Smart Loss Contingency Journal Entry

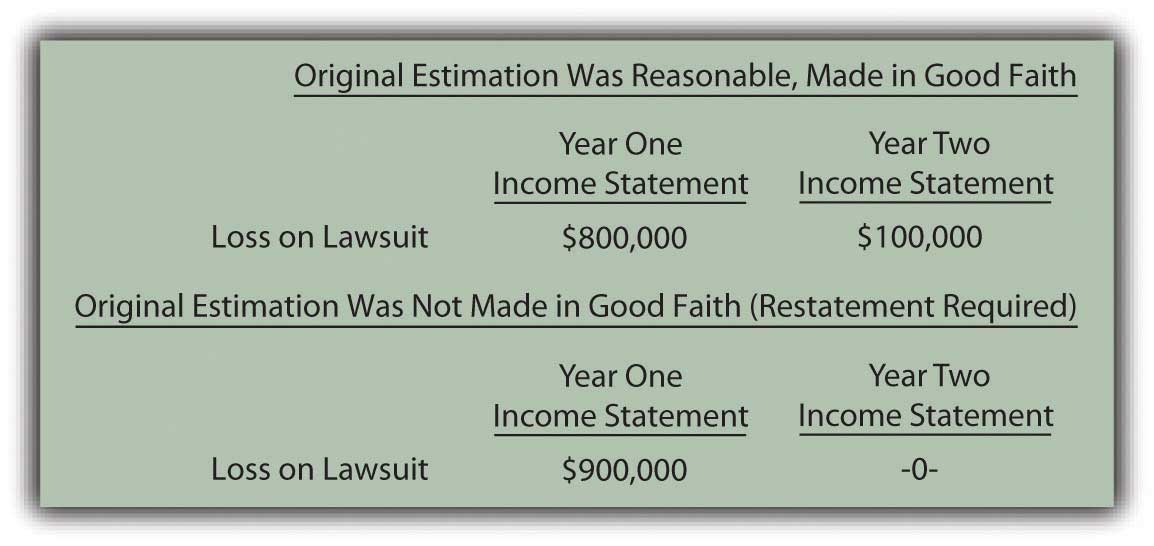

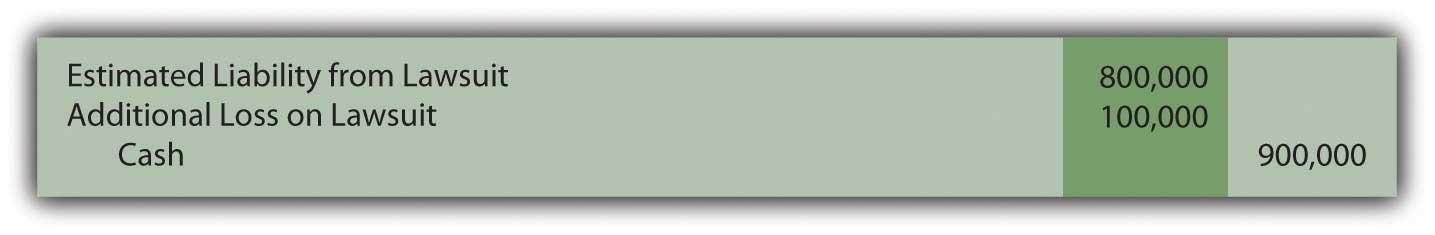

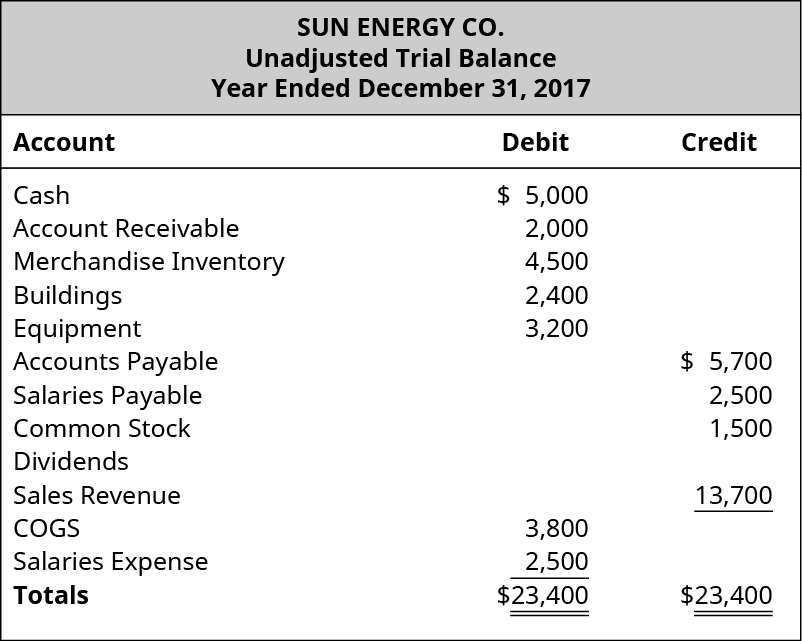

Assuming that the loss contingency is probable and can be reasonably estimated then a journal entry should be recorded to accrue the liability.

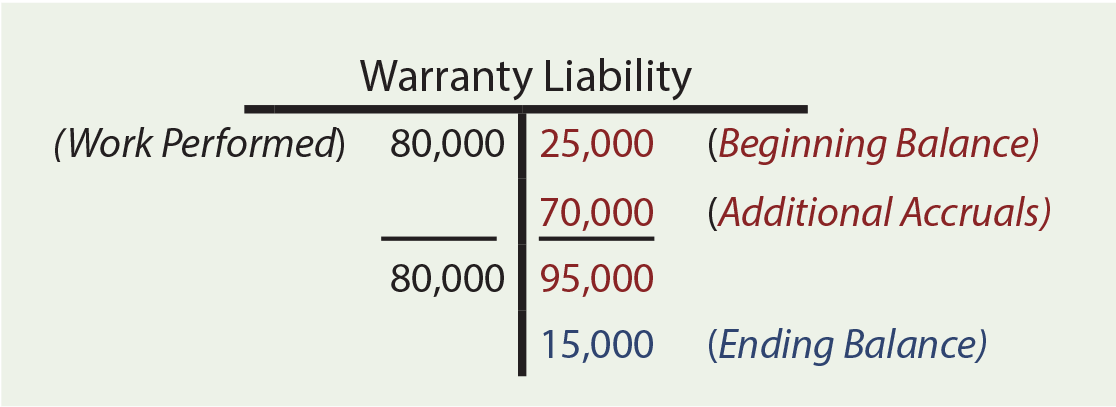

Loss contingency journal entry. Requirements for loss contingencies in response to concerns raised by investors and users of financial reporting that disclosures about loss contingencies under the existing guidance in ASC 450 did not provide adequate and timely information to assist them in assessing the likelihood timing and amount. Gross Amount due from Customer -500000 Loss 1500000 Cost Incurred 900000 Amount Billed 100000. This leads to the result of an increase of.

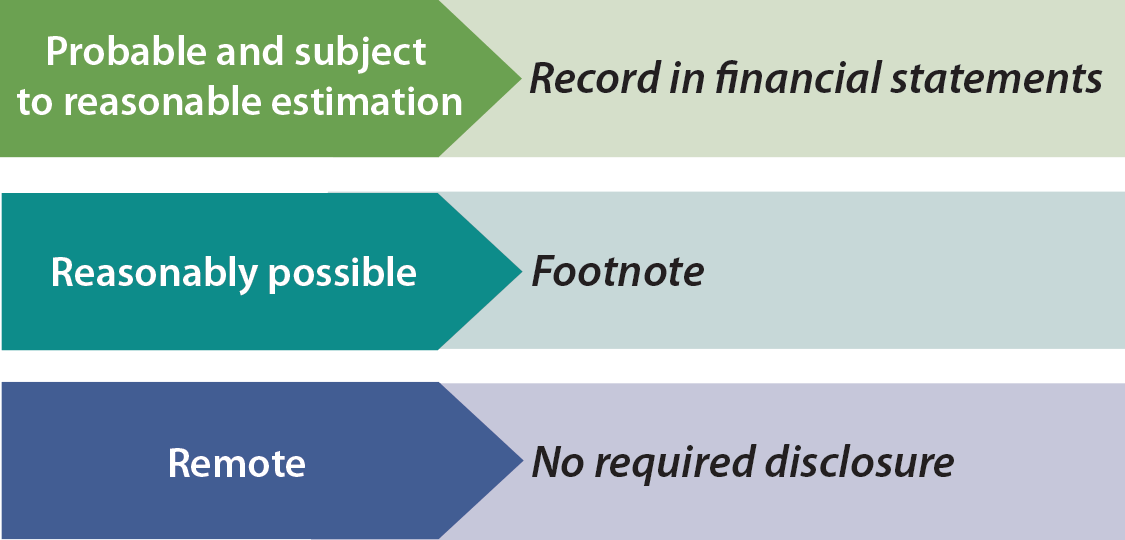

Due to conservative accounting principles loss contingencies are reported on the balance sheet and footnotes on the financial statements if they are. Probable means likely to occur and is often assessed as an 80 likelihood by practitioners. Examples of contingent loss situations are.

Contingent Liability is the potential loss the occurrence of which is dependent on some unfavorable event and when such liability is likely and can be reasonably estimated it is recorded as loss or expense in the statement of income. What is the journal entry to record a contingent liability. Step 4 Prepare Extracts of Financial Statements in respect of Construction Contracts.

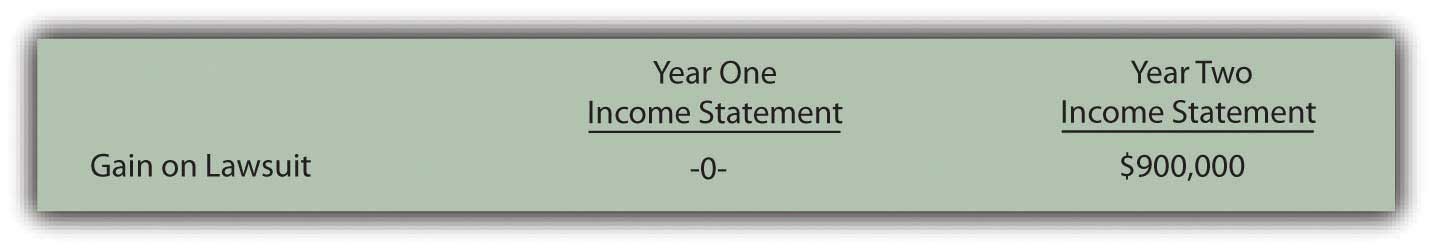

A loss contingency is incurred by the entity based on the outcome of a future event such as litigation. GAAP the recognition of a loss contingency is required if the following are true. The amount of loss can be reasonably estimated.

When both of these criteria are met the expected impact of the loss contingency is recorded. A loss contingency that is probable or possible but the amount cannot be estimated means the amount cannot be recorded in the companys accounts or reported as liability on the balance sheet. The amount of that loss can be reasonably estimated.

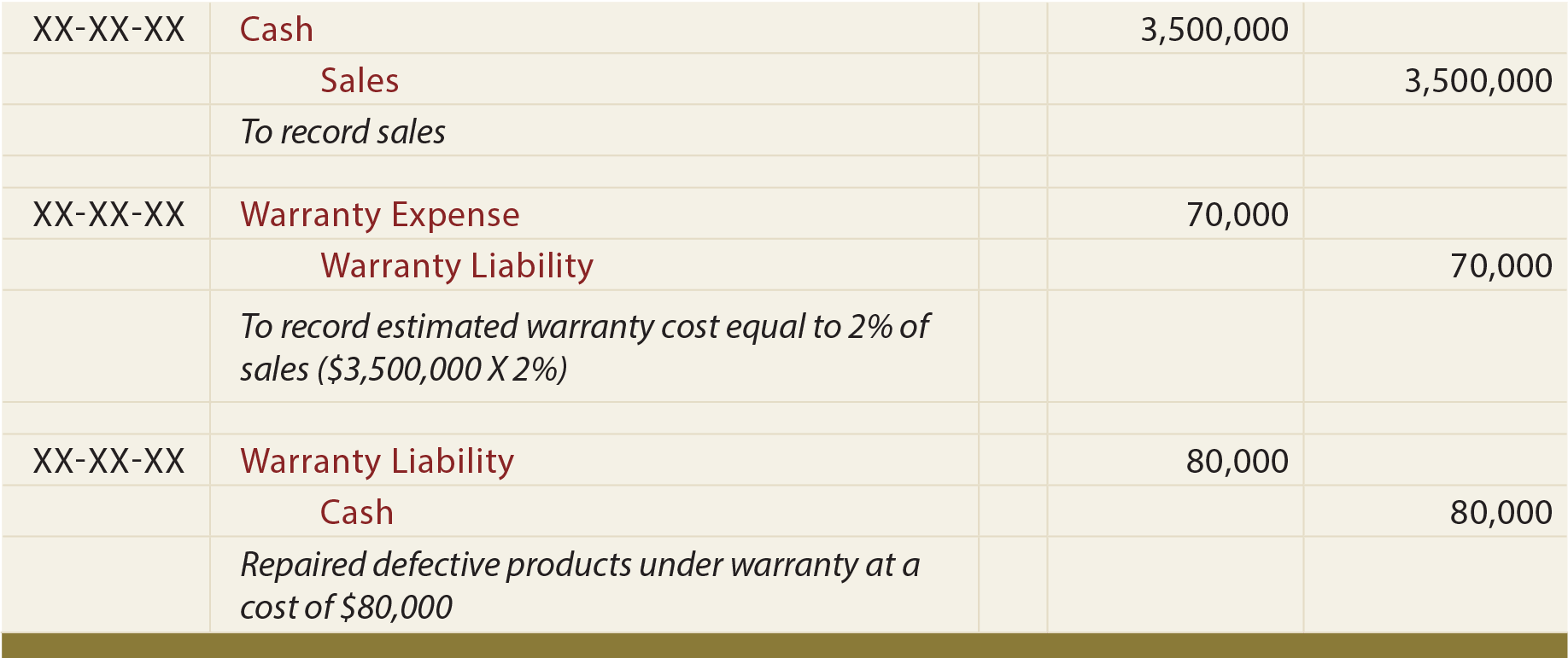

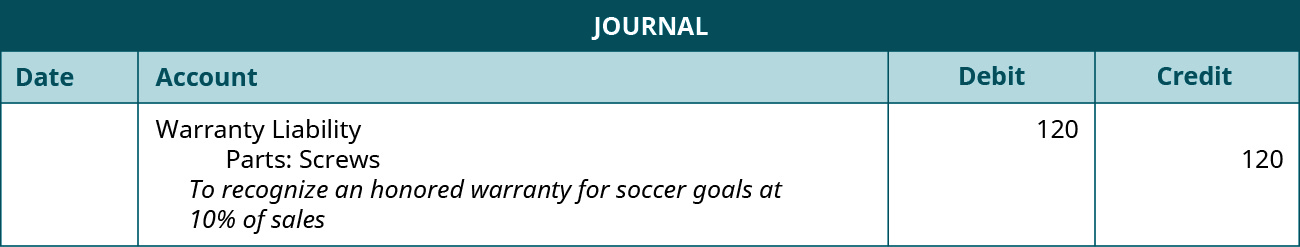

Journal entry to record the collection of accounts receivable previously written-off. Notice how similar the journal entries are for liabilities and loss contingencies. A contingency arises when there is a situation for which the outcome is uncertain and which should be resolved in the future possibly creating a loss.