Unbelievable Ifrs 16 Balance Sheet Presentation

Below we present the entry recorded as of 112021 for our example.

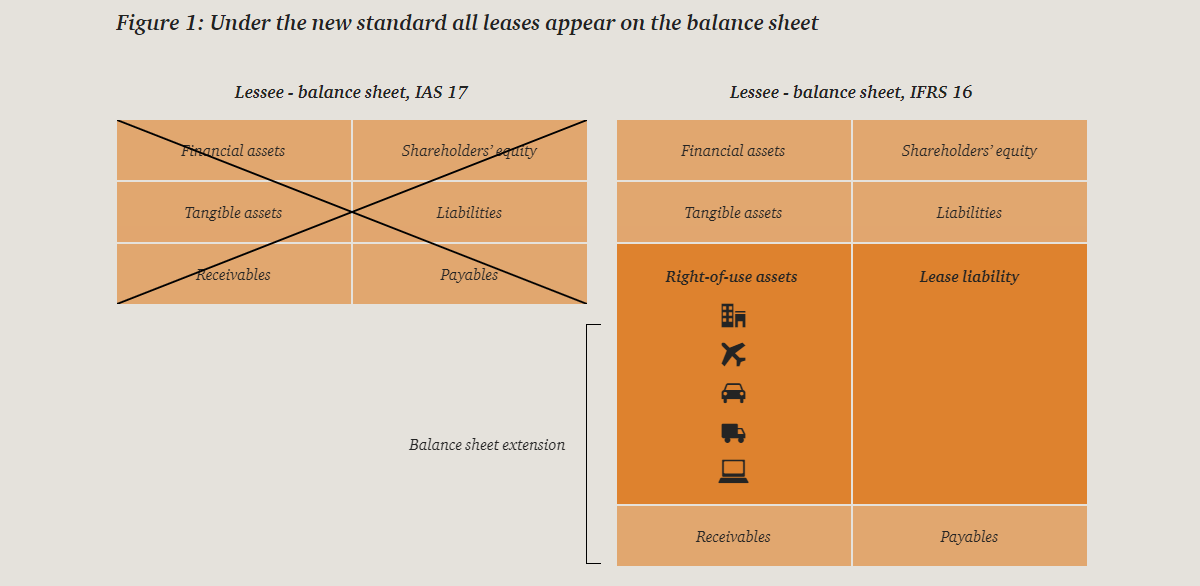

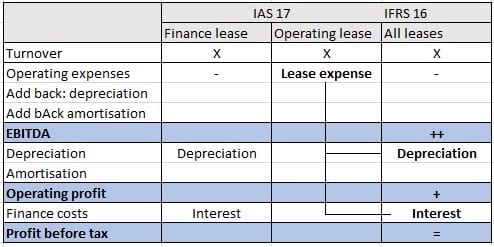

Ifrs 16 balance sheet presentation. The initial journal entry under IFRS 16 records the asset and liability on the balance sheet as of the lease commencement date. IFRS 16 is effective from 1 January 2019. The IASBs new leases standard requires companies to bring most leases on-balance sheet recognising new assets and liabilities.

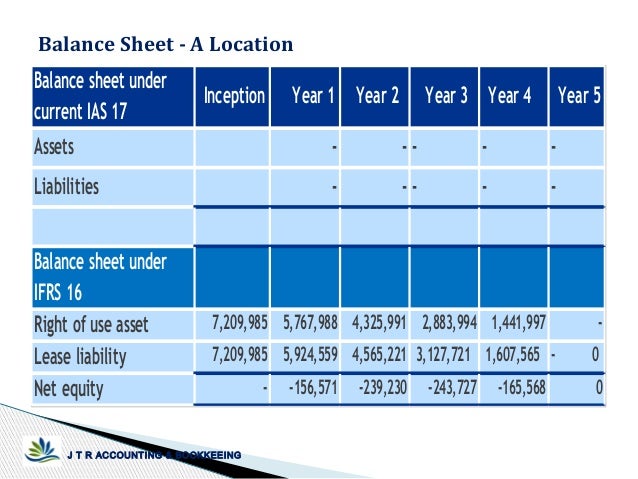

At first the new standard will affect balance sheet and balance sheet-related ratios such as the debtequity ratio. Different and IFRS 16 can be expected to have a significant impact particularly for entities that have previously kept a large proportion of their financing off-balance sheet in the form of operating leases. Lease debt of 45bn non-current liability of 35bn and currently liability of 1bn.

December 2019 Presentation and disclosure requirements of IFRS 16 Leases 2 1. Balance sheet as a receivable and assets subject to operating leases continue to be presented according to the nature of the underlying asset. Balance sheet as at 25August 2018 09bn one-off adjustment to working capital 78bn1 right of use asset net of impairment Lease liability brought on balance sheet Onerous lease provisions replaced by impairment on the asset Right of use asset brought on balance sheet We have paid more tax to date than we would have done under IFRS 16.

Indicative impact of IFRS 16 on balance sheet previously shared in March. All companies that lease. Balance sheet presentation separately as an asset Depreciated over the life of the lease Depreciation carried in profit and loss Reassessed for impairment.

Overview The International Accounting Standards Board IASB issued IFRS 16 Leases which requires lessees to recognise assets and liabilities for most leases. IFRS 16 sets out the principles for the recognition measurement presentation and disclosure of leases for both parties to a contract namely the customer lessee and the supplier lessor. Global Accounting Advisory Insights into IFRS 16 Presentation and disclosure.

IFRS 16 adjustments rounded to the nearest 100m 1 Includes goodwill other intangible assets property plant and equipment investment property and investments in joint ventures and associates 2 Net debt under IFRS 16 comprises lease liabilities and financial. IFRS 16 Example Disclosures How early adopters disclosed IFRS 16 in the 2018 Financial Statements. The products are sold through 25 own-brand stores.