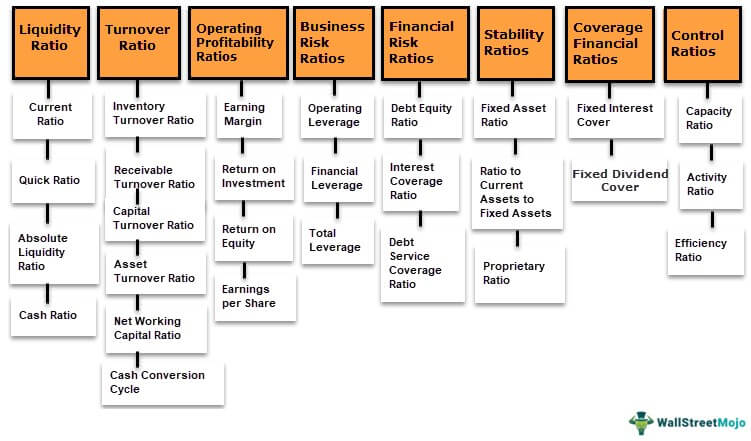

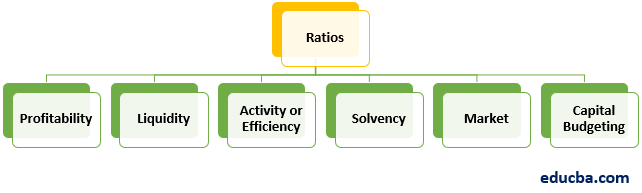

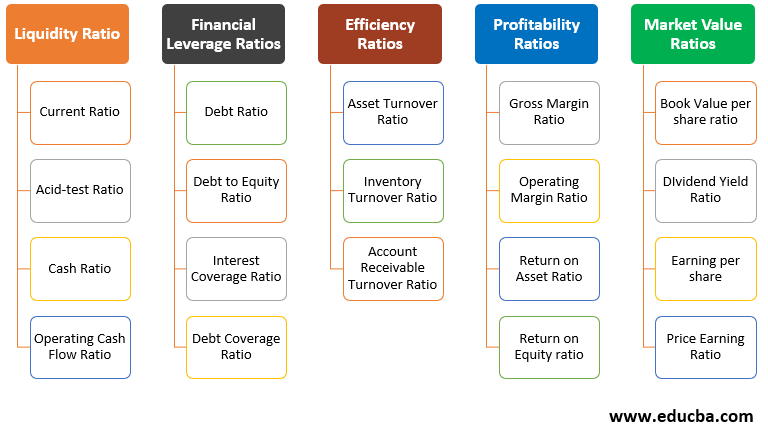

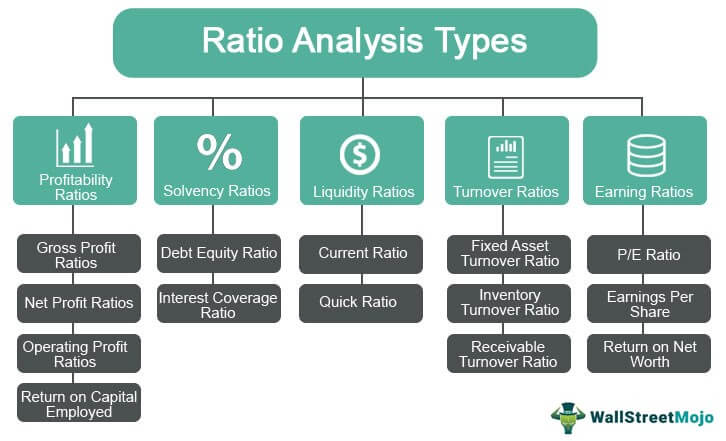

Ratio analysis consists of calculating financial performance using five basic types of ratios. Ratio analysis consists of calculating financial performance using five basic types of ratios. 5 Categories of Financial Ratios.

The financial ratio is not a calculation but an explanation of the economic status of a company in terms of profit liquidity leverage and market valuation. Key Takeaways Fundamental analysis relies on extracting data from corporate financial statements to compute various ratios. Financial ratios are the ratios that are used to analyze the financial statements of the company to evaluate performance where these ratios are applied according to the results required and these ratios are divided into five broad categories which are liquidity ratios leverage financial ratios efficiency ratio profitability ratios and market value ratios.

Perform each of the above five types of analysis using two ratios from each for any publicly traded company that you wish except Pepsico Apple and Kroger. Solvency and liquidity ratios The liquidity or solvency ratios help a firm to focus on its ability to pay off short term debts and similar. Describe the five types of financial ratio analyses.

Please provide and briefly discuss 2 ratios from each of the five types of analysis. By using financial ratios investors can explore various pieces of facts in the financial statement of a company and consists of calculating ratios from the financial statements. Market analysts mainly use it to define various aspects of a business such as liquidity profitability and.