Ace Structural Liquidity Statement

The Statement of Structural Liquidity may however be reported to RBI once a month as on the third Wednesday of every month.

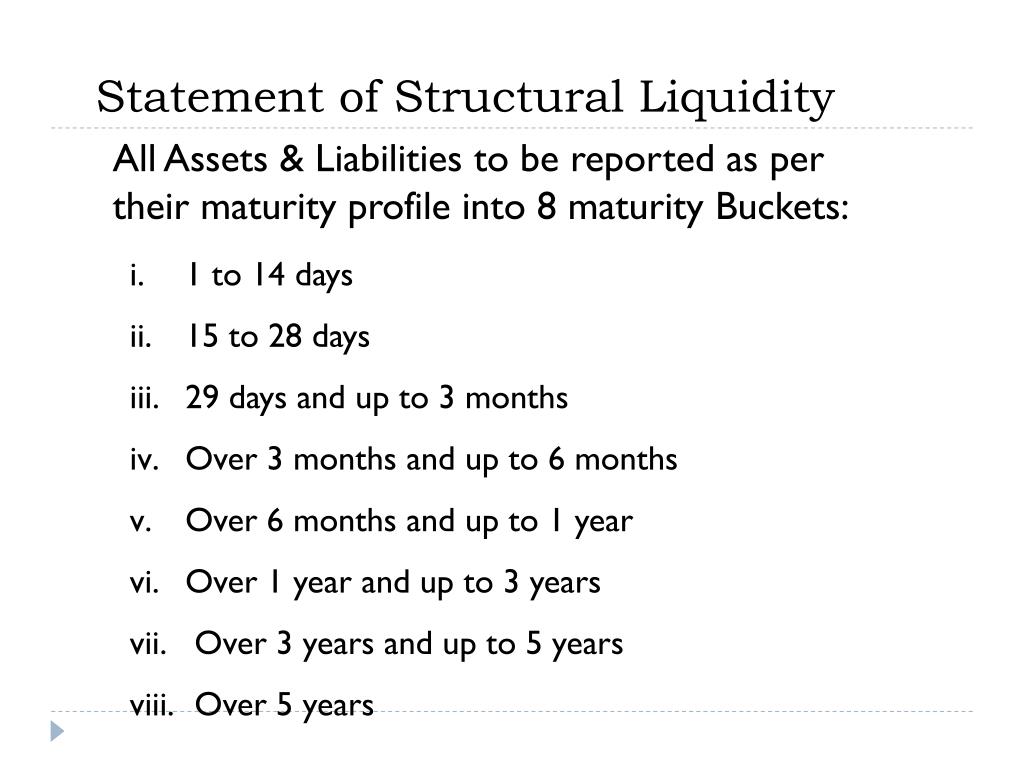

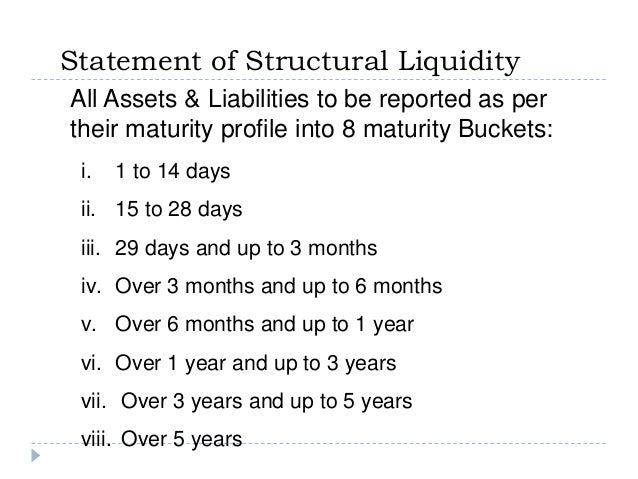

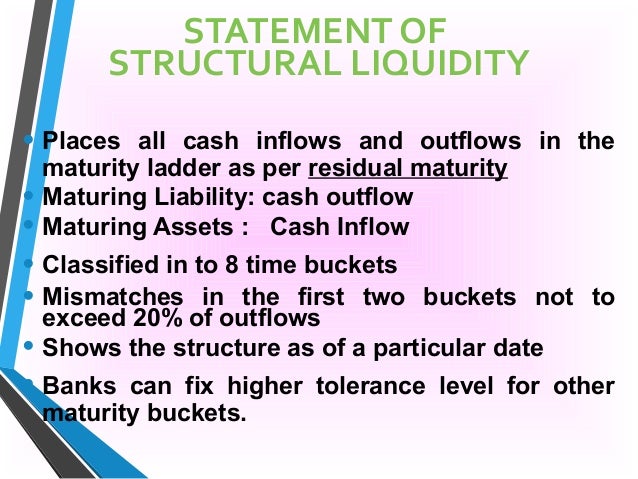

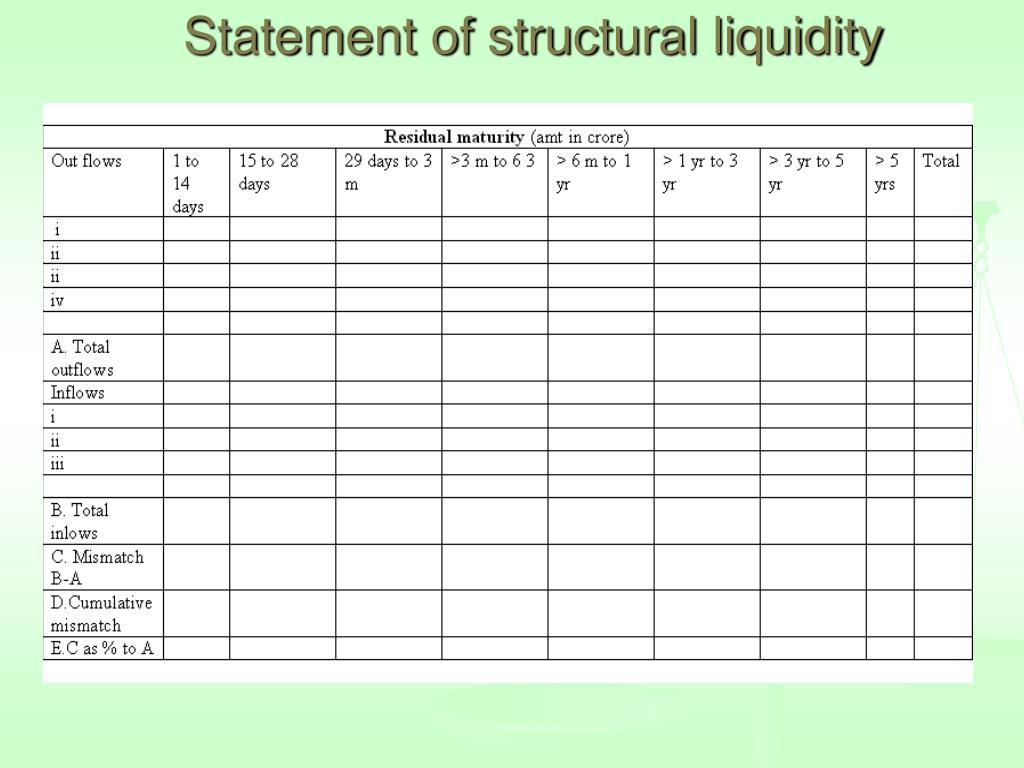

Structural liquidity statement. Time buckets considered are between 1 day and 5 years. The metric helps determine if a company can use its current or liquid assets to cover its current liabilities Current Liabilities Current liabilities are financial obligations of a business entity that are due and payable within a year. - On the 1st row you have the liquidity inflows received over 5 years per bucket.

However transactions undertaken by the government which has an account at Norges Bank can influence structural liquidity. It is prepared based on. Out of all ratio analysis is the most prominent.

D banks may undertake dynamic liquidity management and should prepare the Statement of Structural Liquidity on daily basis. The PL statement shows a companys ability to generate sales manage expenses and create profits. Statement of Structural Liquidity Live 18 DBS STDL Short Term Dynamic Liquidity Live 19 DBS.

Further the guidance for slotting the future cash flows of banks in the various time buckets of the structural liquidity statement is furnished in Appendix IVA thereto. Contingent liquidity risk is the risk associated with finding additional funds or replacing maturing liabilities under potential future stressed market conditions. With this video we show how to prepare SLS using co.

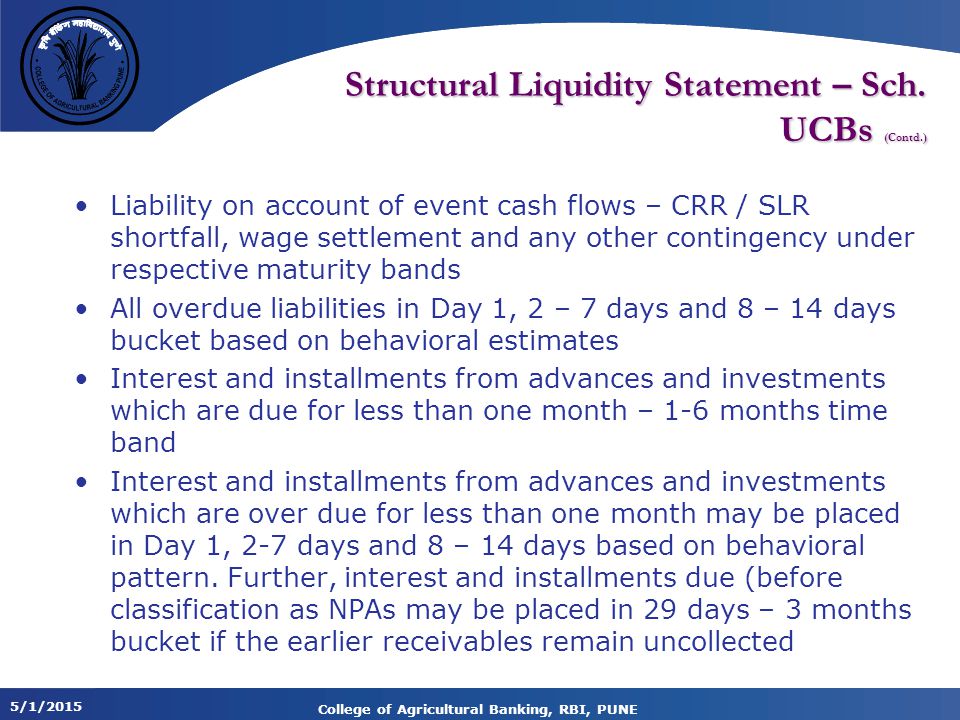

Banks are now required to submit the statement of structural liquidity as on the first and third Wednesday of every month to the Reserve Bank. While slotting the various items of assets and liabilities in structural liquidity statement banks may refer to the guidance for slotting the cash flows in respect of structural liquidity statement rupee which is furnished as Appendix IVA. Structural Liquidity Statements and Cash flow bucketing is the core of modelling liquidity risk in banks.

The format of Statement of Structural Liquidity has been revised suitably and is furnished at Annex I. The format of Statement of Structural Liquidity has been revised suitably and is furnished at Annex I. Based on residual maturity of assets and liabilities.