Best Fair Value Adjustment Balance Sheet

Fair value is defined as whatever price a buyer and seller agree on if.

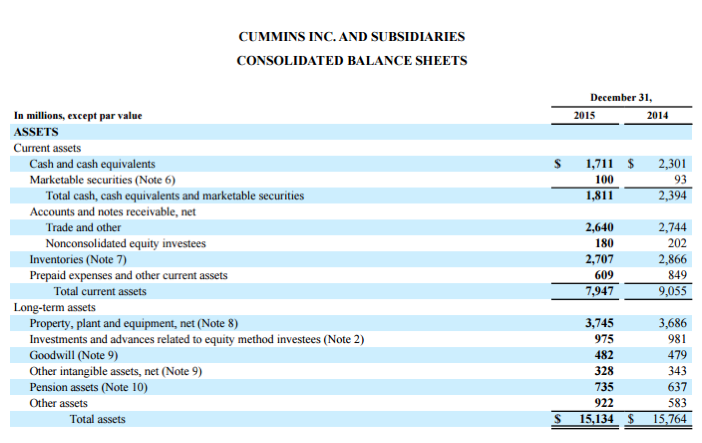

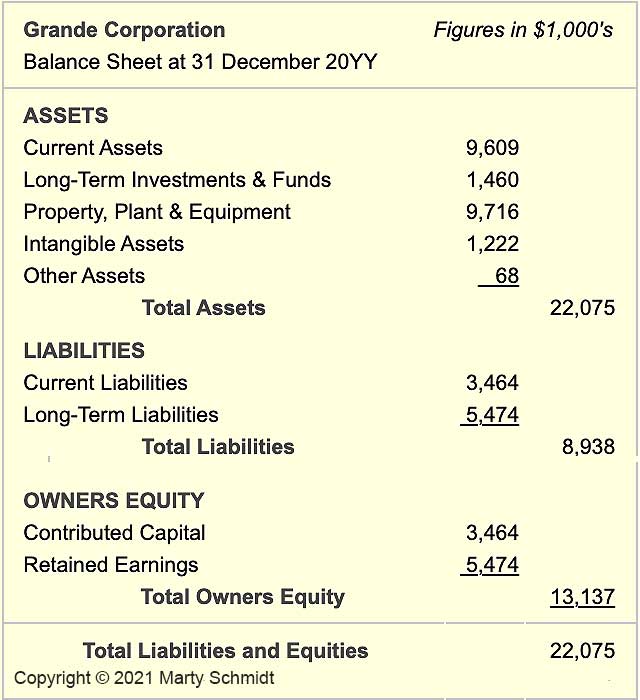

Fair value adjustment balance sheet. But they may also be markedly different. Adjustments include those related to investments inventory property plant and equipment. The process of determining the fair value of the deferred revenues can result in a significant downward adjustment ie.

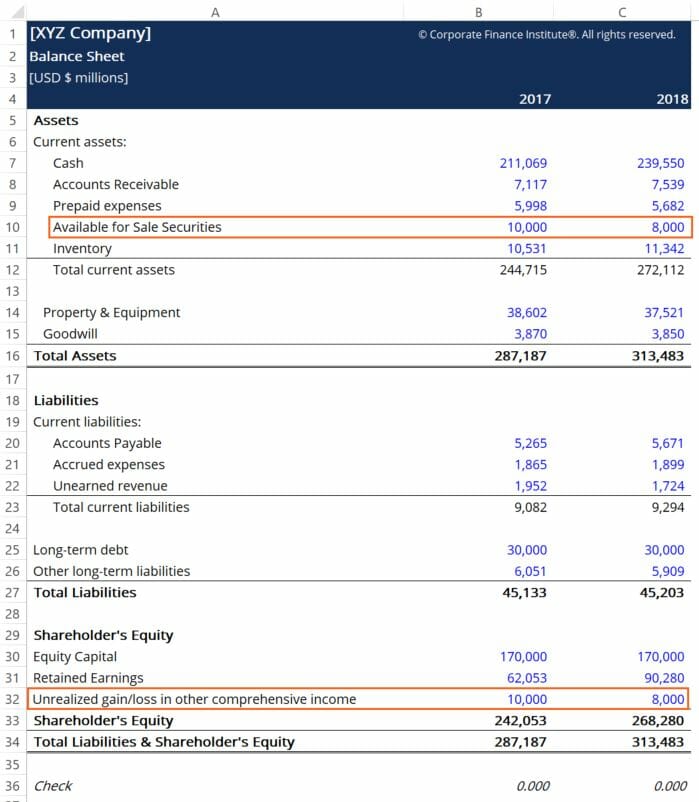

Fair value measurement is not a static discipline and markets are demonstrating increasing interconnectedness and are inherently unstable. The unrealized loss of 12000 is a reduction in equity. A balance sheet account where the fair value adjustment for investments is reported.

Even in a well functioning market there will be a divergence between intrinsic and market value of both assets and equity. The fair value of inventory is generally measured as net realizable value or the. The revaluation of assets of S were subject to.

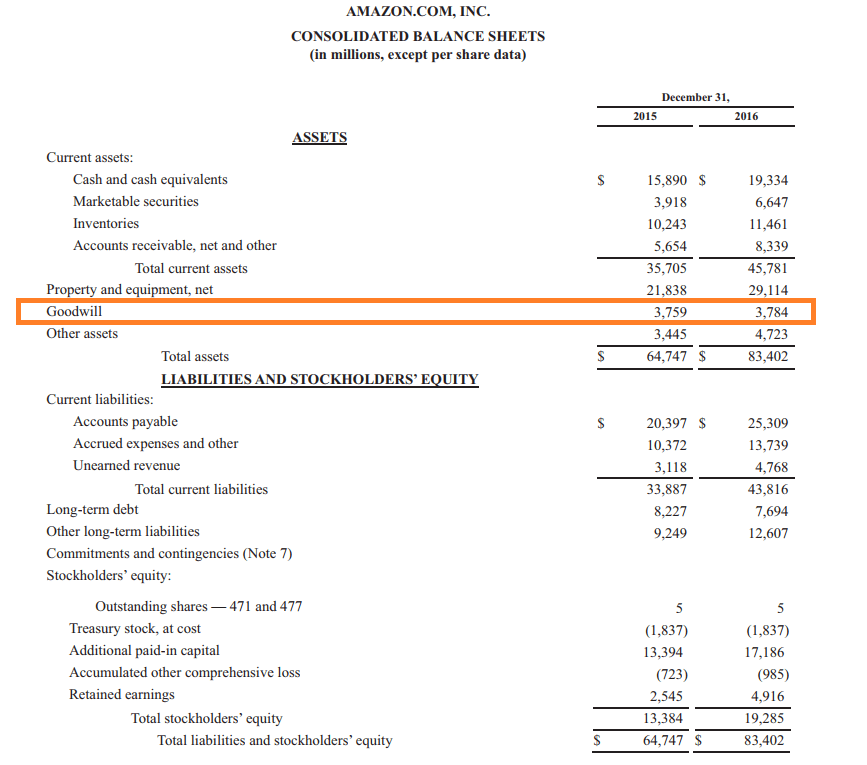

While leaving items on the balance sheet at their carrying value is fine for accounts receivable or accruals both of which are expected to be converted to cash at the amount stated on the balance sheet inventory requires a more advanced valuation process. When the Fair Value Adjustment account contains a credit balance as shown here it serves as a contra-asset account. The valuation account is used to adjust the value in the trading securities account reported on the balance sheet.

The use of fair value measurement for financial reporting continues on an upward trajectory and presents significant challenges requiring judgment and interpretation. You record those on the balance sheet. Typical asset adjustments for business valuation.

The dreamer has to first decide which balance sheet he would like the accounting balance sheet to converge on. This results in teh reporting of the asset long-term investment at its fair value. Under fair value accounting if the asset gains or loses value during the income-statement period you treat that as positive or negative income.