Peerless Accounting Treatment For Provision For Bad Debts

But in this case all assume according to past records of the business.

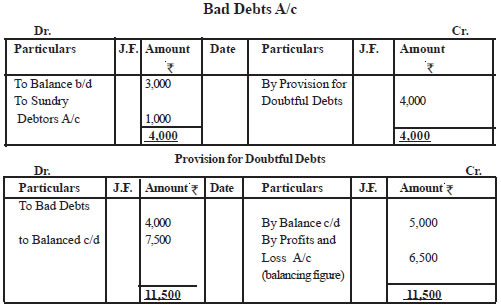

Accounting treatment for provision for bad debts. The effects of provision for doubtful debts in financial statements may be summed up as follows. To reduce a provision which is a credit we enter a debit. - MrX debtor of balance receivable is Rs10000- was become bankruptcy because of huge fire accident in his factorythe amount receivable is treated as bad debt.

Extract of PL to show the Provision. Accounting Treatment For The Increase Or Decrease Of Provision For Doubtful Debts. Debtors in the balance sheet.

See the example below. Assuming earlier in Quarter 1 we have created a provision for doubtful debts of 100000. As provision for bad debts is the future loss which will be recorded.

Xxxxx To Sundry Debtors Account xxxxxx Entry for transferring bad debts to provision for bad debts Account 2. Accounting Treatment for Provisions in Financial Statements. This is recorded as bad debt recoveryHowever if the amount recovered is less than the original bad debt amount the receivable account should not be re-instated for the remaining balance.

Sayat end of Quarter 2 we have reviewed our trade debtors and wanting to increase the provision. Doubtful debts cannot be specified with a surety. Example 50 of our clients are government sector do we really need to take bad debts provision for those customer while calculating bad debts provision for our business case.

Bad debts are basically the debtors which confirm to be irrecoverable. Only change increase or decrease in provision for doubtful is shown in the income statement. In other words collection.