Out Of This World Impairment Loss On Receivables

Accounting thus becomes more of a.

Impairment loss on receivables. ABCs policy is to give 30 days for the repayment of receivables. Allowance Methodrequires the use of valuation account for the receivables. AASB 9 introduces a new impairment model based on expected credit losses.

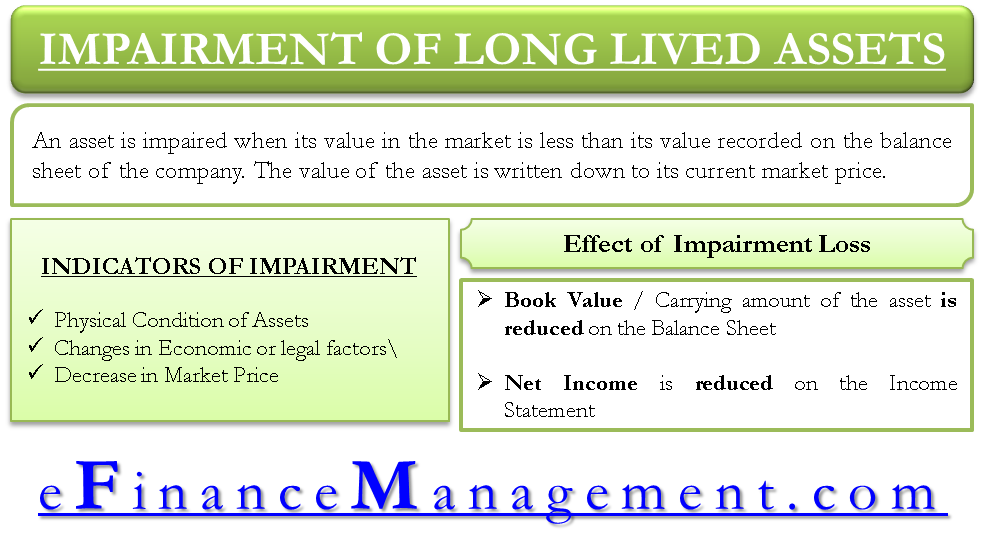

Impairment Loss on Trade Debts Impairment losses or losses on debts incurred on financial assets are tax-deductible as long as the debts are relating to the trade or business and are revenue in nature. Impairment of accounts receivable is the result of the loss of value of the amounts that an entity has pending to claim from its customers for the goods or services delivered. Receivables from goods and services what an implementation could look like and which aspects could be automated.

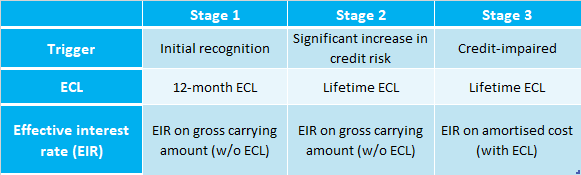

Three approaches to impairment Overview of the three approaches to impairment. The methodology of determining impairment losses on trade receivables is presented on the example of Polish Telecommunication Group. Impairment Loss on Trade Debts under Financial Reporting Standard FRS 39.

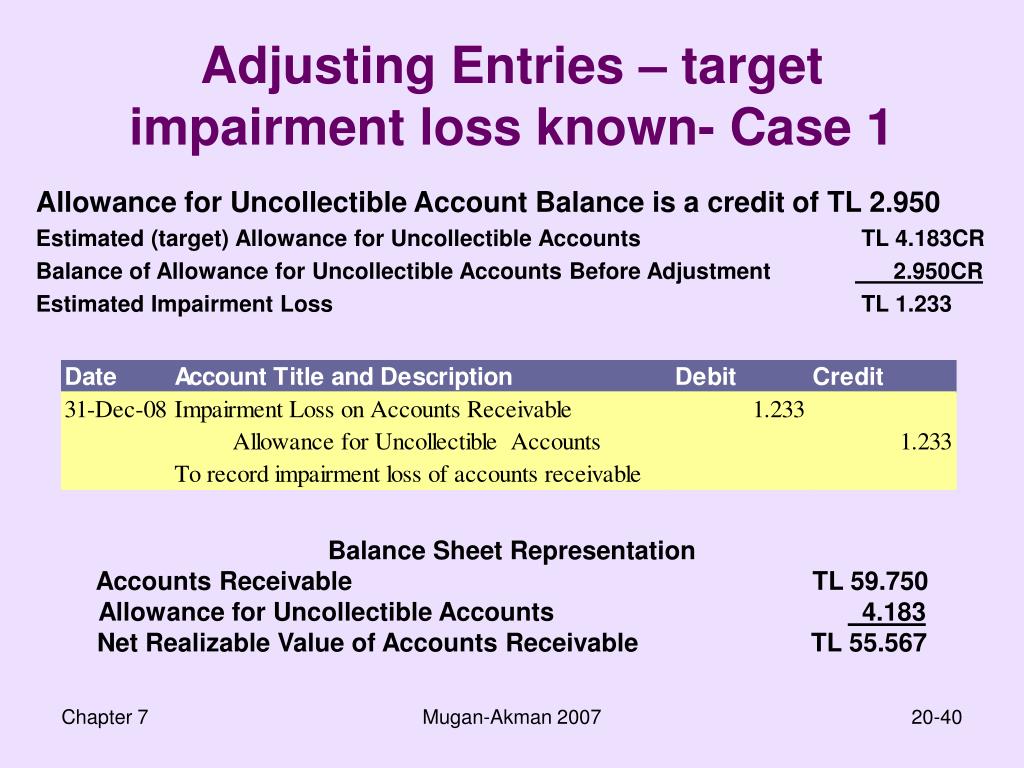

To ensure that sufficient allowance is made for the impairment of receivables in the financial statements. This is different from AASB 139 Financial Instruments. Impairment losses on receivables are charged to other operating expenses or financial expenses debit entry - depending on the type of claims covered by the allowance.

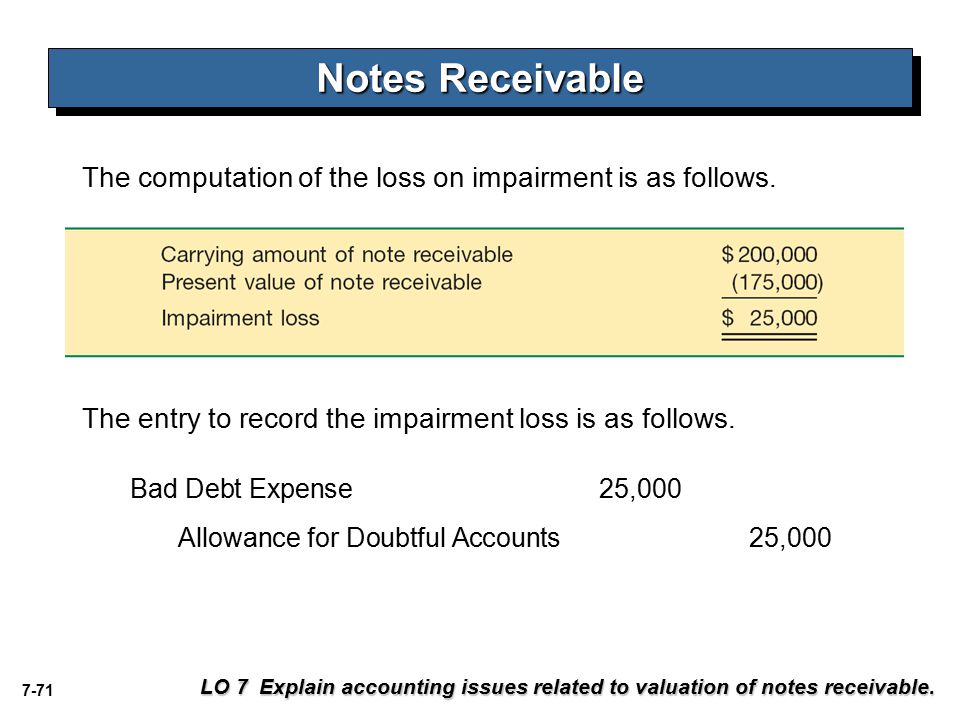

The basic guidance for recognition of impairment losses for all receivables is addressed in ASC 450-20 except for those receivables that are deemed impaired and individually assessed following ASC 310-10-35 guidance and those receivables which have been specifically addressed by other accounting literature such as debt securities certain leases troubled debt restructurings and acquired impaired. This is an important point 30 days credit period means that these receivables have NO significant financing component and therefore you dont have to worry about the present values. To set out a methodology for the impairment of receivables in line with the applicable accounting standards.

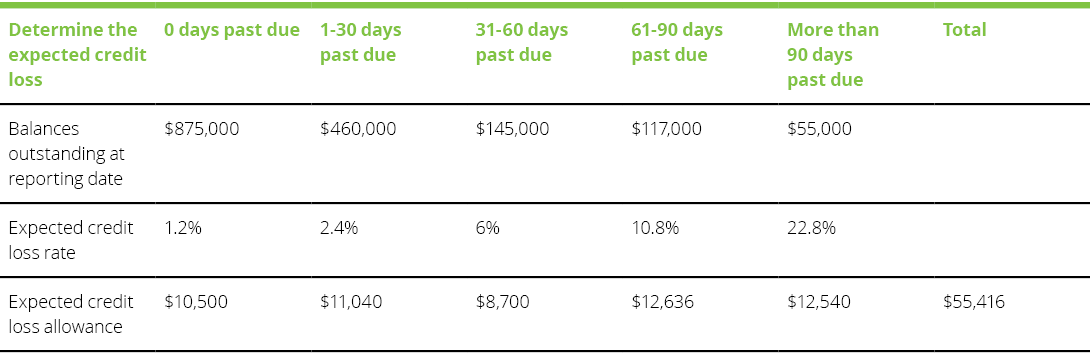

ABC wants to calculate the impairment loss of its trade receivables as of 31 December 20X1. Impairment losses are reversed in subsequent periods and recognised in the income statement when an increase in the receivables recoverable amount can be related objectively to an event occurring after the impairment was recognised subject to the restriction that the carrying amount of the receivables. The annual consolidated financial statement for the year 2011 served as a source of information.

:max_bytes(150000):strip_icc()/Boeing_Customer_financing-dd3b8773bd8d4654b734575f23d51d62.png)