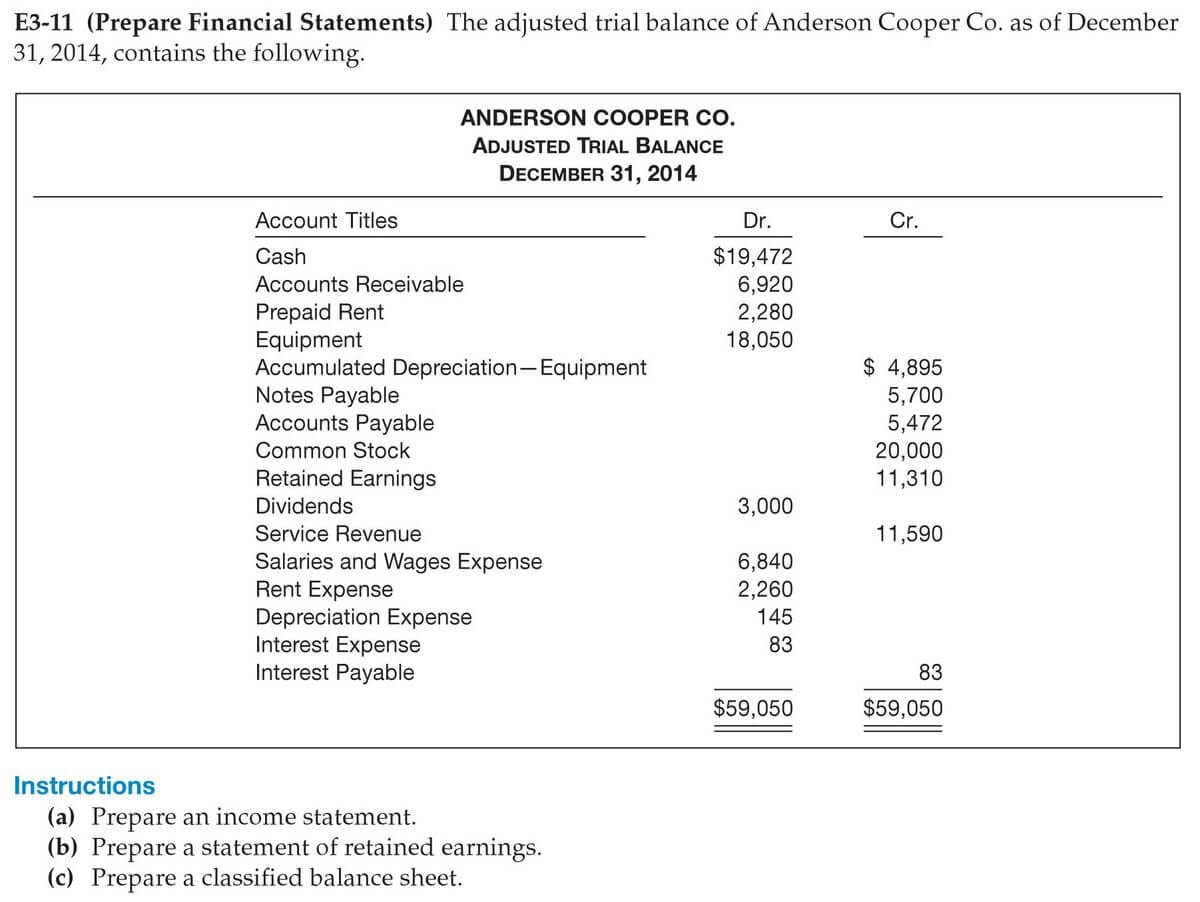

Ideal Interest Receivable On Balance Sheet

Therefore when payment is made on a note receivable both the balance sheet and the income statement are affected.

Interest receivable on balance sheet. Interest receivable definition The current asset that represents the amount of interest revenue that was reported as earned but has not yet been received. Assets Note 2. You would include the interest for December 29 30 and 31st as an accrued liability.

Accrued interest receivable increases the current asset account on a companys balance sheet while interest revenue increases net income. Accounting for Interest Receivable The accounting treatment of interest receivable may vary as shown in the following two examples. The interest income on notes receivable is recognized on the income statement.

A note receivable is an amount of money a customer or other party owes your company. Separate accounts may be maintained on the basis of tax roll year delinquent taxes or both. The account is shown on the balance sheet as a deduction from the Taxes Receivable account to arrive at the net taxes receivable.

Government E F E. Accrued revenues are noncash transactions meaning the company must deduct these amounts from net income to calculate net cash flow. Borrowers list accrued interest as an expense on the income statement and a current liability on the balance sheet.

Key Components of Notes Receivable Here are. Interest receivable is an amount that has been earned by the person but the same has not been received yet. Interest revenue is calculated and recorded separately of interest receivable.

Because its accrued and not yet paid it can be a payable if youre the borrower or receivable if youre the lender. The amount of interest you earn on the notes receivable in an accounting period but have yet to be paid is called interest receivable. A note generally creates interest income even though the interest has yet.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)