Glory Statement Of Estimated Income Tax Payable

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

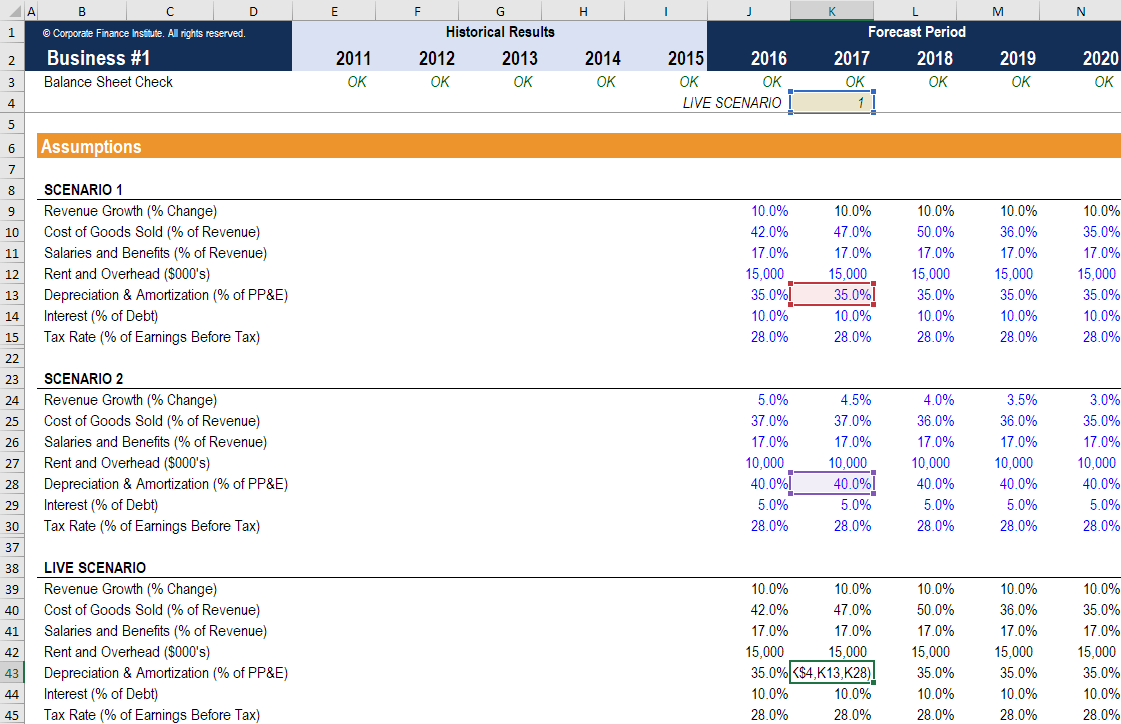

Estimated Chargeable Income before exempt amount 5645 When e-Filing the ECI the company can report its revenue as 80000 and ECI figure as 5645 under the 17 tax rate category.

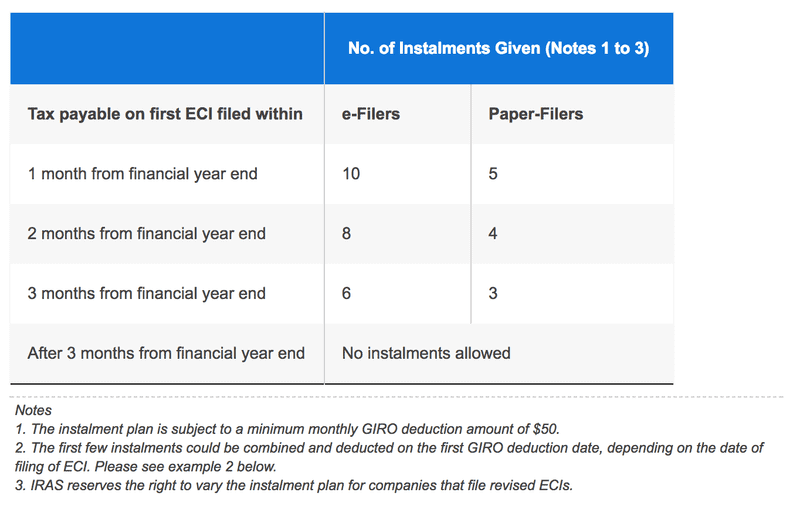

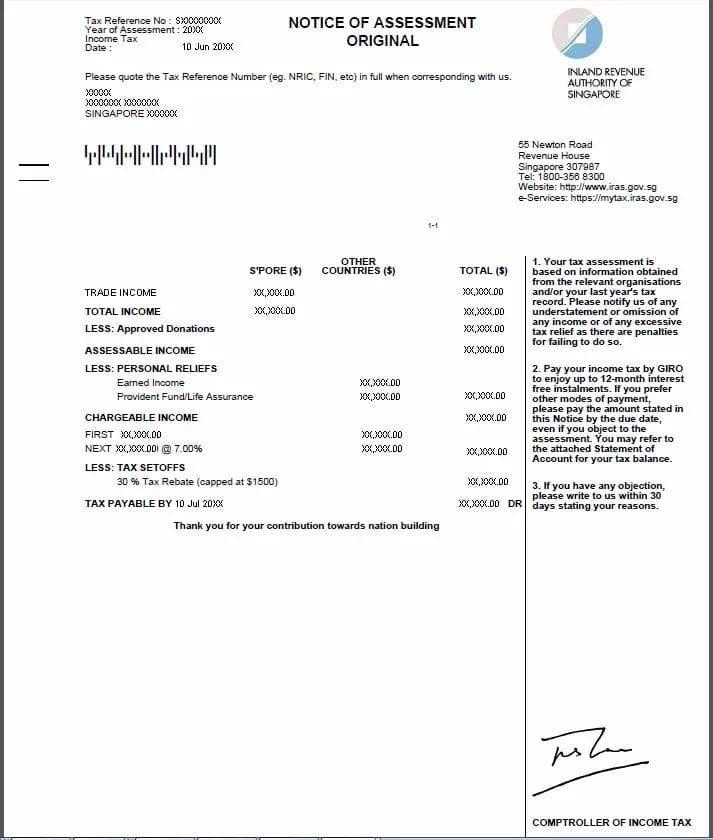

Statement of estimated income tax payable. You may read the set of instructions provided before completing this Statement of Estimated Tax Payable. Difference between the estimate submitted and final tax payable When the tax payable for a particular year of assessment exceeds the original or the revised estimate if a revision is submitted by an amount exceeding 30 of the tax payable the difference will be subject to a penalty of 10. Statement of estimaterevised estimate of tax payable by instalment made on behalf of an entity.

20190401 - 20191231 09 Months 20200101 - 20200331 03 Months 900000. How to Account for Income Taxes. 2012 - 7500 2013 - 2500.

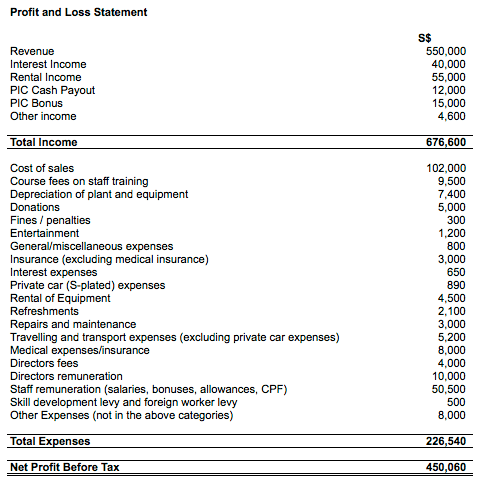

Statement of Estimated Income Tax Payable SET Form will be issued by the Commissioner General to the persons who have been registered for the payment of income tax and also can be downloaded through the web-site of the Department of Inland Revenue or could be obtained from the Tax Payer Services Unit at the IRD Head office or from any Regional Office. The statement of estimated tax payable shall be submitted to TRA office either of the following dates depending on your accounting period. The essential accounting for income taxes is to recognize tax liabilities for estimated income taxes payable and determine the tax expense for the current period.

Posted on May 17 2020 by ADMIN. This is to maintain parity between the tax rates of non-resident individuals and the top marginal tax rate of resident individuals. CALCULATION OF ETIMATED INCOME TAX PAYABLE FOR INDIVIDUALS.

Taxes payable a liability account is a balance sheet item not an income statement component. Before delving further into the income taxes topic we must clarify several concepts that are essential to understanding the related income tax accounting. Further details can be obtained via IRD web portal - wwwirdgovlk.

The enacted tax rates are 21 for 20X1 and 20X2. Taxes on Directors fee Consultation fees and All Other Income. In a Statement of Estimated Income Tax Payable SET you basically estimate the total amount of tax youll have to pay for the next financial year 20202021.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)