Neat Common Size And Index Analysis

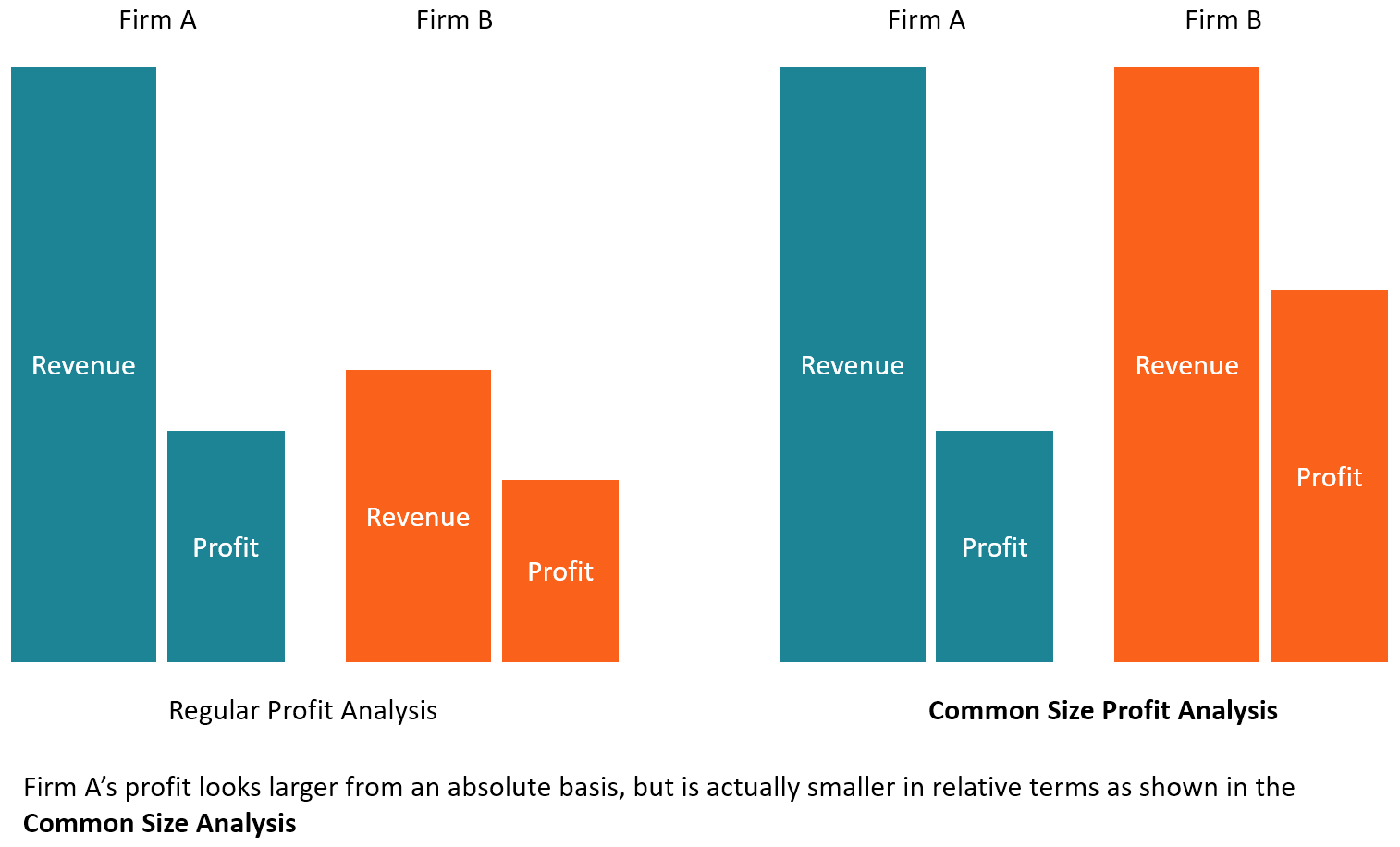

A common size financial statement displays entries as a percentage of a common base figure rather than as absolute numerical figures.

Common size and index analysis. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Income from other sources has initiated this year. Common size statements let analysts compare companies of.

It is because of inflation or inadequate use of resources. This common size analysis template allows you to compare the financial performance of companies in different sizes on the same scale. For example heres the 3 months ended 2018 and 2017 income statement of ShotSpotter.

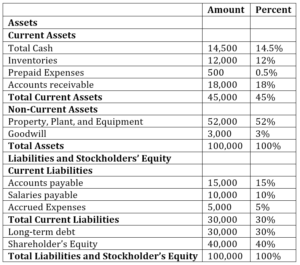

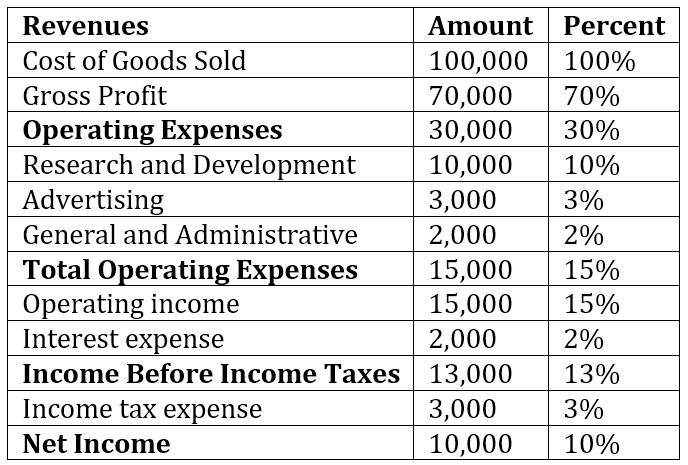

Common Size Income Statement. Is usually the total sales or total revenues. Common size analysis is used to calculate net profit margin as well as gross and operating margins.

The key benefit of a common size analysis is it allows for a vertical analysis by line item over a single time period such as a quarterly or annual period and also from a horizontal perspective. Now lets look at a few items in common size. The ratios tell investors and finance managers how the company is doing in terms of revenues and they can make predictions of future revenues.

PBDIT has decreased by 3 because of increase in material cost. It evaluates financial statements by expressing each line. ANALYSIS OF RATIO COMMON SIZE AND INDEX FIN 745 Company Comparison.

Common size analysis also referred as vertical analysis is a tool that financial managers use to analyze financial statements. COMMON SIZE AND INDEX ANALYSIS Method used by interested parties such as investors creditors and management to evaluate the past current and projected conditions and performance of the firm. Common size simply is when you take each line on the income statement and divide it by the revenue in the same period.